Apple Adjusts Hollywood Approach, Cuts Costs on Original Shows: Report

Apple Adjusts Hollywood Approach, Cuts Costs on Original Shows: Report

Apple Inc (NASDAQ:AAPL) is refining its strategy in Hollywood after spending over $20 billion on original TV shows and movies that have yet to attract large audiences.

在在花费超过200亿美元制作还未吸引大量观众的原创电视节目和电影后,苹果公司(NASDAQ:AAPL)正在改进其在好莱坞的策略。

The company aims to control project spending by holding regular budget meetings with studio chiefs Zack Van Amburg and Jamie Erlicht, Bloomberg reports.

据彭博社报道,苹果公司旨在通过与工作室负责人扎克·范·安伯格和杰米·厄利希特定期召开预算会议来控制项目支出。

The studio invested over $500 million in movies from directors Martin Scorsese, Ridley Scott, and Matthew Vaughn and over $250 million in the World War II miniseries "Masters of the Air."

该工作室投资了来自导演马丁·斯科塞斯、雷德利·斯科特和马修·沃恩的电影超过5000万美元,也投资了二战迷你剧《空中大师》超过2500万美元。

Also Read: Apple TV+ Takes on Netflix with New Hollywood Licensing Deals

还阅读:Apple TV+通过新的好莱坞授权交易迎战Netflix。

Despite these investments, many projects, except "Killers of the Flower Moon," failed to perform well, with "Masters of the Air" attracting fewer viewers than a Japanese show on Netflix Inc (NASDAQ:NFLX).

尽管进行了这些投资,除了《花月杀手》之外,许多项目表现不佳,《空中大师》的观众少于Netflix公司(NASDAQ:NFLX)上的一部日本节目。

Apple's streaming service captures only 0.2% of TV viewing in the U.S. This is significantly lower than competitors like Netflix, which sees more monthly views than Apple does in a day.

在美国,苹果的流媒体服务仅占电视收视量的0.2%,明显低于Netflix的竞争对手,后者的月平均观看量比苹果在一天内多。

Apple plans to make its streaming business more sustainable by paying less upfront for shows and canceling underperforming series faster.

苹果计划通过减少节目的前期成本并更快地取消表现低下的系列节目来使其流媒体业务更具可持续性。

Netflix commanded a market share of 22% in the second quarter of 2024, with Disney+ at 11% and Apple TV+ at 9%, as per Statista.

根据Statista的数据,在2024年第二季度,Netflix占有22%的市场份额,Disney+占11%,Apple TV+占9%。

AAPL Stock Prediction For 2024

2024年AAPL股票预测

Equity research can be a valuable source of information for learning about a company's fundamentals. Analysts create financial models based on the fundamentals and expected future earnings of a company to arrive at a price target and recommendation for the stock.

股权研究是了解公司基本面的宝贵来源。分析师们基于公司的基本面和预期的未来收益创建财务模型,以得出股票的价格目标和建议。

Shares of Apple have an average 1-year price target of $230.6, representing an expected upside of 1.59%.

苹果股票的平均1年价格目标为230.6美元,预计上涨1.59%。

Because of differences in assumptions, analysts can arrive at very different price targets and recommendations. 2 analysts have bearish recommendations on Apple, while 34 analysts have bullish ratings. The street high price target from Loop Capital is $300.0, while the street low from Barclays is $164.0.

由于假设不同,分析师可以得出非常不同的价格目标和建议。2位分析师对苹果持看淡建议,而有34位分析师则持看好评级。 Loop Capital的目标最高价为300.0美元,而巴克莱银行的目标最低价为164.0美元。

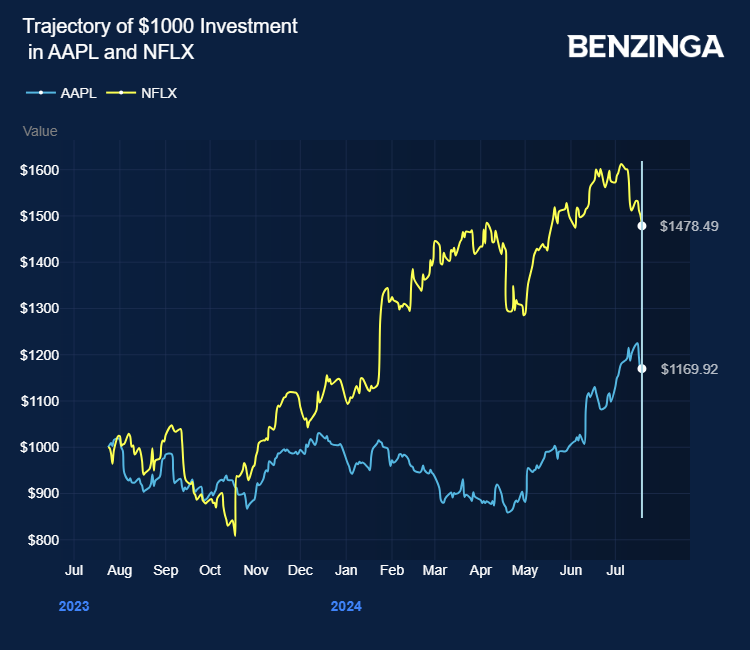

Price Action: AAPL shares traded higher by 0.77% at $226.04 at the last check on Monday.

在上周一的最后一次检查时,AAPL股票以226.04美元的价格上涨了0.77%。

Also Read: Disney Develops Tech to Rival Netflix and Boost Streaming Profits: Report

还阅读:迪士尼开发技术以与Netflix竞争并提高流媒体利润。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:本内容部分使用人工智能工具生成,并经Benzinga编辑审核发布。

Image via Shutterstock

图片来自shutterstock。