What the Options Market Tells Us About JD.com

What the Options Market Tells Us About JD.com

Investors with a lot of money to spend have taken a bullish stance on JD.com (NASDAQ:JD).

拥有大量资金的投资者已经对京东 (纳斯达克:JD) 采取看好态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with JD, it often means somebody knows something is about to happen.

无论这些投资者是机构还是富人,我们不得而知。但是当类似的事情在京东发生时,通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 11 uncommon options trades for JD.com.

今天,Benzinga 期权扫描器发现了11笔金额不寻常的期权交易,其中有5笔认购金额合计为260,532美元,6笔认沽金额合计为890,655美元。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 72% bullish and 27%, bearish.

这些大资金交易者的总体情绪在看好方和看淡方之间,其中看好方占72%,看淡方占27%。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $890,655, and 5 are calls, for a total amount of $260,532.

在我们发现的所有特殊期权中,有6笔认沽金额合计890,655美元,5笔认购金额合计260,532美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.5 to $37.5 for JD.com over the last 3 months.

考虑到这些合同的成交量和未平仓合约量,过去3个月来,鲸鱼一直在瞄准京东的目标价位区间在22.5美元到37.5美元。

Insights into Volume & Open Interest

成交量和持仓量分析

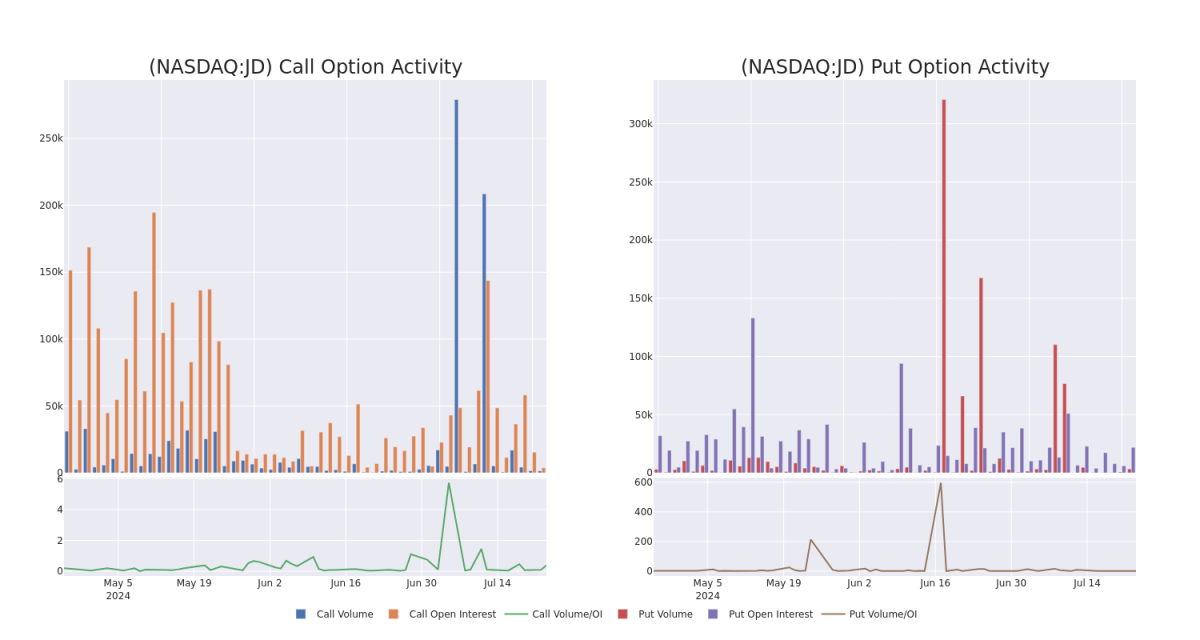

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in JD.com's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to JD.com's substantial trades, within a strike price spectrum from $22.5 to $37.5 over the preceding 30 days.

评估成交量和未平仓合约量是期权交易的一项策略性步骤。这些指标揭示了在特定行权价上, 投资者对京东期权的流动性和兴趣。下面的数据展示了在过去30天内,涉及22.5美元到37.5美元行权价范围内,影响京东的丰富交易的认购和认沽的成交量和未平仓合约量的波动。

JD.com Option Volume And Open Interest Over Last 30 Days

过去30天京东期权成交量和未平仓合约量

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | PUT | TRADE | BULLISH | 09/20/24 | $2.49 | $2.41 | $2.42 | $27.50 | $605.0K | 13.9K | 2.5K |

| JD | CALL | SWEEP | BULLISH | 09/20/24 | $4.4 | $4.0 | $4.4 | $22.50 | $91.7K | 3.7K | 201 |

| JD | PUT | TRADE | BULLISH | 01/17/25 | $7.1 | $6.95 | $6.95 | $32.50 | $69.5K | 6.4K | 100 |

| JD | PUT | SWEEP | BULLISH | 01/17/25 | $11.55 | $11.45 | $11.45 | $37.50 | $57.2K | 1.4K | 50 |

| JD | PUT | TRADE | BEARISH | 01/17/25 | $11.45 | $11.15 | $11.4 | $37.50 | $57.0K | 1.4K | 151 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 京东 | 看跌 | 交易 | 看好 | 09/20/24 | $2.49 | $2.41 | $2.42 | $27.50 | $605.0千 | 13.9千 | 2.5千 |

| 京东 | 看涨 | SWEEP | 看好 | 09/20/24 | $4.4 | $4.0 | $4.4 | $22.50 | $91.7千 | 3.7K | 201 |

| 京东 | 看跌 | 交易 | 看好 | 01/17/25 | $7.1 | $6.95 | $6.95 | $32.50 | $69.5K | 6.4千 | 100 |

| 京东 | 看跌 | SWEEP | 看好 | 01/17/25 | $11.55 | $11.45 | $11.45 | $37.50 | $57.2K | 1.4千 | 50 |

| 京东 | 看跌 | 交易 | 看淡 | 01/17/25 | $11.45 | $11.15 | $11.4 | $37.50 | $57.0K | 1.4千 | 151 |

About JD.com

关于京东

JD.com Inc is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

京东是一家领先的电子商务平台,其2022年中国总交易额与拼多多(交易额不公布)相似,根据我们的估计,但仍低于阿里巴巴。它提供广泛的正品产品,快速可靠的交货。该公司已经建立了自己的全国履行基础设施和末端送货网络,由自己的雇员支持其在线直销、在线市场和全渠道业务。

Where Is JD.com Standing Right Now?

京东现状如何?

- With a trading volume of 1,254,172, the price of JD is down by -2.74%, reaching $26.11.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 22 days from now.

- 交易量为1,254,172,JD的价格下跌了-2.74%,达到26.11美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一个财报将于22天后发布。

Expert Opinions on JD.com

关于京东的专家意见

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $40.0.

在过去一个月中,有1位行业分析师分享了他们对该股票的见解,提出了40.0美元的平均目标价。

- An analyst from Barclays persists with their Overweight rating on JD.com, maintaining a target price of $40.

- 巴克莱银行的一位分析师坚持给予京东超配评级,维持40美元的目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续的教育、战略性交易调整、利用各种因子以及保持对市场动态的敏锐度来缓解这些风险。使用Benzinga Pro的实时警报,了解京东的最新期权交易情况。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with JD, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with JD, it often means somebody knows something is about to happen.