One of the easiest ways to grow wealth is a simple buy-and-hold strategy that âsets it and forgets itâ. In this strategy, you buy a selection of best-in-class TSX stocks, hold them long term (ideally forever), and watch your nest egg steadily grow. Investment returns tend to compound with dividend growth and reinvestment, and could snowball into a sizeable retirement fund â financially setting you up for life.

An investment in Intact Financial (TSX:IFC) stock today could generate steady capital gains, earn growing quarterly dividend paycheques for a lifetime, and help set you up for a pretty long, worry-free retirement.

Intact Financial stock: A reliable growth engine

Intact Financial, a Canadian insurance giant, has grown into a global financial industry force organically and through strategic acquisitions over the past two decades. It has excelled at generating strong shareholder returns, consistently outperforming market peers. Consequently, its reputation remains intact.

The $43 billion property and casualty insurer was a significantly smaller player in 2009, boasting a market capitalization of just $4.3 billion. Since then, IFC stock has grown tenfold through organic business volume expansion, sustained profitability, and accretive acquisitions. Its proven business strategy positions it well for continued stock price appreciation beyond the next decade.

The $43 billion property and casualty insurer was a significantly smaller player in 2009, boasting a market capitalization of just $4.3 billion. Since then, IFC stock has grown tenfold through organic business volume expansion, sustained profitability, and accretive acquisitions. Its proven business strategy positions it well for continued stock price appreciation beyond the next decade.

