Ford Gears Up For Q2 Earnings: Will Bullish Charts Overcome Recent Dip?

Ford Gears Up For Q2 Earnings: Will Bullish Charts Overcome Recent Dip?

Ford Motor Co (NYSE:F) will report second-quarter earnings on Wednesday. Wall Street expects 66 cents in EPS and $44 billion in revenues as the company reports after market hours.

福特汽车公司(纽交所:F)将于星期三发布第二季度收益报告。华尔街预计每股收益为66美分,收入为440亿美元,由于该公司在市场交易后发布报告。

The stock is down 0.18% over the past year, but up 14.31%% YTD. Ford stock is dipping Tuesday, alongside General Motors Co (NYSE:GM) stock's decline, following the latter's Q2 earnings report, delay of its 2024 Buick EV, and postponement of its EV pickup plant opening to 2026.

该股票在过去的一年中下跌了0.18%,但本年度已上涨14.31%。星期二,福特汽车公司的股票下跌,与通用汽车公司(纽交所:GM)的股票下跌一起出现,后者发布了第二季度收益报告,推迟了2024年别克电动汽车的推出,并将其电动皮卡工厂的开放推迟到2026年。

Let's look at what the charts indicate for Ford stock, and how the stock currently maps against Wall Street estimates.

让我们看看福特公司的股票图表指示什么,以及它如何与华尔街的预期相匹配。

Ford Technical Setup

福特技术组合

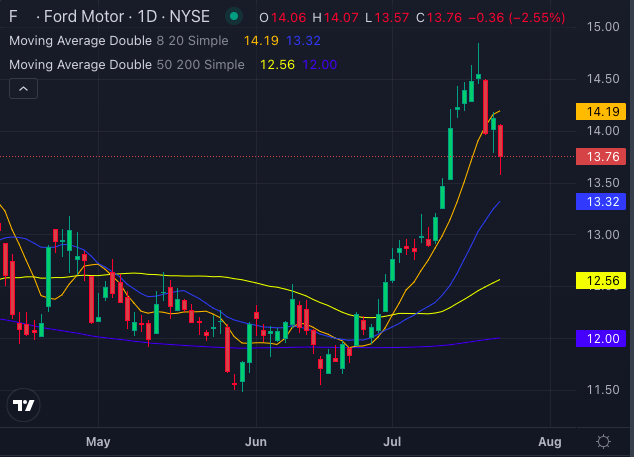

Ford Motor's stock is currently exhibiting a moderately bullish trend with buying pressure, indicating potential for future bullish movement.

福特汽车的股票目前展示了一个带有买入压力的中度看好趋势,表明未来可能会有看涨的动向。

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

The share price of $13.76 is slightly below the 8-day simple moving average of $14.19, signaling a bearish moment.

每股收益为13.76美元的股价略低于14.19美元的8日简单移动平均线,这表明出现了看淡的时刻。

This is counterbalanced by stronger bullish indicators. The stock price is above both the 20-day SMA of $13.32 and the 50-day SMA of $12.56, which are bullish signals.

然而,更强劲的看涨因子抵消了这个趋势。股价高于13.32美元的20日简单移动平均线和12.56美元的50日简单移动平均线,这都是看涨的信号。

Additionally, the price exceeds the 200-day SMA of $12.00, further reinforcing the bullish outlook.

此外,价格超过了12美元的200日简单移动平均线,进一步强化了看涨的前景。

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

The Moving Average Convergence Divergence (MACD) indicator at 0.51 supports a bullish stance, though the Relative Strength Index (RSI) of 59.51 suggests the stock is nearing overbought conditions. Meanwhile, the Bollinger Bands range from $11.23 to $14.85, indicating favorable buying conditions.

移动平均线收敛/发散(MACD)指标为0.51,支持看涨立场,尽管相对强弱指数(RSI)为59.51,表明该股已接近超买区域。与此同时,布林带的区间为11.23美元至14.85美元,表明有利的购买条件。

Read Also: What's Going On With Ford Stock Tuesday?

阅读更多:福特股票周二的情况怎么样?

Ford Analysts Consensus Ratings

福特分析师共识评级

Ratings & Consensus Estimates: The consensus analyst rating on Ford stock stands at an Overweight currently with a price target of $15.55.

评级和共识预计:福特汽车股票的分析师共识评级目前为超重,目标价为15.55美元。

Recent analyst ratings from Barclays, Bernstein, and Citigroup suggest a 24.31% upside for Ford Motor stock with an average price target of $17.

巴克莱(Barclays)、伯恩斯坦(Bernstein)和花旗集团(Citigroup)最近的分析师评级表明,福特汽车股票的上涨空间为24.31%,目标价格平均为17美元。

F Price Action: Ford stock was trading at $13.94, down 1.24% at the time of publication.

F的股票价格在发稿时为13.94美元,下跌了1.24%。

- Turn Trading Into The Ultimate Side Hustle Using Benzinga Tools In A Free Webinar

- 在免费网络研讨会中,将Benzinga工具转化为终极副业

Image: Shutterstock

图片:shutterstock