Nasdaq 100 Notches Worst Session Since Late 2022, Falls Below Key 50-Day Moving Average: Is The AI Tech Bubble Bursting?

Nasdaq 100 Notches Worst Session Since Late 2022, Falls Below Key 50-Day Moving Average: Is The AI Tech Bubble Bursting?

Technology stocks endured their steepest decline since late 2022 on Wednesday, with nearly 75% of Nasdaq 100 constituents slipping into the red.

科技股周三遭遇自2022年底以来最大跌幅,近75%的纳斯达克100成分股收跌。

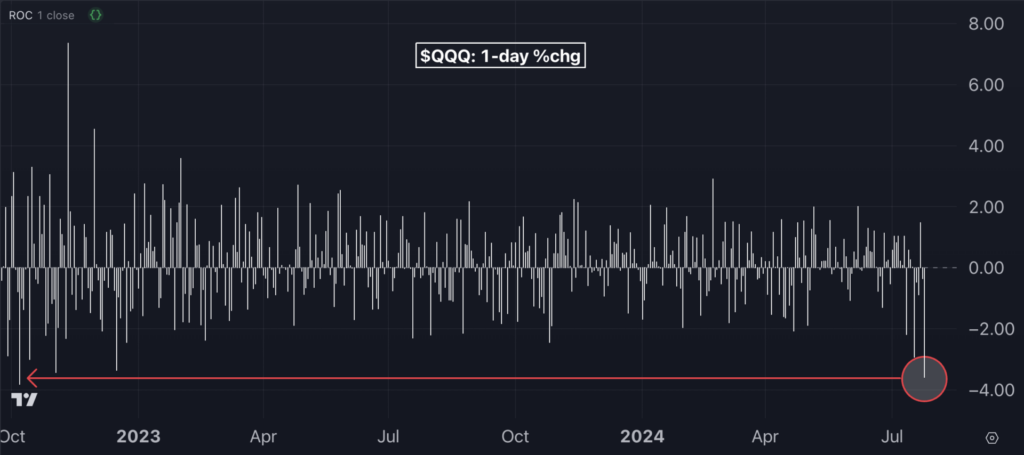

The Nasdaq 100 — tracked by the Invesco QQQ Trust (NASDAQ:QQQ) — dropped 3.6%, marking its fifth decline in six sessions and the sharpest one-day drop since October 2022.

纳斯达克100指数(由纳指100etf-invesco qqq trust纳斯达克:qqq跟踪)下跌3.6%,创下六个交易日中第五个下跌的记录,也是截至2022年10月以来的最大单日跌幅。

The tech-heavy index fell below its 50-day moving average for the first time since early May. It mostly stayed above this key support level since late October 2023, barring a brief two-week period between April and May.

这个科技股为主的指数自5月初以来首次跌破50日移动平均线。除4月至5月短短两周的时间外,自2023年10月以来它基本上一直保持在这个关键的支撑水平上。

GDP Q2 Preview – 5 ETFs To Monitor Thursday As Economic Data Unfolds

GDP Q2预览-在经济数据公布时监控的5个etf

Shares of Alphabet Inc (NASDAQ:GOOG), the parent company of Google, plummeted 4.9% due to higher-than-expected AI spending and disappointing YouTube ad revenue.

谷歌的母公司Alphabet Inc(纳斯达克:goog)的股票因为人工智能支出高于预期和YouTube广告收入不佳暴跌4.9%。

Tesla Inc. (NASDAQ:TSLA) shares tumbled 12% following a 7% drop in auto revenue, a profit miss, and delays in the Robotaxi project.

特斯拉股价(纳斯达克:tsla)下跌12%,汽车收入下降7%,利润不达预期,无人驾驶出租车计划延误。

Chip stocks also suffered, with Nvidia falling 6.2%, Broadcom Inc. (NASDAQ:AVGO) losing 7.6%, and Arm Holdings plc (NASDAQ:ARM) sinking 8.2%.

芯片股也遭受了重创,英伟达下跌6.2%,博通股份(纳斯达克:avgo)下跌7.6%,Arm Holdings plc(纳斯达克:arm)下跌8.2%。

The Magnificent Seven, tracked by the Roundhill Magnificent Seven ETF (NYSE:MAGS), plunged 5.8%. This marks the worst daily performance since the fund's inception. Collectively, the seven tech giants wiped out nearly $700 billion in market value in a single session, with Nvidia Corp. (NASDAQ:NVDA) alone shedding $180 billion.

由Roundhill Magnificent Seven(纽交所:mags)跟踪的科技七巨头下跌5.8%,这标志着基金成立以来最差的单日表现,7家科技巨头一起在单个交易日里抹去了近7000亿市值,其中英伟达公司(纳斯达克:nvda)就单独蒸发了1800亿。

Chart: Nasdaq 100 Falls Below 50-Day Moving Average, QQQ Marks Worst Day Since October 2022

图表:纳斯达克100指数跌破50日移动平均线,纳指100etf-invesco qqq trust (纳斯达克:qqq)创出了自2022年10月以来最糟糕的一天。

The key question now is whether the tech-led bull market is over or the AI bubble is bursting. Investors have also been rotating out of tech since July 11, according to veteran Wall Street investor Ed Yardeni.

现在的关键问题是科技主导的牛市是否结束了,或者人工智能泡沫是否正在破裂。根据华尔街老牌投资人爱德•雅尔德尼的说法,自7月11日起,投资者已开始对科技产业进行轮换。

The lower-than-expected CPI in June prompted investors to pile into interest-rate-sensitive stocks.

6月低于预期的CPI使投资者大举投资利率敏感的股票。

"We agree with that expectation," Yardeni said, "but we also think it could be a one-and-done rate cut for 2024 because the economy remains resilient."

“我们同意这种预期,”雅尔德尼说,“但我们也认为这可能是2024年唯一一次的降息,因为经济依然强劲。”

"For now, we believe that the stock market was overbought and is experiencing a minor selloff," he added.

他补充说:“目前来看,我们认为股市被高估了,正在经历一次轻微的抛售。”

On July 16, the S&P 500 was 15% above its 200-day moving average. Historically, such levels have often preceded 10%-20% corrections or more significant declines during recessions.

在7月16日,标普500指数高出200日移动平均线15%。从历史数据来看,这种情况往往预示着经历过经济衰退的10%至20%的纠正性回调。

This time, the selloff doesn't seem linked to widespread recession fears, Yardeni says. After all, the Fed is poised to potentially lower interest rates in September.

雅尔德尼表示,这次卖盘似乎没有与普遍的经济衰退担忧有关。毕竟,联邦储备委员会正准备在9月可能降息。

Now Read:

现在就阅读吧:

- US Stocks Tumble, Magnificent 7 Wipe Out $570 Billion As Mega-Tech Earnings Disappoint, VIX Spikes: What's Driving Markets Wednesday?

- 美国股票下跌,科技七巨头因盈利不佳而蒸发5700亿美元,VIX飙升:周三市场动向何去何从?