Kinetik Holdings (NYSE:KNTK) Has A Somewhat Strained Balance Sheet

Kinetik Holdings (NYSE:KNTK) Has A Somewhat Strained Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Kinetik Holdings Inc. (NYSE:KNTK) does use debt in its business. But should shareholders be worried about its use of debt?

霍华德·马克斯说得好:与其担心股价波动,不如担心“永久性损失的可能性……我认识的每一个实际投资者都担心这一点。”当您考察其风险水平时,自然而然会考虑公司的资产负债表,因为债务常常是业务崩溃的因素。我们可以看到Kinetik Holdings Inc.(纽交所:KNTK)的业务确实涉及债务。但是,股东是否应该担心其债务使用呢?

What Risk Does Debt Bring?

债务带来了什么风险?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

当企业无法通过自由现金流或以有吸引力的价格筹集资本来履行债务时,债务和其他负债将变得具有风险。最终,如果公司无法履行其法律还债义务,股东可能一文不值。然而,更常见(但仍然痛苦)的情况是,公司不得不以低价募集新的股权资本,从而永久地稀释股东的股份。当然,许多公司在没有任何负面后果的情况下利用债务来资助增长。在考察债务水平时,我们首先会考虑现金和债务水平。

What Is Kinetik Holdings's Net Debt?

Kinetik Holdings的净债务是多少?

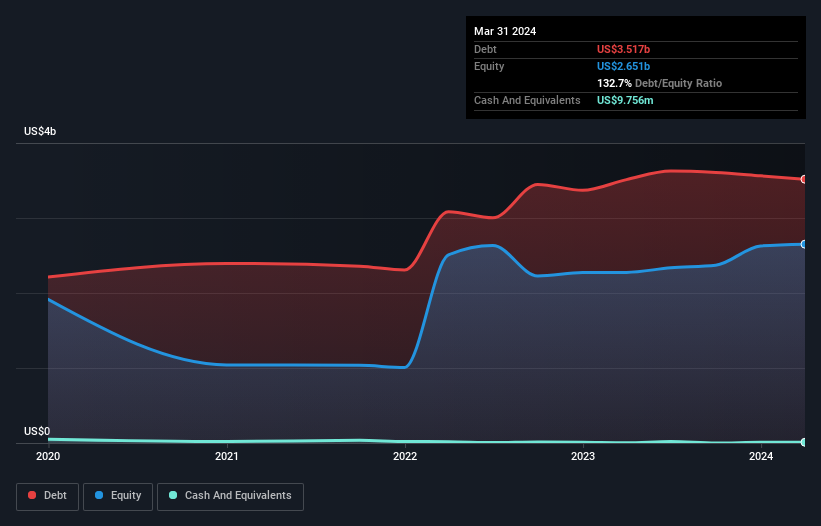

The chart below, which you can click on for greater detail, shows that Kinetik Holdings had US$3.52b in debt in March 2024; about the same as the year before. Net debt is about the same, since the it doesn't have much cash.

下面的图表,您可以点击以获取更详细信息,显示Kinetik Holdings在2024年3月有35.2亿美元的债务;与前一年大致相同。由于它没有太多现金,因此净债务大致相同。

How Strong Is Kinetik Holdings' Balance Sheet?

Kinetik Holdings的资产负债表有多强?

We can see from the most recent balance sheet that Kinetik Holdings had liabilities of US$234.0m falling due within a year, and liabilities of US$3.56b due beyond that. On the other hand, it had cash of US$9.76m and US$209.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.58b.

我们从最新的资产负债表中可以看到,Kinetik Holdings在一年内到期的负债为2340万美元,到期超过一年的负债为35.6亿美元。另一方面,它有970万美元的现金和20990万美元的应付账款到期在一年内。因此,其负债超过其现金和(短期)应收账款总和358亿美元。

Kinetik Holdings has a market capitalization of US$6.92b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

Kinetik Holdings的市值为6920万美元,因此,如果需要,它很有可能筹集资金来改善其资产负债表。但显然,我们肯定应该仔细考虑它是否可以在没有稀释的情况下管理其债务。

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

我们使用两个主要的比率来告诉我们相对于收益的债务水平。第一个是净债务除以利息、税、折旧和摊销前利润(EBITDA),而第二个是其利润前利息和税(EBIT)覆盖其利息费用的次数(或其利息覆盖率,简称)。因此,我们考虑与折旧和摊销费用相关的盈利以及没有相关费用的盈利相对于债务水平。

Weak interest cover of 1.0 times and a disturbingly high net debt to EBITDA ratio of 7.5 hit our confidence in Kinetik Holdings like a one-two punch to the gut. The debt burden here is substantial. Given the debt load, it's hardly ideal that Kinetik Holdings's EBIT was pretty flat over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Kinetik Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

利息覆盖率只有1.0倍,净债务对EBITDA比率高达7.5,这两点打击了我们对Kinetik Holdings的信恳智能。这里的债务负担相当高。考虑到债务负担,Kinetik Holdings过去十二个月的EBIt基本持平,这显然不是理想的状态。当分析债务水平时,资产负债表是明显的起点。但最终,企业未来的盈利能力将决定Kinetik Holdings是否能够随时间加强其资产负债表。因此,如果您专注于未来,可以查看这份免费报告,其中显示了分析师预测的利润。

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Kinetik Holdings actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

最后,尽管税务人员可能喜欢会计利润,但贷款人只接受冰冷的现金。因此,我们总是查看多少EBIt转化为自由现金流。在过去的三年中,Kinetik Holdings的自由现金流实际上比EBIt多。这种强大的现金转换让我们像大众音乐会上节拍跳动的人一样兴奋。

Our View

我们的观点

Neither Kinetik Holdings's ability to cover its interest expense with its EBIT nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Looking at all the angles mentioned above, it does seem to us that Kinetik Holdings is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with Kinetik Holdings (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

从Kinetik Holdings的EBIt覆盖利息支出的能力以及其净债务与EBITDA的比率来看,我们对其承担更多债务的能力没有信恳智能。好消息是,它似乎能够轻松将EBIt转化为自由现金流。从上面提到的所有角度来看,我们认为,由于其债务,Kinetik Holdings作为一种有风险的投资。在未来,如果有所收益,不是所有的风险都是坏的。但是值得记住的是,这种债务风险。毫无疑问,我们可以从资产负债表中了解大部分债务。但最终,每个公司都可能存在超出资产负债表之外的风险。我们在Kinetik Holdings中找到了3个警告信号(至少有1个不太好),了解它们应该是您投资过程的一部分。

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

当然,如果您是那种喜欢购买没有负债负担的股票的投资者,则今天就可以发现我们的独家净现金增长股清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容感到担忧?请直接与我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?对内容感到担忧?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

We can see from the most recent balance sheet that Kinetik Holdings had liabilities of US$234.0m falling due within a year, and liabilities of US$3.56b due beyond that. On the other hand, it had cash of US$9.76m and US$209.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.58b.

We can see from the most recent balance sheet that Kinetik Holdings had liabilities of US$234.0m falling due within a year, and liabilities of US$3.56b due beyond that. On the other hand, it had cash of US$9.76m and US$209.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.58b.