Unpacking the Latest Options Trading Trends in Chipotle Mexican Grill

Unpacking the Latest Options Trading Trends in Chipotle Mexican Grill

Deep-pocketed investors have adopted a bullish approach towards Chipotle Mexican Grill (NYSE:CMG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CMG usually suggests something big is about to happen.

财力雄厚的投资者对Chipotle Mexico Grill(纽约证券交易所代码:CMG)采取了看涨态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是CMG的如此实质性变动通常表明即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Chipotle Mexican Grill. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Chipotle Mexico Grill的11项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 18% bearish. Among these notable options, 5 are puts, totaling $177,710, and 6 are calls, amounting to $259,800.

这些重量级投资者的总体情绪存在分歧,45%的人倾向于看涨,18%的人倾向于看跌。在这些值得注意的期权中,有5个是看跌期权,总额为177,710美元,6个是看涨期权,总额为259,800美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.8 to $60.0 for Chipotle Mexican Grill over the recent three months.

根据交易活动,看来主要投资者的目标是在最近三个月中将Chipotle Mexico Grill的价格从30.8美元扩大到60.0美元。

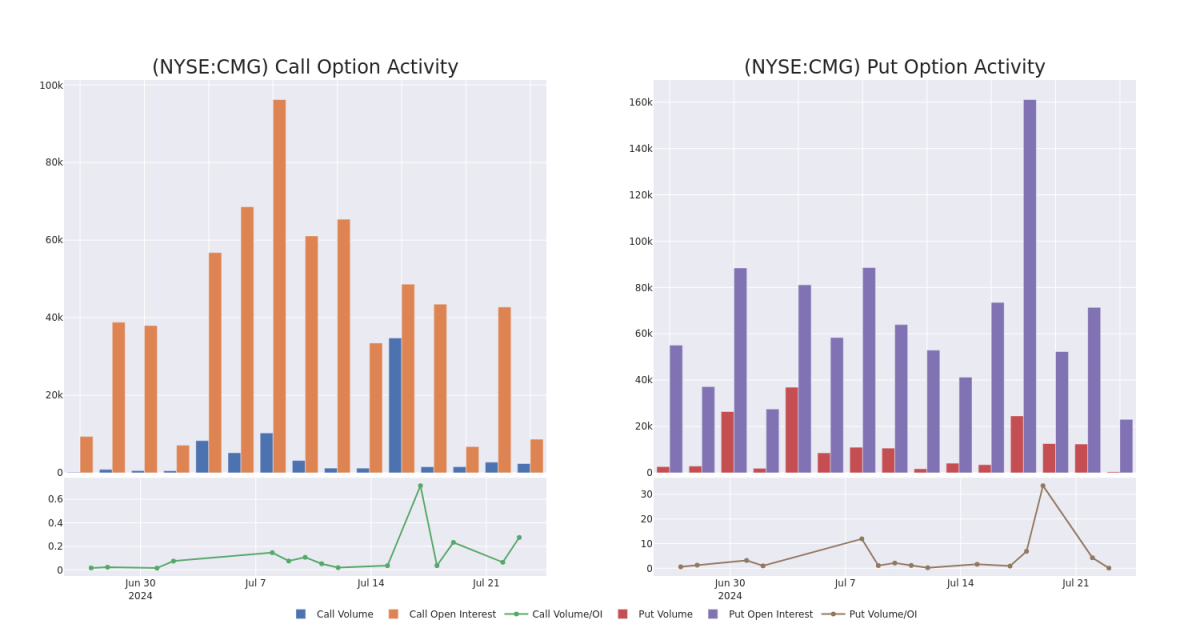

Volume & Open Interest Development

交易量和未平仓合约的发展

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Chipotle Mexican Grill's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Chipotle Mexican Grill's substantial trades, within a strike price spectrum from $30.8 to $60.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了Chipotle Mexico Grill在指定行使价下期权的流动性和投资者对Chipotle Mexico Grill期权的兴趣。即将发布的数据可视化了与Chipotle Mexico Grill的大量交易相关的看涨期权和未平仓合约的波动,在过去30天内,行使价范围从30.8美元到60.0美元不等。

