Decoding EMCOR Group's Options Activity: What's the Big Picture?

Decoding EMCOR Group's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on EMCOR Group. Our analysis of options history for EMCOR Group (NYSE:EME) revealed 11 unusual trades.

金融巨头在EMCOR Group上做了明显的看淡举动。我们分析了EMCOR Group(NYSE:EME)期权历史,发现11次不同寻常的交易。

Delving into the details, we found 45% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $184,750, and 8 were calls, valued at $500,020.

深入挖掘细节,我们发现45%的交易者看好,54%的交易者表现出看淡趋势。我们发现所有发现的交易中,有3次看跌交易,价值为$ 184,750,8次看涨交易,价值为$ 500,020。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $310.0 to $380.0 for EMCOR Group over the last 3 months.

考虑到这些合同的成交量和未平仓合约数量,似乎鲸鱼们在过去3个月里一直在瞄准EMCOR Group的价格区间为$ 310.0至$ 380.0。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

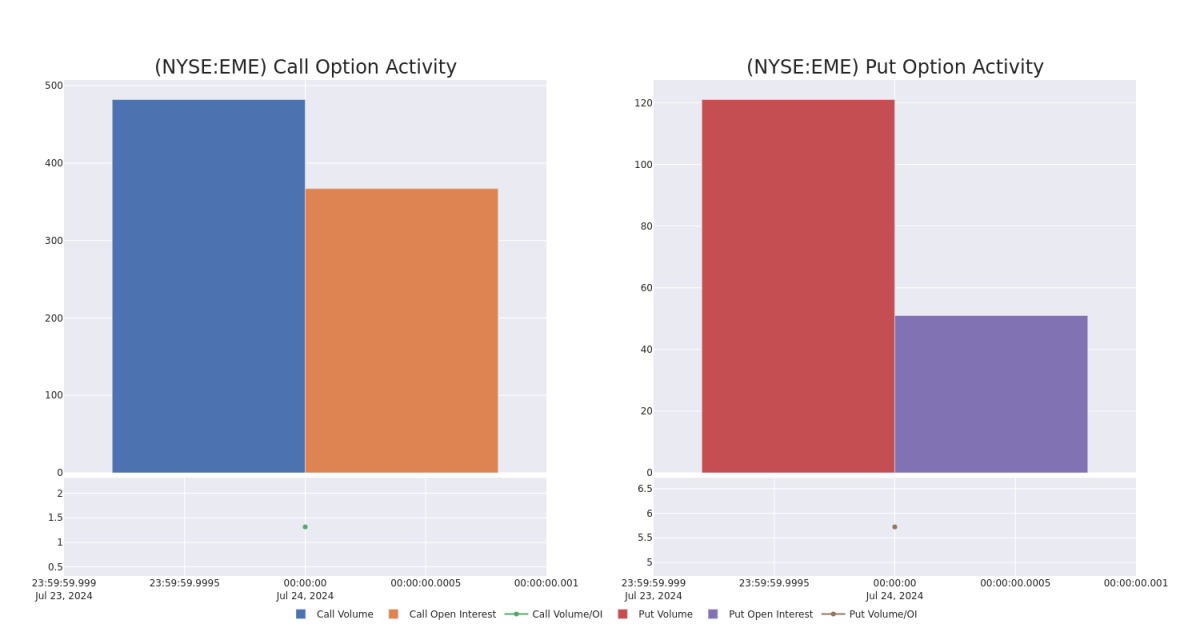

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in EMCOR Group's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to EMCOR Group's substantial trades, within a strike price spectrum from $310.0 to $380.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易的重要步骤。这些指标揭示了EMCOR Group期权的流动性和投资者对指定行权价的兴趣。即将到来的数据可视化了EMCOR Group在$ 310.0至$ 380.0行权价区间内的看涨和看跌期权的成交量和未平仓合约的波动情况,这些期权交易与EMCOR Group的重大交易相关。 过去30天。

EMCOR Group Option Volume And Open Interest Over Last 30 Days

EMCOR Group过去30天的期权成交量和未平仓合约

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EME | CALL | TRADE | BULLISH | 05/16/25 | $53.5 | $51.7 | $53.5 | $370.00 | $160.5K | 151 | 30 |

| EME | PUT | SWEEP | BULLISH | 08/16/24 | $14.6 | $12.2 | $13.7 | $360.00 | $130.1K | 45 | 100 |

| EME | CALL | TRADE | BULLISH | 05/16/25 | $52.0 | $50.4 | $52.0 | $370.00 | $104.0K | 151 | 50 |

| EME | CALL | SWEEP | BEARISH | 10/18/24 | $20.7 | $18.2 | $18.2 | $380.00 | $91.0K | 210 | 50 |

| EME | CALL | TRADE | BEARISH | 05/16/25 | $52.2 | $50.0 | $50.0 | $370.00 | $30.0K | 151 | 80 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EME | 看涨 | 交易 | 看好 | 05/16/25 | $ 53.5 | $51.7 | $ 53.5 | $370.00 | $ 160.5K | 151 | 30 |

| EME | 看跌 | SWEEP | 看好 | 08/16/24 | 14.6美元 | $12.2 | $13.7 | $360.00 | $130.1K | 45 | 100 |

| EME | 看涨 | 交易 | 看好 | 05/16/25 | $52.0 | $ 50.4 | $52.0 | $370.00 | 104,000美元 | 151 | 50 |

| EME | 看涨 | SWEEP | 看淡 | 10/18/24 | $20.7美元 | $18.2 | $18.2 | $380.00 | 91000 美元 | 210 | 50 |

| EME | 看涨 | 交易 | 看淡 | 05/16/25 | $52.2 | $50.0 | $50.0 | $370.00 | $30.0K | 151 | 80 |

About EMCOR Group

关于EMCOR Group

EMCOR Group Inc is a specialty contractor in the United States and a provider of electrical and mechanical construction and facilities services, building services, and industrial services. Its services are provided to a broad range of commercial, technology, manufacturing, industrial, healthcare, utility, and institutional customers through approximately 100 operating subsidiaries. The company's operating subsidiaries are organized into reportable segments: United States electrical construction and facilities services, United States mechanical construction and facilities services, United States building services, United States industrial services, and United Kingdom building services. Geographically the majority of revenue is generated from the United States.

EMCOR Group Inc是美国的一家专业承包商,提供电力和机械建设和设施服务、建筑服务和工业服务。该公司通过大约100个运营子公司向广泛的商业、科技、制造、工业、医疗保健、公用事业和机构客户提供服务。该公司的运营子公司被组织成可报告的细分:美国电力施工和设施服务、美国机械施工和设施服务、美国建筑服务、美国工业服务和英国建筑服务。就地理位置而言,大部分收入来自美国。

Having examined the options trading patterns of EMCOR Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析了EMCOR Group期权交易模式之后,我们现在将直接转向该公司。这种转变使我们能够深入研究其现在的市场地位和表现。

EMCOR Group's Current Market Status

EMCOR Group当前的市场状态

- With a volume of 602,665, the price of EME is down -5.93% at $356.73.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 1 days.

- EME的成交量为602,665,价格下跌-5.93%,为$ 356.73。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下次盈利预计将于1天内发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。