American Express Unusual Options Activity For July 23

American Express Unusual Options Activity For July 23

Financial giants have made a conspicuous bearish move on American Express. Our analysis of options history for American Express (NYSE:AXP) revealed 10 unusual trades.

金融巨头们对美国运通采取了明显的看淡操作。我们对美国运通 (纽交所: AXP) 的期权历史记录进行分析后,发现有 10 笔异常交易。

Delving into the details, we found 0% of traders were bullish, while 100% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $286,350, and 8 were calls, valued at $324,889.

深入研究后,我们发现 0% 的交易人持有买入看好的观点,而 100% 的交易人表现出看淡的趋势。在我们发现的所有交易中,有 2 笔看跌交易,价值 286,350 美元,有 8 笔看涨交易,价值 324,889 美元。

Expected Price Movements

预期价格波动

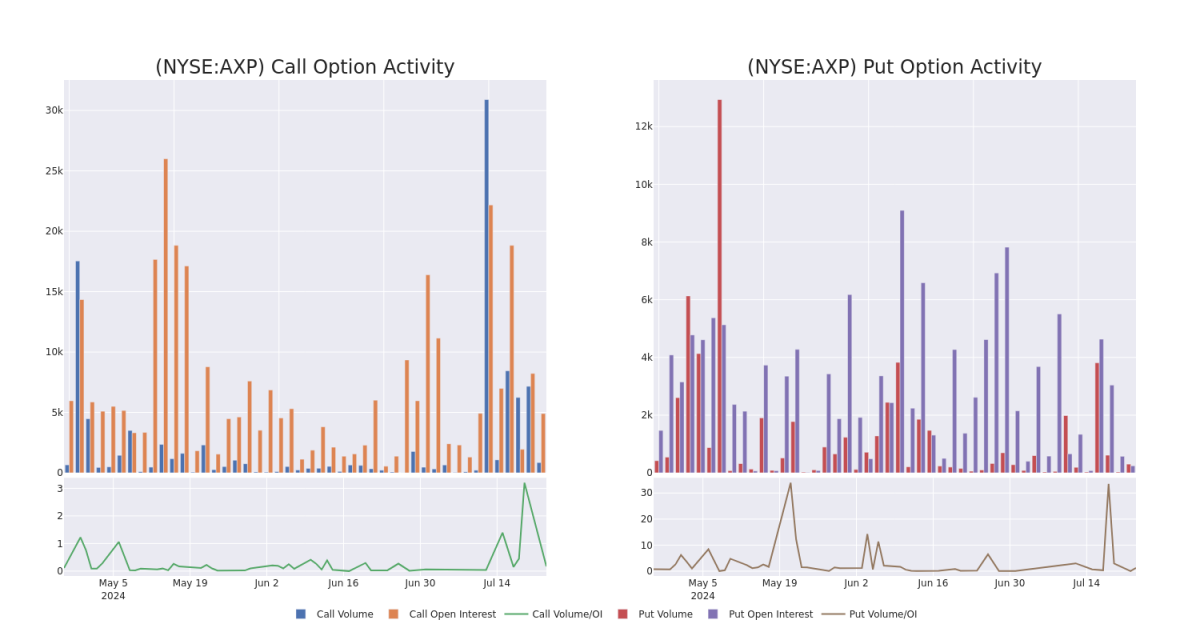

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $220.0 and $280.0 for American Express, spanning the last three months.

通过评估成交量和未平仓量,很明显市场大户们把美国运通的价格区间定在 220.0 到 280.0 美元之间,跨越过去三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for American Express options trades today is 572.0 with a total volume of 1,150.00.

以流动性和利率为标准,今天美国运通期权交易的平均未平仓量为 572.0,总成交量为 1,150.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for American Express's big money trades within a strike price range of $220.0 to $280.0 over the last 30 days.