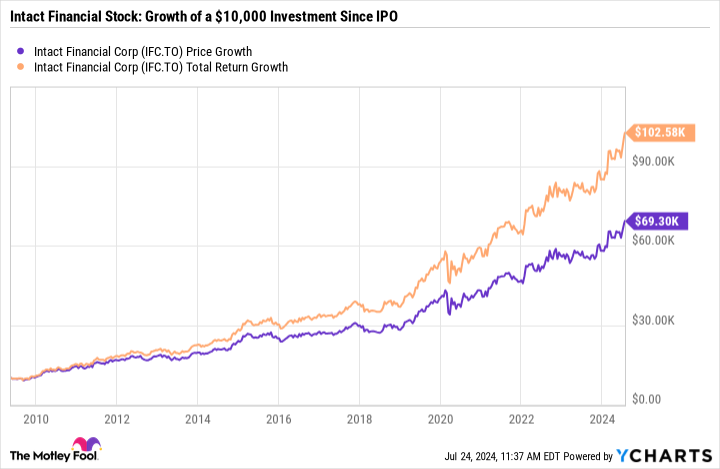

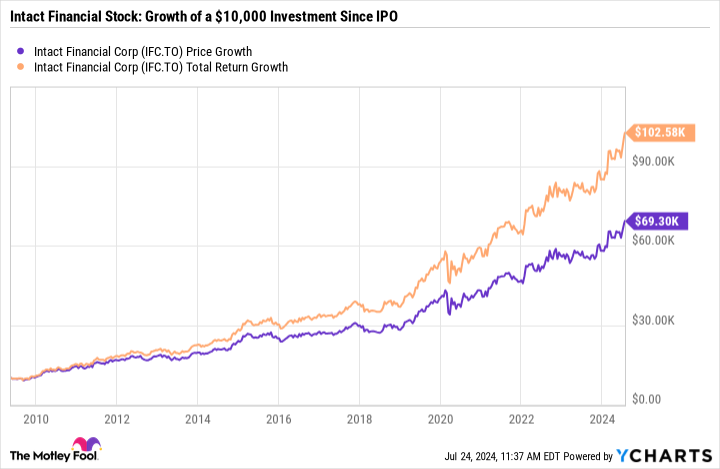

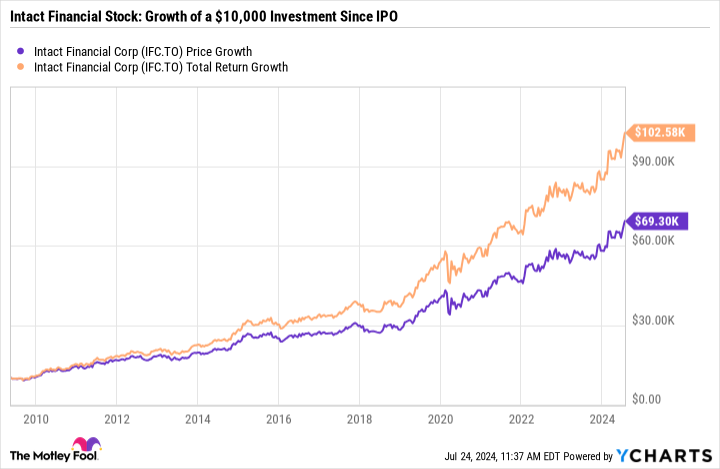

Intact Financialâs track record speaks for itself. Since going public 20 years ago, IFC stock has generated a staggering 1,288% in total returns for shareholders. A $10,000 investment back in 2004 would be worth over 102,000 today. The stockâs potential for generating wealth is far from exhausted.

IFC data by YCharts

How will Intact Financial continue to reward investors?

The insurance giantâs focus on strategic acquisitions remains a key growth driver. It opportunistically acquired a United Kingdom-based competitor recently to grow volumes. The company has closed nine accretive acquisitions since 2009.

Further, organic growth in underwritten premiums should remain positive, fueled by healthy economies in Intact Financialâs markets, positive interest rate regimes, strong brand recognition, population growth rates in target markets due to immigration, and Intact Financialâs continuous innovation expanding its market share.

Innovation: The key to unlocking IFC stockâs future growth

Intact Financial has already deployed more than 93 artificial intelligence (AI) models to maintain agility, gain a data-driven competitive edge, control costs, and attract more business from customers.

Investments in operational efficiency and data-driven performance should propel Intact Financial towards achieving its long-term goal of 10% annual growth in net operating income per share (NOIPS) and exceeding industry return on equity (ROE) by 500 basis points.

The company has historically comfortably beaten its long-term targets. Recent management reports show IFC stock delivered a 12% compound annual growth rate in NOIPS and exceeded average industry ROE by 6.8% over the past decade.

Intact Financialâs strong NOIPS growth over the past decade translated into a 15.7% average annual total return on IFC stock. Continued income growth and above-average ROE can attract further investment, fuelling sustained share price appreciation beyond the next decade.

Sustainable dividends enhance shareholder value

Intact Financial offers a quarterly dividend with a 2% annual yield. The dividend yield seems low for new dividend investors today only because the stock price has persistently rallied. Management has raised dividends for 19 consecutive years while IFC stockâs dividend growth averaged 9.6% per annum over the past decade. The dividend is healthy given an earnings payout ratio of 52%.

Growing dividends can significantly compound returns on IFC stock, setting you up for a lifetime of increasing passive income. For example, investors who bought the stock at prices under $29 a share in December 2004 earned $0.163 per share in quarterly dividends ($0.65 annualized). The quarterly payout has grown to $1.21 per share ($4.84 annualized) today. Early investors in 2004 could be earning a 17% dividend yield (on cost) this year. Their dividend âearningsâ have substantially grown. They are well set for a lifetime of passive income.

If you want in on this proven TSX stock that has set others up for life, you can purchase some shares today. The stock appears fairly valued with a forward price-to-earnings (PE) multiple of 15.4 and a price-earnings-to-growth (PEG) ratio of 1.2, which implies IFC stock is appropriately priced considering its strong potential for double-digit earnings growth.

The post 1 TSX Stock That Could Help Set You Up for Life appeared first on The Motley Fool Canada.

增长财富最简单的方法之一是简单的购买并持有策略,将其设置并忘记。在此策略中,您购买精选的TSX股票中的最佳股票,长期持有它们(理想情况下永远持有),并观察您的储蓄逐步增长。投资回报往往随着股息增长和再投资而复利,可能会积累成为可观的退休基金,为您带来财务上的稳定。

投资Intact Financial(TSX:IFC)股票,可以产生稳定的资本收益,为终身提供不断增长的季度分红支票,并帮助您安心度过纷繁的退休生活。

Intact Financial股票:一个可靠的增长引擎

加拿大保险巨头Intact Financial通过有机增长和战略性收购,在过去的二十年中发展成为全球金融业合力。它以产生强大的股东回报表现出色,持续超越市场同行。因此,其声誉始终如一。

430亿美元的财产和意外保险公司在2009年是一个相对较小的玩家,市值仅为43亿美元。自那时以来,IFC股票通过机构业务量的扩张、持续的盈利和增值收购,已经扩大了十倍。其成熟的业务策略使它在未来十年股价增长方面的表现良好。

430亿美元的财产和意外保险公司在2009年是一个相对较小的玩家,市值仅为43亿美元。自那时以来,IFC股票通过机构业务量的扩张、持续的盈利和增值收购,已经扩大了十倍。其成熟的业务策略使它在未来十年股价增长方面的表现良好。

Intact Financial的业绩记录不言自明。自二十年前上市以来,IFC股票为股东们创造了惊人的1288%的总回报。2004年10,000美元的投资在今天价值超过10.2万美元。该股票的财富创造潜力还远未耗尽。

IFC数据通过YCharts提供

Intact Financial将如何继续回报投资者?

