Market Whales and Their Recent Bets on DHR Options

Market Whales and Their Recent Bets on DHR Options

Investors with a lot of money to spend have taken a bullish stance on Danaher (NYSE:DHR).

有大量资金可以花的投资者对丹纳赫(纽约证券交易所代码:DHR)采取了看涨立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,当我们在本辛加追踪的公开期权历史记录中出现头寸时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DHR, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当 DHR 发生这么大的事情时,通常意味着有人知道某件事即将发生。

Today, Benzinga's options scanner spotted 10 options trades for Danaher.

今天,本辛加的期权扫描仪发现了丹纳赫的10笔期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 80% bullish and 20%, bearish.

这些大额交易者的整体情绪分为80%看涨和20%(看跌)。

Out of all of the options we uncovered, there was 1 put, for a total amount of $150,334, and 9, calls, for a total amount of $532,503.

在我们发现的所有期权中,有1个看跌期权,总额为150,334美元,还有9个看涨期权,总额为532,503美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $230.0 to $260.0 for Danaher over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将丹纳赫的价格定在230.0美元至260.0美元之间。

Volume & Open Interest Trends

交易量和未平仓合约趋势

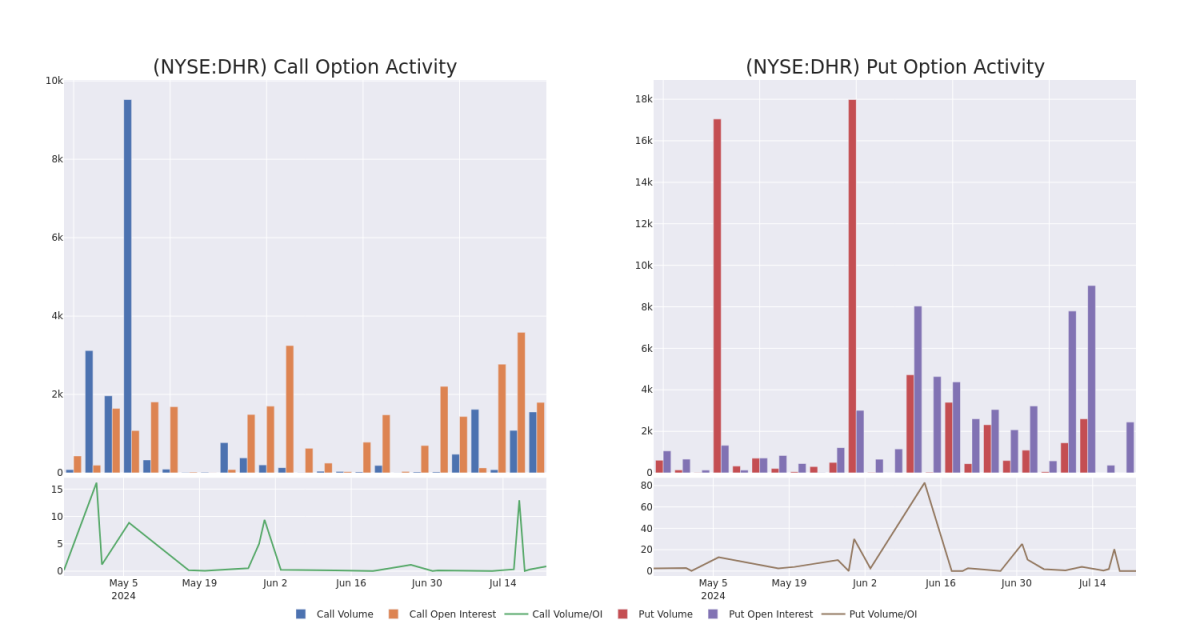

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Danaher's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Danaher's substantial trades, within a strike price spectrum from $230.0 to $260.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了丹纳赫期权在指定行使价下的流动性和投资者对丹纳赫期权的兴趣。即将发布的数据可视化了与丹纳赫大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从230.0美元到260.0美元不等。

Danaher 30-Day Option Volume & Interest Snapshot

丹纳赫30天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | CALL | SWEEP | BULLISH | 10/18/24 | $7.3 | $7.2 | $7.3 | $260.00 | $171.5K | 56 | 0 |

| DHR | PUT | SWEEP | BULLISH | 09/20/24 | $6.6 | $6.5 | $6.5 | $240.00 | $150.3K | 2.4K | 1 |

| DHR | CALL | SWEEP | BULLISH | 10/18/24 | $7.4 | $7.2 | $7.3 | $260.00 | $80.3K | 56 | 242 |

| DHR | CALL | SWEEP | BULLISH | 07/26/24 | $1.7 | $1.6 | $1.65 | $260.00 | $78.0K | 264 | 145 |

| DHR | CALL | SWEEP | BULLISH | 01/16/26 | $38.6 | $37.8 | $37.8 | $250.00 | $52.9K | 72 | 30 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | 打电话 | 扫 | 看涨 | 10/18/24 | 7.3 美元 | 7.2 美元 | 7.3 美元 | 260.00 美元 | 171.5 万美元 | 56 | 0 |

| DHR | 放 | 扫 | 看涨 | 09/20/24 | 6.6 美元 | 6.5 美元 | 6.5 美元 | 240.00 美元 | 150.3 万美元 | 2.4K | 1 |

| DHR | 打电话 | 扫 | 看涨 | 10/18/24 | 7.4 美元 | 7.2 美元 | 7.3 美元 | 260.00 美元 | 80.3 万美元 | 56 | 242 |

| DHR | 打电话 | 扫 | 看涨 | 07/26/24 | 1.7 美元 | 1.6 美元 | 1.65 美元 | 260.00 美元 | 78.0 万美元 | 264 | 145 |

| DHR | 打电话 | 扫 | 看涨 | 01/16/26 | 38.6 美元 | 37.8 美元 | 37.8 美元 | 250.00 美元 | 52.9 万美元 | 72 | 30 |

About Danaher

关于丹纳赫

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

1984年,丹纳赫的创始人将一家房地产组织转变为一家以工业为重点的制造公司。通过一系列合并、收购和资产剥离,在2023年底剥离其环境和应用解决方案集团Veralto之后,丹纳赫现在主要专注于生命科学和诊断行业的科学仪器和消耗品的制造。

Danaher's Current Market Status

丹纳赫的当前市场状况

- Trading volume stands at 1,129,939, with DHR's price up by 0.82%, positioned at $245.54.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 1 days.

- 交易量为1,129,939美元,DHR的价格上涨了0.82%,为245.54美元。

- RSI指标显示,该股目前在超买和超卖之间处于中立状态。

- 预计将在1天后公布财报。

Expert Opinions on Danaher

关于丹纳赫的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $260.0.

上个月,1位专家发布了该股的评级,平均目标价为260.0美元。

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Danaher with a target price of $260.

- Evercore ISI集团的一位分析师在评估中保持了对丹纳赫跑赢大盘的评级,目标价为260美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Danaher options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时警报,随时了解最新的丹纳赫期权交易。