July 23, 2024 - $SAP SE (SAP.US)$shares surged 6.07% to $212.63 in pre-market trading on Tuesday. The company announced its financial results for the second quarter ended June 30, 2024.

Financial Highlights

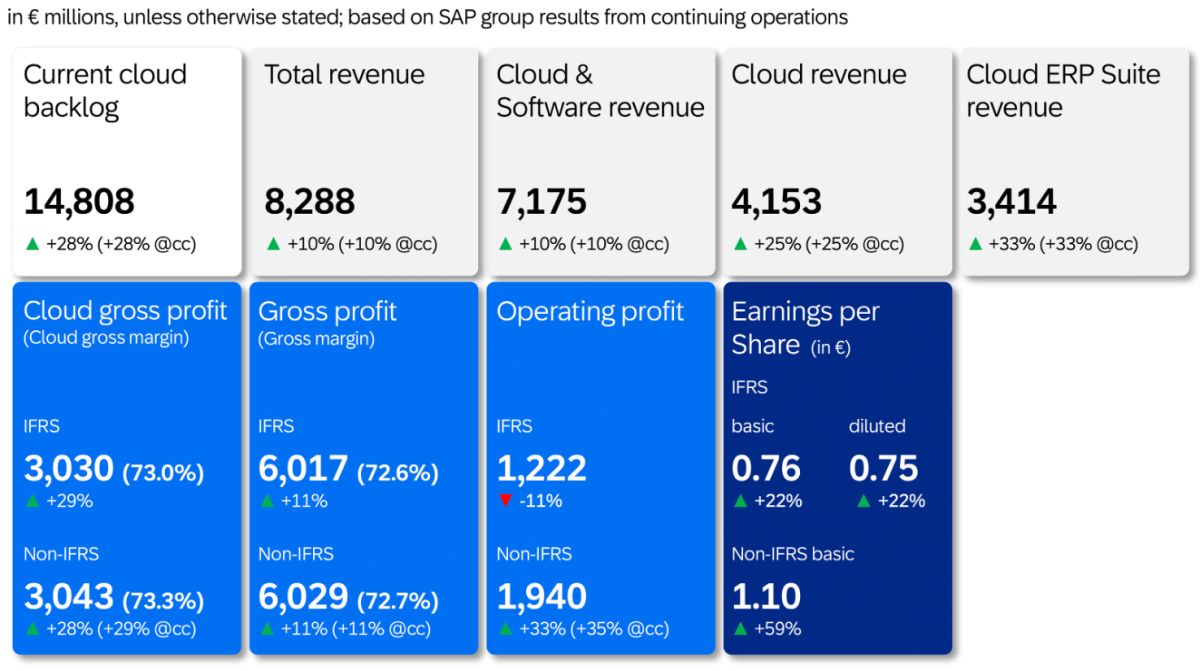

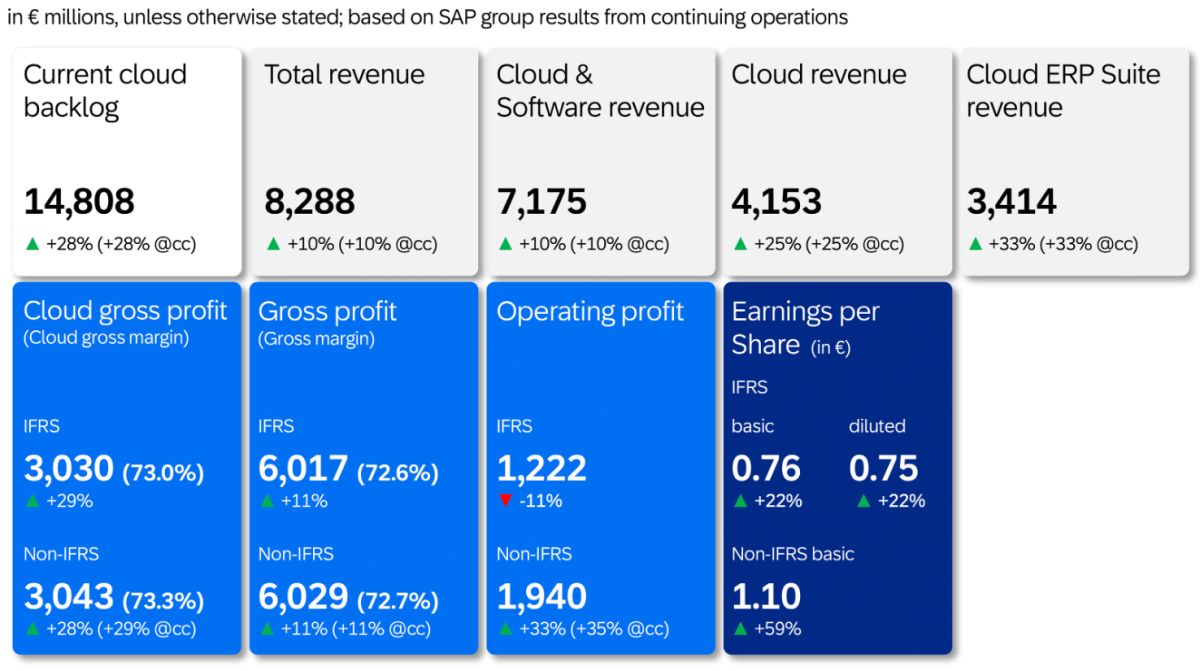

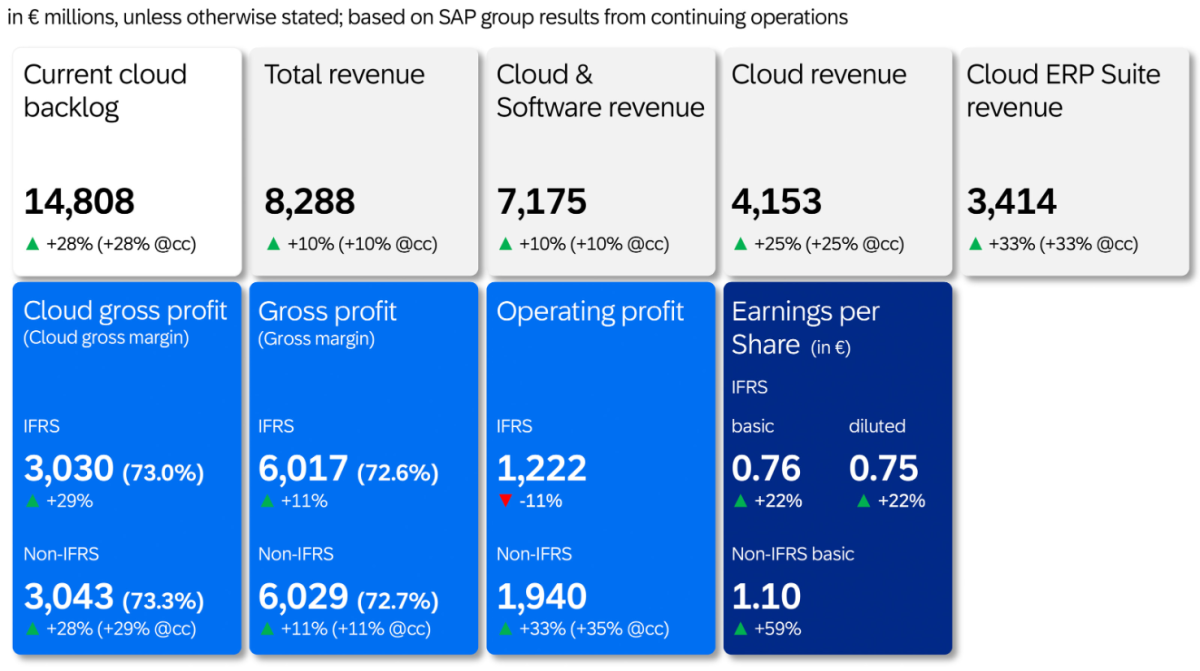

Current cloud backlog of €14.8 billion, up 28%, both at nominal and constant currencies.

Cloud revenue up 25%, underpinned by 33% Cloud ERP Suite revenue growth, all at nominal and constant currencies.

Total revenue up 10%, both at nominal and constant currencies.

Total revenue up 10%, both at nominal and constant currencies.

IFRS cloud gross profit up 29%, non-IFRS cloud gross profit up 28% and up 29% at constant currencies.

IFRS operating profit down 11% due to restructuring expenses of €0.6 billion. Non-IFRS operating profit up 33% and up 35% at constant currencies.

