Goldman Sachs: Time To Hedge? Goldman's Flow-Of-Funds Guru Scott Rubner Suggests Hedging. Here Are Inexpensive Ways To Do So Ahead Of Mag 7 Earnings Next Week

Goldman Sachs: Time To Hedge? Goldman's Flow-Of-Funds Guru Scott Rubner Suggests Hedging. Here Are Inexpensive Ways To Do So Ahead Of Mag 7 Earnings Next Week

"Hedging Is Gaining Traction"

“对冲正在获得越来越多的支持。”

That's what Goldman Sachs's flow of funds guru Scott Rubner said in his note earlier today ("I Am Not Buying This Dip").

那就是高盛资金流动专家斯科特·拉布纳(Scott Rubner)在今天早些时候的笔记《我不会买入这个低谷》中所说的。

He also pointed out that four of the Magnificent Seven mega caps are reporting earnings next week: Microsoft Corporation (NASDAQ:MSFT), Meta Platforms, Inc. (NASDAQ:META), Apple, Inc. (NASDAQ:AAPL), and Amazon.com, Inc. (NASDAQ:AMZN), and that if their results and guidance are not "great", those stocks will likely get punished in this market environment.

他还指出,科技七巨头中的四个公司将在下周公布财报:微软(纳斯达克代码:MSFT)、meta platforms(纳斯达克代码:META)、苹果(纳斯达克代码:AAPL)和亚马逊(纳斯达克代码:AMZN),如果他们的业绩和展望不“出色”,这些股票可能会在这个市场环境中受到惩罚。

In the video below, I show inexpensive ways of hedging Microsoft and Meta ahead of their earnings next week.

在下面的视频中,我展示了在微软和meta公布财报前结束对冲的廉价方法。

I mention a couple of times there that there's a link to download the newly updated Portfolio Armor iPhone app in the description of the video. Unfortunately, I found out after recording that that YouTube is not allowing me to post clickable links in the description, apparently because I uploaded a newsworthy clip of the late head of Wagner PMC recruiting prisoners for the Ukraine War last year (they have Wagner listed as a criminal organization, even though it's basically the Russian version of America's Blackwater).

我在视频中几次提到,视频说明里有下载新版 Armor iPhone 应用的链接。不幸的是,在录制后,我发现 YouTube 不允许我在说明中发布可点击的链接,显然是因为我去年上传了有关 Wagner PMC 前负责招募乌克兰战争囚犯的头目的新闻片断(尽管 Wagner 被列为犯罪组织,但基本上相当于俄罗斯版的美国黑水)。

But you can download the app here.

但是您可以在这里下载该应用程序。

Hedging META Ahead Of Earnings

财报发布前对冲meta

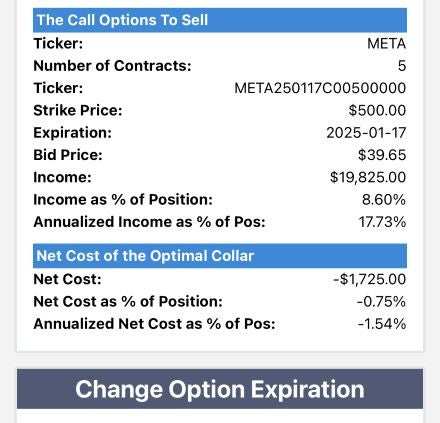

This is one of the hedges I present in the video, an optimal collar, as of Wednesday's close, to hedge 500 shares of META against a >5% decline by next Friday, without capping your possible upside at less than 8% on the week.

这是我在视频中介绍的对冲策略之一,一个有效的领口,截至上周三的收盘价,用于对冲500股meta的超过5%的跌幅,而不会将您的潜在收益上限在本周限制在低于8%。

As you can see, the net cost there was negative, meaning you'd collect a net credit of $1,725 when hedging META this way.

如您所见,净成本为负,意味着以这种方式对冲meta时您将获得净收益1725美元。

Something to consider if you're long Mag 7 stocks heading into earnings next week.

如果您持有科技七巨头的股票并将进入下周的财报,这是值得考虑的事情。

Using The Correction To Look For Buying Opportunities

利用调整寻找购买机会

In the Portfolio Armor trading Substack, we'll be using any further correction to look for buying opportunities. If you'd like a heads up when we place our next trade their, feel free to subscribe below.

在 Portfolio Armor 交易 Substack 中,我们将利用进一步的调整寻找购买机会。如果您想在我们下一笔交易时获得提醒,请在下方订阅。

If you'd like to stay in touch

如果你想保持联系

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).

你可以在我们的网站上扫描个股的最优对冲策略、查找我们当前的前十股票、创建对冲组合。你也可以在这里关注Portfolio Armor,或者使用以下链接成为我们交易Substack的免费订户(我们现在在那里发送偶发电子邮件)。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文来自非报酬的外部投稿人。它不代表Benzinga的报道,并且没有因为内容或准确性而被编辑。

I mention a couple of times there that there's a link to download the newly updated Portfolio Armor iPhone app in the description of the video. Unfortunately, I found out after recording that that YouTube is not allowing me to post clickable links in the description, apparently because I uploaded a newsworthy clip of the late head of Wagner PMC recruiting prisoners for the Ukraine War last year (they have Wagner listed as a criminal organization, even though it's basically the Russian version of America's Blackwater).

I mention a couple of times there that there's a link to download the newly updated Portfolio Armor iPhone app in the description of the video. Unfortunately, I found out after recording that that YouTube is not allowing me to post clickable links in the description, apparently because I uploaded a newsworthy clip of the late head of Wagner PMC recruiting prisoners for the Ukraine War last year (they have Wagner listed as a criminal organization, even though it's basically the Russian version of America's Blackwater).