Chipotle Mexican Grill 30-Day Option Volume & Interest Snapshot

Chipotle Mexico Grill 30 天期权交易量和利息快照

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | CALL | SWEEP | BULLISH | 07/26/24 | $2.05 | $2.0 | $2.0 | $55.00 | $86.4K | 3.3K | 994 |

| CMG | CALL | TRADE | NEUTRAL | 09/20/24 | $1.8 | $1.7 | $1.75 | $59.00 | $43.7K | 2.9K | 665 |

| CMG | PUT | SWEEP | BEARISH | 09/20/24 | $3.5 | $3.4 | $3.5 | $55.00 | $43.7K | 11.8K | 181 |

| CMG | PUT | TRADE | BEARISH | 09/20/24 | $2.9 | $2.85 | $2.9 | $54.00 | $43.5K | 8.4K | 140 |

| CMG | CALL | SWEEP | BULLISH | 09/20/24 | $1.65 | $1.6 | $1.65 | $59.00 | $41.2K | 2.9K | 368 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | 打电话 | 扫 | 看涨 | 07/26/24 | 2.05 美元 | 2.0 美元 | 2.0 美元 | 55.00 美元 | 86.4 万美元 | 3.3K | 994 |

| CMG | 打电话 | 贸易 | 中立 | 09/20/24 | 1.8 美元 | 1.7 美元 | 1.75 美元 | 59.00 美元 | 43.7 万美元 | 2.9K | 665 |

| CMG | 放 | 扫 | 粗鲁的 | 09/20/24 | 3.5 美元 | 3.4 美元 | 3.5 美元 | 55.00 美元 | 43.7 万美元 | 11.8K | 181 |

| CMG | 放 | 贸易 | 粗鲁的 | 09/20/24 | 2.9 美元 | 2.85 美元 | 2.9 美元 | 54.00 美元 | 43.5 万美元 | 8.4K | 140 |

| CMG | 打电话 | 扫 | 看涨 | 09/20/24 | 1.65 美元 | 1.6 美元 | 1.65 美元 | 59.00 美元 | 41.2 万美元 | 2.9K | 368 |

About Chipotle Mexican Grill

关于 Chipotle 墨西哥烧烤

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is predominately company-owned, although it recently inked a development agreement with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

Chipotle Mexico Grill是美国最大的快餐连锁餐厅,2023年全系统销售额为99亿美元。墨西哥的概念主要由公司所有,尽管它最近与Alshaya集团在中东签署了一项开发协议。尽管它在加拿大、英国、法国和德国的份额很小,但截至2023年底,其足迹已接近3,440家门店,与美国挂钩。Chipotle 销售墨西哥卷饼、墨西哥卷饼碗、炸玉米饼、墨西哥玉米饼和饮料,其销售主张围绕有竞争力的价格、高质量的食物采购、服务速度和便利性而建立。该公司的收入完全来自餐厅的销售和送货费。

Having examined the options trading patterns of Chipotle Mexican Grill, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Chipotle Mexican Grill的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Chipotle Mexican Grill's Current Market Status

Chipotle 墨西哥烧烤店目前的市场地位

- With a volume of 2,150,303, the price of CMG is up 1.81% at $54.53.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 1 days.

- CMG的交易量为2,150,303美元,上涨了1.81%,至54.53美元。

- RSI 指标暗示标的股票可能被超卖。

- 下一份财报预计将在1天后公布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chipotle Mexican Grill options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。通过 Benzinga Pro 的实时提醒,随时了解最新的Chipotle Mexican Grill期权交易。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.8 to $60.0 for Chipotle Mexican Grill over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.8 to $60.0 for Chipotle Mexican Grill over the recent three months.