下面的图表显示了在过去 30 天内,美国运通的看涨期权和看跌期权的成交量和未平仓量的发展情况,其中行权价格范围为 220.0 到 280.0 美元的大宗交易。

American Express Option Activity Analysis: Last 30 Days

美国运通期权活动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | PUT | SWEEP | BEARISH | 11/15/24 | $5.75 | $5.55 | $5.75 | $230.00 | $200.6K | 242 | 151 |

| AXP | PUT | TRADE | BEARISH | 11/15/24 | $5.75 | $5.55 | $5.75 | $230.00 | $85.6K | 242 | 150 |

| AXP | CALL | SWEEP | BEARISH | 03/21/25 | $34.5 | $34.15 | $34.15 | $230.00 | $81.9K | 138 | 29 |

| AXP | CALL | TRADE | BEARISH | 11/15/24 | $34.5 | $33.75 | $33.75 | $220.00 | $40.5K | 174 | 12 |

| AXP | CALL | SWEEP | BEARISH | 10/18/24 | $6.75 | $6.7 | $6.7 | $260.00 | $40.2K | 955 | 673 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | 看跌 | SWEEP | 看淡 | 11/15/24 | $5.75 | $5.55 | $5.75 | $230.00 | $200.6K | 242 | 151 |

| AXP | 看跌 | 交易 | 看淡 | 11/15/24 | $5.75 | $5.55 | $5.75 | $230.00 | $85.6K | 242 | 150 |

| AXP | 看涨 | SWEEP | 看淡 | 03/21/25 | $34.5 | 34.15 | 34.15 | $230.00 | $81.9K | 138 | 29 |

| AXP | 看涨 | 交易 | 看淡 | 11/15/24 | $34.5 | $33.75 | $33.75 | $220.00 | $40.5K | 174 | 12 |

| AXP | 看涨 | SWEEP | 看淡 | 10/18/24 | 其股票的收盘价格昨天为$5.75。 | $6.7 | $6.7 | $260.00 | $40.2K | 955 | 673 |

About American Express

关于美国运通

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

美国运通是一家全球性的金融机构,在大约130个国家经营,为消费者和企业提供信用卡和借记卡支付产品。该公司还经营着一个非常赚钱的商家支付网络。自2018年以来,它在三个板块上运营:全球消费者服务、全球商业服务和全球商家和网络服务。除了支付产品外,该公司的商业业务还提供费用管理工具、咨询服务和商业贷款。

After a thorough review of the options trading surrounding American Express, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在深入研究美国运通期权交易后,我们继续对该公司进行更详细的审查,包括评估其当前的市场地位和表现。

Current Position of American Express

美国运通的当前位置

- Currently trading with a volume of 2,561,991, the AXP's price is up by 0.88%, now at $246.9.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 87 days.

- 美国运通的交易量为 2,561,991,涨幅为 0.88%,现报 246.9 美元。

- RSI读数表明该股目前可能接近超买水平。

- 预期财报发布还有 87 天。

What The Experts Say On American Express

关于美国运通的专家意见

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $261.6.

在过去30天内,共有5位专业分析师对这支股票发表了评论,平均目标价为261.6美元。

- Consistent in their evaluation, an analyst from Jefferies keeps a Hold rating on American Express with a target price of $235.

- Reflecting concerns, an analyst from Compass Point lowers its rating to Neutral with a new price target of $260.

- Consistent in their evaluation, an analyst from Monness, Crespi, Hardt keeps a Buy rating on American Express with a target price of $265.

- An analyst from B of A Securities persists with their Buy rating on American Express, maintaining a target price of $263.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on American Express with a target price of $285.

- 一位Jefferies的分析师对美国运通持有持有评级,目标价为235美元,持续一致。

- 反映担忧的是,Compass Point的一位分析师将其评级调低至中立,目标价为260美元。

- 一位来自Monness, Crespi, Hardt的分析师对美国运通进行买入评级,目标价为265美元,持续一致。

- 一位来自b of A Securities的分析师持续买入评级,目标价为263美元。

- 富国银行的分析师一致看好美国运通,目标价为285美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

In terms of liquidity and interest, the mean open interest for American Express options trades today is 572.0 with a total volume of 1,150.00.

In terms of liquidity and interest, the mean open interest for American Express options trades today is 572.0 with a total volume of 1,150.00.