2024 financial outlook reiterated. 2025 operating profit ambition increased to reflect anticipated incremental efficiency gains from expanded transformation program.

“Our cloud growth momentum remained strong in Q2, with Business AI enabling many deals. We continue to execute on our transformation with great discipline, leading to an increase in our operating profit ambition for 2025. At the same time, we continue to invest into our transformation to be the leader in Business AI. Given our progress and strong pipeline, we are confident to achieve accelerating topline growth through 2027.” said Christian Klein, CEO of SAP SE.

Share Repurchase Program

In May 2023, SAP announced a share repurchase program with an aggregate volume of up to €5 billion and a term until December 31, 2025. As of June 30, 2024, SAP had repurchased 12,895,525 shares at an average price of €145.20 resulting in a purchased volume of approximately €1.87 billion under the program.

Financial Outlook 2024

€17.0 – 17.3 billion cloud revenue at constant currencies (2023: €13.66 billion), up 24% to 27% at constant currencies.

€29.0 – 29.5 billion cloud and software revenue at constant currencies (2023: €26.92 billion), up 8% to 10% at constant currencies.

€7.6 – 7.9 billion non-IFRS operating profit at constant currencies (2023: €6.51 billion), up 17% to 21% at constant currencies.

Free cash flow of approximately €3.5 billion (2023: €5.09 billion).

An effective tax rate (non-IFRS) of approximately 32% (2023: 30.3%).

About SAP

As a global leader in enterprise applications and business AI, SAP (NYSE:SAP) stands at the nexus of business and technology. For over 50 years, organizations have trusted SAP to bring out their best by uniting business-critical operations spanning finance, procurement, HR, supply chain, and customer experience.

2024年7月23日——周二盘前交易中,股价飙升6.07%,至212.63美元。该公司公布了截至2024年6月30日的第二季度财务业绩。

财务要闻

目前的云积压为148欧元,按名义货币和固定货币计算,增长了28%。

云端收入增长了25%,这得益于33%的云ERP套件收入增长,均以名义和固定货币计算。

按名义货币和固定货币计算,总收入均增长了10%。

按名义货币和固定货币计算,总收入均增长了10%。

按固定货币计算,国际财务报告准则云端毛利增长29%,非国际财务报告准则云端毛利增长28%,增长29%。

由于6欧元的重组费用,国际财务报告准则的营业利润下降了11%。按固定货币计算,非国际财务报告准则的营业利润增长了33%,增长了35%。

重申了2024年的财务展望。2025年的营业利润目标有所提高,以反映扩大转型计划带来的预期增量效率提高。

“我们的云增长势头在第二季度保持强劲,商业人工智能促成了许多交易。我们将继续以严格的纪律执行转型,从而提高了我们2025年的营业利润目标。同时,我们将继续投资转型,成为商业人工智能领域的领导者。鉴于我们的进展和强劲的产品线,我们有信心在2027年之前实现收入的加速增长。” SAP SE首席执行官克里斯蒂安·克莱因说。

股票回购计划

2023年5月,SAP宣布了一项股票回购计划,总交易量最高为50欧元,期限至2025年12月31日。截至2024年6月30日,SAP已回购了12,895,525股股票,平均价格为145.20欧元,根据该计划,购买量约为18.7欧元。

2024 年财务展望

按固定货币计算,云收入为17.0欧元至173欧元(2023年:136.6欧元),按固定货币计算增长24%至27%。

按固定货币计算,云和软件收入295欧元(2023年:269.2欧元),按固定货币计算增长8%至10%。

7.6 — 79欧元非国际财务报告准则按固定货币计算的营业利润(2023年:65.1欧元),按固定货币计算增长17%至21%。

自由现金流约为35欧元(2023年:50.9欧元)。

有效税率(非国际财务报告准则)约为32%(2023年:30.3%)。

关于 SAP

作为企业应用程序和商业人工智能领域的全球领导者,SAP(纽约证券交易所代码:SAP)站在商业和技术的纽带上。50 多年来,各组织一直相信 SAP 能够通过整合财务、采购、人力资源、供应链和客户体验等关键业务运营来发挥其最佳水平。

按名义货币和固定货币计算,总收入均增长了10%。

按名义货币和固定货币计算,总收入均增长了10%。

Total revenue up 10%, both at nominal and constant currencies.

Total revenue up 10%, both at nominal and constant currencies.