这家保险巨头对战略性收购的关注仍是关键的增长驱动力。最近,它机会主义地收购了英国的一家竞争对手以扩大销售量。该公司自2009年以来已经完成了9项有益的收购。

此外,在Intact Financial的市場中经济繁荣,利率处于积极阶段,强大的品牌知名度,由于移民导致目标市場的人口增长率等各方面,其承保保费的有机增长应保持积极。Intact Financial持续推动其创新,以拓展其市场份额。

创新:解锁IFC股票未来的增长关键

Intact Financial已经部署了93多个人工智能模型,以保持灵活性,获得数据驱动的竞争优势,控制成本,吸引更多来自客户的业务。

运营效率和数据驱动表现的投资应推动Intact Financial实现其目标,即每股净营业收入(NOIPS)年增长率为10%,并超过行业的股本回报率(ROE)500个基点。

该公司历史上始终轻松超越其长期目标。最近的管理报告显示,IFC股票的净营业收入年复合增长率为12%,并在过去十年中超过行业平均ROE 6.8%。

在过去十年中,Intact Financial强劲的NOIPS增长转化为IFC股票的平均年总回报率为15.7%。持续的收入增长和高于平均的ROE可能吸引更多投资,推动持续的股价升值超过下一个十年。

持续股息增长将增强股东价值

Intact Financial每季度提供2%年收益率的股息。尽管股票价格持续上涨,但对于新股票投资者来说,股息收益率似乎偏低。管理层在过去19年中提高了股息,IFC股票的股息增长年均为9.6%。放眼整个行业,配股比率只占收益的52%,可见其分红是健康的。

股息的增长可以显著地增加IFC股票的收益,为您带来一生增长的被动收入。例如,在2004年以每股29美元以下的价格购买股票的投资者,在当年每股获得0.163美元的季度股息(全年0.65美元)。目前,季度股息增长至每股1.21美元(全年4.84美元)。早期股东在今年可以获得17%的股息支出(运营成本),并且其股息收益已经显著增长。他们的被动收入将很好地持续增长。

如果您想拥有这种经过验证的TSX股票,并为生活做好准备,可以今天购买一些股票。根据前瞻市盈率(PE)为15.4,市盈率增长率(PEG)为1.2,该股票似乎定价适当,考虑到其强劲的两位数盈利增长潜力。

1只能帮助您获得余生的TSX股票,如果您购买了该股票,股市能够为您提供良好的资本收益,稳定支付季度分红,并帮助您迎接漫长、无忧的退休生活。这篇文章最初发表在The Motley Fool Canada。

430亿美元的财产和意外保险公司在2009年是一个相对较小的玩家,市值仅为43亿美元。自那时以来,IFC股票通过机构业务量的扩张、持续的盈利和增值收购,已经扩大了十倍。其成熟的业务策略使它在未来十年股价增长方面的表现良好。

430亿美元的财产和意外保险公司在2009年是一个相对较小的玩家,市值仅为43亿美元。自那时以来,IFC股票通过机构业务量的扩张、持续的盈利和增值收购,已经扩大了十倍。其成熟的业务策略使它在未来十年股价增长方面的表现良好。

The $43 billion property and casualty insurer was a significantly smaller player in 2009, boasting a market capitalization of just $4.3 billion. Since then, IFC stock has grown tenfold through organic business volume expansion, sustained profitability, and accretive acquisitions. Its proven business strategy positions it well for continued stock price appreciation beyond the next decade.

The $43 billion property and casualty insurer was a significantly smaller player in 2009, boasting a market capitalization of just $4.3 billion. Since then, IFC stock has grown tenfold through organic business volume expansion, sustained profitability, and accretive acquisitions. Its proven business strategy positions it well for continued stock price appreciation beyond the next decade.