Top 2 Consumer Stocks Which Could Rescue Your Portfolio In Q3

Top 2 Consumer Stocks Which Could Rescue Your Portfolio In Q3

Q3季度可以拯救你消费(Consumer)股票组合的前两个股票

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies. `

消费板块中被超卖的股票提供了一个买进被低估的公司的机会。`

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

Conn's Inc (NASDAQ:CONN)

康恩斯科恩股份有限公司(纳斯达克:CONN)

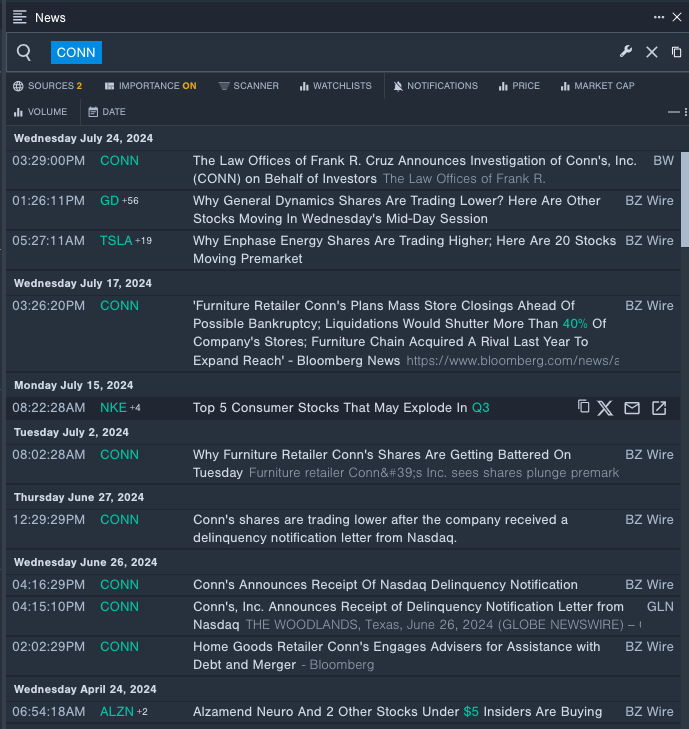

- On June 26, Conn's received a delinquency notification letter from the Nasdaq. The company's stock fell around 48% over the past five days and has a 52-week low of $0.31.

- RSI Value: 17.61

- CONN Price Action: Shares of Conn's closed at $0.35 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest CONN news.

- 6月26日,Conn's收到了纳斯达克的逾期通知信。公司股价在过去五天内下跌约48%,52周最低价为0.31美元。

- RSI值:17.61

- CONN价格行情:周三Conn's的股票收盘价为0.35美元。

- Benzinga Pro的即时新闻提醒了最新的CONN资讯。

Levi Strauss & Co (NYSE:LEVI)

Levi Strauss & Co(纽约证券交易所:LEVI)

- On June 26, Levi Strauss reported quarterly earnings of 16 cents per share which beat the analyst consensus estimate of 11 cents. "We delivered another strong quarter driven by the Levi's brand's prominence at the center of culture, a robust pipeline of newness and innovation, and continued momentum in our global direct-to-consumer channel. Our amplified focus on women's and denim lifestyle is delivering outsized growth and driving meaningful market share gains," said Michelle Gass, CEO of Levi Strauss & Co. The company's stock fell around 24% over the past month. It has a 52-week low of $12.42.

- RSI Value: 25.55

- LEVI Price Action: Shares of Levi Strauss fell slightly to close at $17.50 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in LEVI stock.

- 6月26日,Levi Strauss每股收益为16美分,超过分析师的共识预期11美分。Levi's品牌在文化中心的突出地位,新产品和创新的强大管道以及全球直销业务的持续势头推动了我们的强劲增长。我们放大了对女性和丹宁生活方式的关注,实现了超额增长并带动了有意义的市场份额增长。"Levi Strauss&Co.首席执行官Michelle Gass说。公司股价在过去一个月内下跌了约24%。它的52周最低价为12.42美元。

- RSI值:25.55

- LEVI价格行情:周三Levi Strauss的股票略微下跌,收于17.50美元。

- Benzinga Pro的图表工具帮助识别LEVI股票的趋势。

- Nasdaq, S&P 500 Record Worst Session Since 2022 Amid Tesla, Alphabet Selloff: Investor Optimism Decreases Further

- 纳斯达克、标普500指数因特斯拉、Alphabet抛售而创下2022年以来最劣表现:投资者信心进一步降低。