AT&T Q2 Earnings: Strong Wireless Net Adds, Higher Free Cash Flow, Stable Annual Outlook

AT&T Q2 Earnings: Strong Wireless Net Adds, Higher Free Cash Flow, Stable Annual Outlook

AT&T Inc (NYSE:T) reported fiscal second-quarter 2024 operating revenues of $29.8 billion, down 0.4% year over year and missing the analyst consensus estimate of $29.9 billion.

AT&T公司(纽交所:T)报告了2024财年第二季度营业收入为298亿美元,同比下降0.4%,未达到分析师共识预期的299亿美元。

Adjusted EPS of $0.57 is in line with the analyst consensus estimate. The stock price gained after the print.

每股调整后的收益为0.57美元,符合分析师共识预期。股价在公布后上涨。

Also Read: AT&T and Snowflake Hit by Cyberattack, Millions of Customers Affected

同时阅读:AT&T和Snowflake遭受网络攻击,数万客户受影响

In the Mobility segment, AT&T clocked 997 thousand wireless net adds, including 419 thousand postpaid phone net adds, beating analyst estimates of 279 thousand, Bloomberg reports.

在移动业务板块,AT&T的无线净增加99.7万,其中包括41.9万的后付费手机净增,在彭博报告中超过了分析师的预期27.9万。

Verizon Communications Inc (NYSE:VZ) reported postpaid phone net additions of 148 thousand, surpassing forecasts of 118 thousand for the quarter.

Verizon通信公司(纽交所:VZ)报告了半年付费手机净增加14.8万,超过了季度预测的11.8万。

AT&T has attracted budget-conscious customers with its lower-priced unlimited plans, standing out amid fierce competition, CNBC reports.

CNBC报道称,AT&T通过其价格更低的无限计划吸引了预算有限的客户,在激烈竞争中脱颖而出。

AT&T's mobility segment saw a postpaid churn of 0.85% versus 0.95% a year ago. The Consumer Wireline segment had 239 thousand AT&T Fiber net adds, implying fiber broadband net additions lagging behind analyst estimates of 253 thousand. Verizon reported 391 thousand total broadband net additions.

AT&T的移动业务板块的后付费流失率为0.85%,比去年同期的0.95%要低。消费者固定线路业务板块新增了23.9万个AT&T Fiber用户,这意味着光纤宽带净增仍落后于分析师预期的25.3万个。Verizon报告了总计39.1万个宽带净增加。

The company reported 139 thousand AT&T Internet Air net adds.

该公司报告了13.9万个AT&T互联网Air净增加。

AT&T's adjusted EBITDA of $11.3 billion was up from $11.1 billion a year ago. It spent $4.4 billion on Capex.

AT&T的调整后EBITDA为113亿美元,高于去年的111亿美元。它在资本支出方面花费了440亿美元。

The company generated $9.1 billion in operating cash flow (down from $9.9 billion in the year-ago quarter) and $4.6 billion in free cash flow (up from $4.2 billion last year).

该公司产生了91亿美元的营业现金流(低于去年同期的99亿美元)和46亿美元的自由现金流(高于去年的42亿美元)。

Currently, AT&T's dividend yield stands at 6.10%. Higher free cash flows allow the company to raise shareholder returns through higher stock buybacks and dividends.

目前,AT&T的股息收益率为6.10%。更高的自由现金流可以通过更高的股票回购和股息来提高股东回报。

Prepaid churn was 2.57% compared to 2.50% in the year-ago quarter. Postpaid phone-only ARPU was $56.42, up 1.4% compared to the year-ago quarter.

预付费流失率为2.57%,去年同期为2.50%。后付费仅手机ARPU为56.42美元,比去年同期上涨1.4%。

Operating Income: Operating income was $5.8 billion versus $6.4 billion a year ago.

营业收入为58亿美元,相比去年的64亿美元有所下降。

Mobility segment operating income was up 1.6% year over year to $6.72 billion, with a margin of 32.8% compared to 32.6% in the year-ago quarter.

移动业务板块的营业收入同比增长1.6%,达到了672亿美元,利润率为32.8%,比去年同期的32.6%有所提高。

The Business Wireline segment operating margin was 2.1% compared to 7.5% in the year-ago quarter. The Consumer Wireline segment operating margin was 5.5% compared to 5.2% in the year-ago quarter.

商业固定线路业务板块的营业利润率为2.1%,去年同期为7.5%。消费者固定线路业务板块的营业利润率为5.5%,去年同期为5.2%。

FY24 Outlook: AT&T reiterated Wireless service revenue growth in the 3% range, Broadband revenue growth of 7%+, and adjusted EPS of $2.15 – $2.25 versus the $2.22 consensus.

FY24展望:AT&T重申无线服务收入同比增长3%,宽带收入增长7%以上,调整后EPS在2.15美元至2.25美元之间,与共识的2.22美元相符。

It maintained full-year adjusted EBITDA growth in the 3% range and a full-year free cash flow of $17 billion-$18 billion.

它保持全年调整后EBITDA同比增长在3%范围内,全年自由现金流为170亿至180亿美元。

For 2025, the company affirmed the adjusted EPS growth guidance.

对于2025年,该公司重申调整后EPS的增长预测。

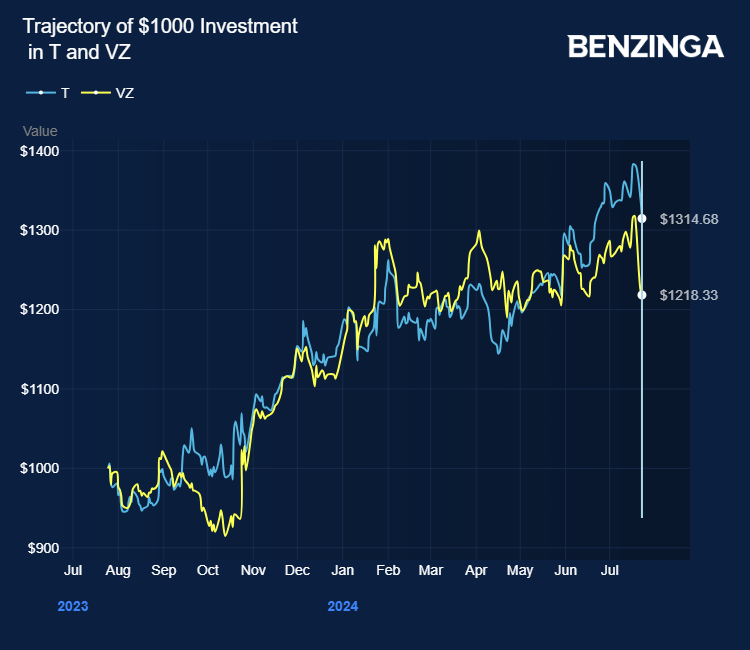

Price Action: T shares traded higher by 2.86% at $18.74 in the premarket at the last check on Wednesday.

价格走势:周三,AT&T股票在盘前交易中上涨2.86%,最后报价为18.74美元。

Also Read:

还阅读:

- Comcast'sComcast's Q2 Earnings: Studios And Theme Parks Pull Revenue Lower, Broadband And Video Subs Fall

- Comcast的Q2盈利报告:制片厂和主题公园拉低收入,宽带和视频订户下降。

Photo by 2p2play via Shutterstock

由2p2play提供的Shutterstock照片