This Is What Whales Are Betting On MercadoLibre

This Is What Whales Are Betting On MercadoLibre

Investors with a lot of money to spend have taken a bullish stance on MercadoLibre (NASDAQ:MELI).

有大量资金可以花的投资者对MercadoLibre(纳斯达克股票代码:MELI)采取了看涨立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MELI, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当MELI发生这么大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 8 uncommon options trades for MercadoLibre.

今天,Benzinga的期权扫描仪发现了MercadoLibre的8种不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 37% bullish and 25%, bearish.

这些大资金交易者的整体情绪在37%的看涨和25%的看跌之间。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $89,540, and 6 are calls, for a total amount of $363,548.

在我们发现的所有特殊期权中,有两个是看跌期权,总额为89,540美元,6个是看涨期权,总额为363,548美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1520.0 to $1690.0 for MercadoLibre over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将MercadoLibre的价格定在1520.0美元至1690.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

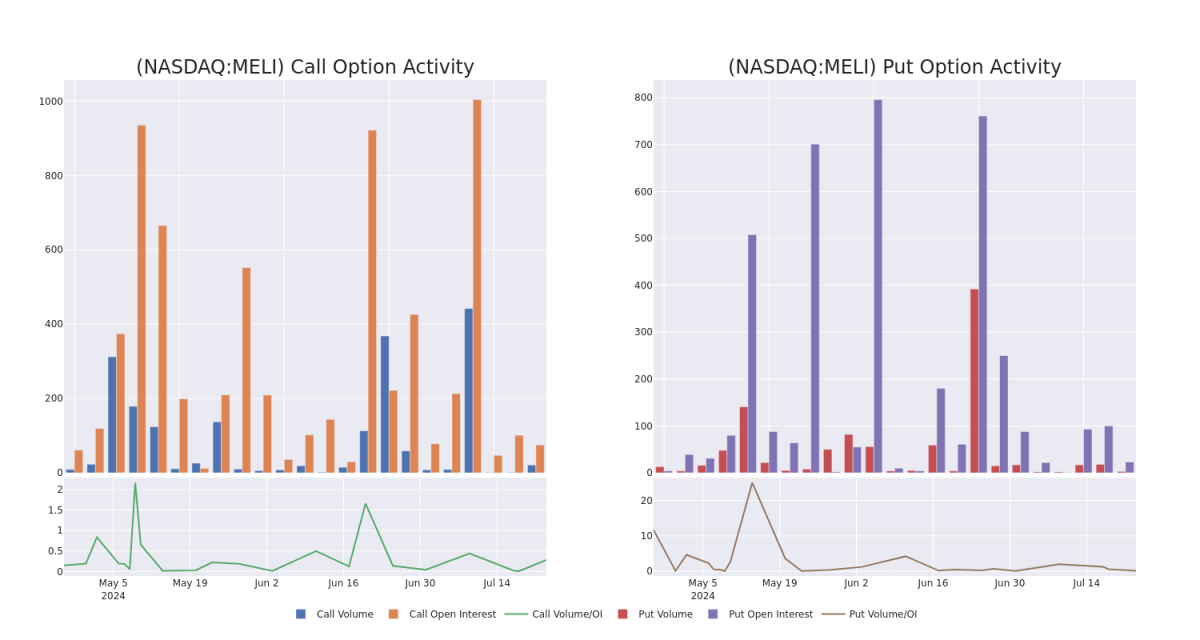

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下MercadoLibre期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale activity within a strike price range from $1520.0 to $1690.0 in the last 30 days.

下面,我们可以分别观察过去30天在1520.0美元至1690.0美元行使价范围内的所有MercadoLibre鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化。

MercadoLibre Option Activity Analysis: Last 30 Days

MercadoLibre 期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | SWEEP | NEUTRAL | 09/20/24 | $120.9 | $108.2 | $114.55 | $1690.00 | $117.5K | 23 | 0 |

| MELI | CALL | SWEEP | BULLISH | 09/20/24 | $198.1 | $184.3 | $189.9 | $1550.00 | $94.9K | 28 | 5 |

| MELI | PUT | TRADE | NEUTRAL | 01/17/25 | $133.6 | $120.1 | $127.1 | $1640.00 | $50.8K | 23 | 3 |

| MELI | CALL | TRADE | NEUTRAL | 07/26/24 | $49.0 | $40.0 | $43.97 | $1655.00 | $43.9K | 20 | 0 |

| MELI | CALL | TRADE | BULLISH | 09/20/24 | $202.4 | $197.4 | $202.45 | $1550.00 | $40.4K | 28 | 7 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 梅利 | 打电话 | 扫 | 中立 | 09/20/24 | 120.9 美元 | 108.2 美元 | 114.55 美元 | 1690.00 美元 | 117.5 万美元 | 23 | 0 |

| 梅利 | 打电话 | 扫 | 看涨 | 09/20/24 | 198.1 美元 | 184.3 美元 | 189.9 美元 | 1550.00 美元 | 94.9 万美元 | 28 | 5 |

| 梅利 | 放 | 贸易 | 中立 | 01/17/25 | 133.6 美元 | 120.1 美元 | 127.1 美元 | 1640.00 美元 | 50.8 万美元 | 23 | 3 |

| 梅利 | 打电话 | 贸易 | 中立 | 07/26/24 | 49.0 美元 | 40.0 美元 | 43.97 美元 | 1655.00 美元 | 43.9 万美元 | 20 | 0 |

| 梅利 | 打电话 | 贸易 | 看涨 | 09/20/24 | 202.4 美元 | 197.4 美元 | 202.45 美元 | 1550.00 美元 | 40.4 万美元 | 28 | 7 |

About MercadoLibre

关于 MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

MercadoLibre运营着拉丁美洲最大的电子商务市场,截至2023年底,在18个国家有超过2.18亿活跃用户和100万活跃卖家融入其商业网络或金融科技解决方案。该公司经营一系列与其核心在线商店互补的业务,其中运输解决方案(Mercado Envios)、支付和融资业务(Mercado Pago和Mercado Credito)、广告(Mercado Clics)、分类广告和一站式电子商务解决方案(Mercado Shops)完善了其武器库。MercadoLibre的收入来自最终价值费用、广告特许权使用费、付款处理、插入费、订阅费以及消费者和小企业贷款的利息收入。

In light of the recent options history for MercadoLibre, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于MercadoLibre最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

MercadoLibre's Current Market Status

MercadoLibre 目前的市场地位

- With a trading volume of 9,348, the price of MELI is up by 0.45%, reaching $1694.95.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 13 days from now.

- MELI的交易量为9,348美元,上涨了0.45%,达到1694.95美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于即日起13天后发布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解MercadoLibre的最新期权交易情况,获取实时提醒。