Apple's Taiwanese Chip Supplier ASE Tech Clocks Modest Q2 Growth In Revenues

Apple's Taiwanese Chip Supplier ASE Tech Clocks Modest Q2 Growth In Revenues

ASE Technology Holding Co (NYSE:ASX) reported a fiscal second-quarter 2024 net revenue growth of 2.9% year-on-year to 140.24 billion New Taiwan dollars ($4.35 billion), missing the analyst consensus estimate of $4.51 billion. The revenue of the Apple Inc (NASDAQ:AAPL) chip supplier grew by 5.6% quarter-on-quarter.

日月光半导体控股有限公司(纽交所:ASX)报告2024财年第二季度净营业收入年同比增长2.9%,达到1402.4亿新台币(43.5亿美元),低于分析师共识预期的45.1亿美元。苹果公司(纳斯达克:AAPL)芯片供应商的营业收入环比增长5.6%。

Net revenues for ATM (assembly, testing, and material) business was 77.81 billion New Taiwan dollars, up by 2.2% Y/Y and 5.3% Q/Q.

ATm(装配测试及材料)业务净收入为778.1亿新台币,同比增长2.2%,环比增长5.3%。

EMS (electronic manufacturing services) net revenues were 62.91 billion New Taiwan dollars, up by 4.1% Y/Y and 6.0% Q/Q.

EMS(电子制造服务)净收入为629.1亿新台币,同比增长4.1%,环比增长6.0%。

Gross margin increased by 70 bps Q/Q to 16.4%. The operating margin grew by 70 bps Q/Q to 6.4%.

毛利率环比增长70个基点至16.4%。营业利润率环比增长70个基点至6.4%。

Diluted EPS was 1.75 New Taiwan dollars (or $0.109 per ADS) versus analyst consensus estimate of $0.110.

摊薄后每股收益为1.75新台币(或每股美国存托股票0.109美元),略低于分析师预期的0.110美元。

Capital expenditures totaled $406 million.

资本支出总额为40600万美元。

Earlier in July, ASE Technology opened its second testing facility in San Jose, California, to enhance its advanced chip testing capabilities to meet growing customer needs for artificial intelligence (AI) and high-performance computing (HPC). ISE Labs Inc, a wholly owned subsidiary of ASE, will manage this new facility, the Taipei Times reported.

今年7月,日月光半导体在加州圣何塞开设了第二个测试设施,以增强其先进芯片测试能力,以满足人工智能(AI)和高性能计算(HPC)领域不断增长的客户需求。据《台北时报》报道,日月光全资子公司ISE Labs Inc将管理这一新设施。

ISE Labs has invested about $500 million in its U.S. labs, and plans to invest around $200 million in the San Jose facility.

ISE Labs在美国实验室投资了约5亿美元,并计划在圣何塞设施投资约2亿美元。

In April, ASE Technology increased its capital spending by 10% from an earlier estimate of $2.1 billion to meet growing demand.

今年4月,日月光半导体将其资本支出从早期估计的21亿美元增加了10%,以满足不断增长的需求。

It also plans to allocate a larger portion of its budget to the chip testing business, increasing it to 24% from the original 18%. ASE Technology is also exploring potential locations for advanced chip packaging capacity in the U.S., Japan, and Mexico.

它还计划将更大比例的预算分配给芯片测试业务,将其从原定的18%增加至24%。同时,日月光半导体还在探索在美国、日本和墨西哥等地的先进芯片封装产能潜力。

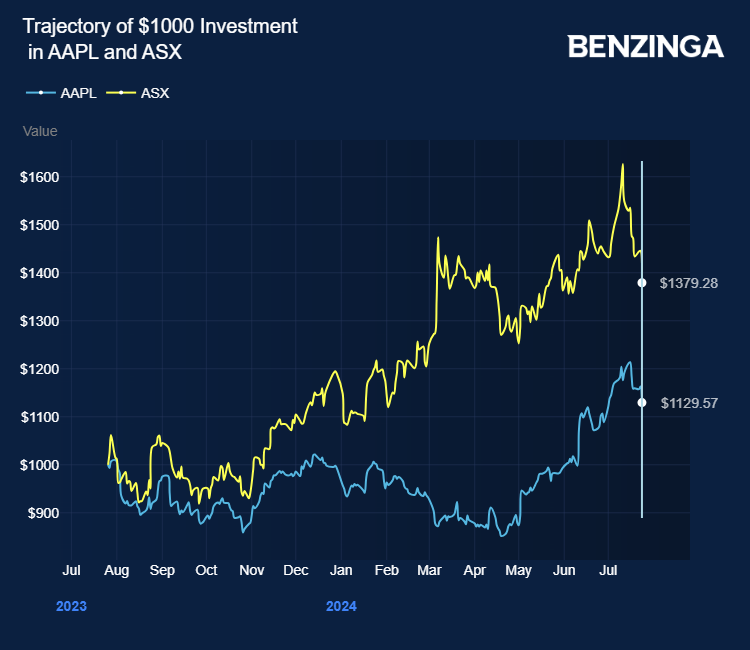

ASE Technology stock gained over 37% in the last 12 months.

在过去的12个月中,日月光半导体股价上涨了超过37%。

Price Action: At the last check on Thursday, ASX shares traded lower by 0.38% at $10.56 premarket.

股价走势:上周四最后一次交易时,日月光股价报10.56美元,盘前下跌0.38%。

Photo via Shutterstock

图片来自shutterstock。