How to Use Your TFSA to Earn $5,000 Per Year in Tax-Free Income

How to Use Your TFSA to Earn $5,000 Per Year in Tax-Free Income

Do you want to earn $5,000 per year tax-free in your Tax-Free Savings Account (TFSA)?

你想在你的免税储蓄账户(TFSA)中每年免税赚取5000美元吗?

It's not easy, but it can be done.

这并不容易,但是可以做到。

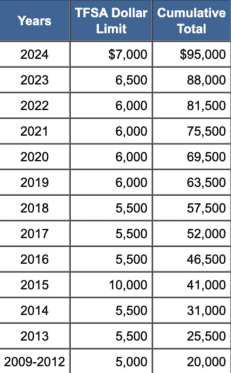

If you're 33 years old and have never contributed to a TFSA before, you have $95,000 worth of TFSA contribution room. "Contribution room" is the amount of contributions you can make and expect them to be exempt from taxation. It takes about a 5.3% yield to get to $5,000 per year in a $95,000 account. So, you do not need to push the boundaries of sanity with yield to get $5,000 coming into a TFSA each year. In this article, I will explore some ways that you can get there.

如果你今年33岁,以前从未为TFSA做出过贡献,那么你有95000加元的TFSA贡献空间。 “贡献空间”是你可以进行的贡献金额,并期望免征税。在95000加元账户中,需要约5.3%的收益率才能达到每年5000美元的目标。因此,不需要通过收益来达到每年在TFSA中进账5000美元而破坏理智的极限。在本文中,我将探讨一些实现目标的方法。

$5,000 per year: How to get there

每年5000美元:如何实现

There are two ways to get to $5,000 per year tax-free in your TFSA:

实现每年在TFSA中免税进账5000美元有两种方法:

- Invest at a fairly high yield (5.3% to be exact) and start collecting $5,000 this year.

- Invest at the market yield and make recurring contributions into the future, until you hit 5.3%.

- 以相当高的收益率投资(确切地说是5.3%),并开始收取今年的5000美元。

- 以市场收益率投资,并进行未来的定期贡献,直到达到5.3%。

The former method could be achieved today, but you'll need to research your stocks very carefully, as 5.3% is a higher yield than the TSX Index pays and thus can't be achieved with a simple indexing strategy. It also requires you to be at least 33 years old. The latter method is safe and can be done with index funds, but it could have you waiting several years before you hit your $5,000 annual income goal. The TSX currently yields 3.3%, so you'll only get $3,135 if you invest all your TFSA money into the index.

前者方法可能今天就能实现,但您需要非常仔细地研究您的股票,因为5.3%的收益率高于tsx指数,因此无法通过简单的指数策略实现。它还要求您年满33岁。后者方法比较安全,并且可以使用指数基金来实现,但可能需要您几年时间才能达到每年5000美元的收入目标。 TSX指数当前的收益率为3.3%,因此如果您将所有TFSA资金投资于指数上,您只能获得3135美元。

How much can you tax shelter

你可以避税多少

How much money you can tax shelter in a TFSA depends on three factors:

你的TFSA可以避税多少取决于以下三个因素:

- Your age.

- How much you've already contributed to your TFSA.

- The returns you earned on amounts already contributed.

- 你的年龄。

- 你已经向你的TFSA做出了多少贡献。

- 你已经贡献的金额的回报率。

If you realized well above-average returns on TFSA investments made in the past, then it's not inconceivable that you could have a $1 million TFSA balance. Otherwise, it all depends on how many years' worth of annual contribution increases have accrued since your 18th birthday. The table below, courtesy of Tax Tips, shows how much room has accumulated per year since 2009.

如果您在过去的TFSA投资中获得了高于平均水平的回报,那么你的TFSA账户余额可能会达到100万加元。否则,它完全取决于自你18岁生日以来增加了几年的年度贡献。下表(由“税务技巧”提供)显示了自2009年以来每年累积的空间。

Some good TFSA assets to hold

一些不错的TFSA资产

Now, we need to look at TFSA assets to hold. A good place to start is Guaranteed Investment Certificates (GICs). These days, they yield about 5%. You can get $4,750 per year holding 5% GICs in a $95,000 TFSA, which is pretty close to our $5,000 goal.

现在,我们需要查看可以持有的TFSA资产。一个好的起点是保本投资证书(GICs)。这些天,它们的收益率约为5%。在95000加元的TFSA中持有5%的GICs,您可以获得每年4750美元的收益,这非常接近我们的5000美元目标。

Another asset class you could look at is index funds. The broad market index funds don't pay enough to get you to $5,000 per year with $95,000 invested, but you may be able to find sector funds or theme funds with 5.3% yields.

您还可以查看另一类资产——指数基金。广泛市场指数基金的收益不足以使您以95000美元投资每年获得5000美元,但您可以通过找到收益率为5.3%的板块基金或主题基金来实现。

You could also look into individual stocks. Though they take more research than indexes, they sometimes provide superior results. Consider Canadian National Railway (TSX:CNR), for example. It's a Canadian railroad stock that has easily beaten the TSX Index over the last 10 years. With only one major competitor, an indispensable role in North America's economy, and a 35% net profit margin, it may continue outperforming.

您也可以研究个别股票。虽然它们需要比指数更多的研究,但有时会提供更好的结果。例如,考虑加拿大国家铁路(TSX:CNR)。它是一家占据重要地位的加拿大铁路公司,在过去的10年中轻松击败了TSX指数。由于只有一个主要竞争对手,在北美经济中具有不可或缺的作用,以及35%的净利润率,它可能会继续表现优异。 CN铁路股票每季度支付0.84加元的股息,即每年3.36加元。按照今天的股价165.66加元,这些股息的收益率为2.02%。要以2.02%的收益率获得5000美元的收益,您需要投资247,524.75美元。有关更多详细信息,请参见下表。

CN Railway shares pay a dividend of $0.84 per quarter, or $3.36 per year. At today's stock price of $165.66, those dividends yield 2.02%. To get to $5,000 at a 2.02% yield, you need to invest $247,524.75. See the table below for more details.

CNR

| COMPANY | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| CNR | $165.66 | 1,488 | $0.84 ($3.36 per year) | $1,249.9 ($4,999 per year) | Quarterly |

| 公司 | 最近价格 | 所拥有的股份数目 | 红利 | 总支付 | 频率 |

| cnr | $165.66 | 1,488 | $0.84(每年$3.36) | $1,249.9(每年$4,999) | 季度 |

As you can see, it takes more than $95,000 invested in CNR stock today to get to $5,000 per year in dividend income. That means you can't get $5,000 in an all-CNR TFSA portfolio today. However, the stock has a 10.5% compounded 10-year dividend-growth rate. If it can keep that up, the yield-on-cost will reach 5.3% at some point in the future.

正如您所看到的,在加拿大国家铁路公司的股票上投资超过$95,000,才能获得每年$5,000的股息收入。这意味着您今天无法在所有国家铁路公司的投资账户中获得$5,000的收益。 但是,该股票具有10.5%的复合10年股息增长率。如果能够保持这种增长速度,未来某个时间点的股息收益率将达到5.3%。

The post How to Use Your TFSA to Earn $5,000 Per Year in Tax-Free Income appeared first on The Motley Fool Canada.

如何使用您的TFSA赚取每年5,000加元无税收入的发帖。发帖来源于The Motley Fool Canada。