Novo Nordisk's Options Frenzy: What You Need to Know

Novo Nordisk's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on Novo Nordisk.

有很多钱可以花的鲸鱼们对Novo Nordisk采取了明显的看淡态度。

Looking at options history for Novo Nordisk (NYSE:NVO) we detected 8 trades.

查看Novo Nordisk(纽交所:NVO)的期权历史,我们检测到了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 62% with bearish.

如果我们考虑到每个交易的具体情况,准确地说37%的投资者看涨,62%看跌。

From the overall spotted trades, 3 are puts, for a total amount of $155,555 and 5, calls, for a total amount of $255,360.

从总体上看,有3个认购期权和5个认沽期权,总金额为$155,555和$255,360。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $175.0 for Novo Nordisk during the past quarter.

分析这些合同的成交量和未平仓量,似乎大牌玩家在过去的季度里一直关注着Novo Nordisk在100.0到175.0美元之间的价格窗口。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

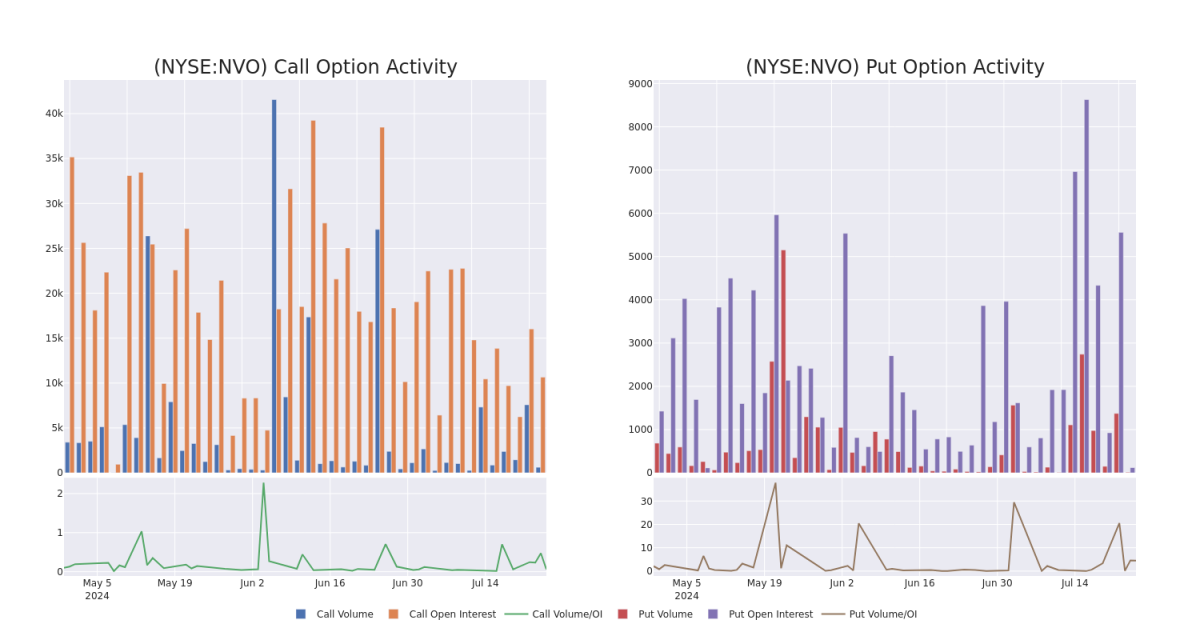

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $100.0 to $175.0 over the preceding 30 days.

评估成交量和未平仓量是期权交易中的一项策略性步骤。这些指标揭示了Novo Nordisk期权在特定行权价格上的流动性和投资者兴趣。即将发布的数据可视化了过去30天内100.0到175.0美元之间的行权价格范围内,与Novo Nordisk实质性交易相关的认购期权和认沽期权的成交量和未平仓量的波动。

Novo Nordisk Call and Put Volume: 30-Day Overview

挪威诺德斯克看涨和看跌成交量:30天概述

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | PUT | TRADE | BEARISH | 11/15/24 | $3.6 | $3.45 | $3.55 | $115.00 | $71.0K | 100 | 4 |

| NVO | CALL | SWEEP | BEARISH | 08/16/24 | $5.4 | $5.25 | $5.25 | $127.00 | $66.0K | 2 | 125 |

| NVO | CALL | SWEEP | BEARISH | 01/17/25 | $33.65 | $33.3 | $33.42 | $100.00 | $63.4K | 1.4K | 19 |

| NVO | CALL | SWEEP | BULLISH | 09/20/24 | $1.75 | $1.71 | $1.73 | $145.00 | $48.9K | 8.1K | 415 |

| NVO | CALL | SWEEP | BEARISH | 01/17/25 | $15.25 | $14.4 | $14.66 | $125.00 | $43.9K | 1.0K | 31 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | 看跌 | 交易 | 看淡 | 11/15/24 | $3.6 | $3.45 | $3.55 | $115.00 | $71.0K | 100 | 4 |

| NVO | 看涨 | SWEEP | 看淡 | 08/16/24 | $5.4 | $5.25 | $5.25 | $127.00 | $66.0K | 2 | 125 |

| NVO | 看涨 | SWEEP | 看淡 | 01/17/25 | $33.65 | $33.3 | $33.42 | $100.00。 | $63.4K | 1.4千 | 19 |

| NVO | 看涨 | SWEEP | 看好 | 09/20/24 | $1.75 | $1.71 | $1.73 | $145.00 | $48.9K | 8.1千 | 415 |

| NVO | 看涨 | SWEEP | 看淡 | 01/17/25 | $15.25 | 14.4美元 | $14.66 | $125.00 | $43.9K | 1.0K | 31 |

About Novo Nordisk

诺和诺德是一家领先的全球医疗保健公司,致力于研发创新药品,帮助患糖尿病的患者过上更长寿、更健康的生活,这一传统已有100多年。这种传统为我们提供了经验和能力,使我们能够推动变革,帮助人们战胜其他严重的慢性疾病,如肥胖症、罕见的血液和内分泌紊乱。我们始终坚信,持久的成功公式是保持专注,长远思考,并以财务、社会和环境负责任的方式做生意。诺和诺德在新泽西州设有美国总部,在7个州加上华盛顿特区拥有商业、生产和研究设施,在全国约有8000名员工。有关更多信息,访问novonordisk-us.com,Facebook、Instagram和X。

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

作为全球治疗糖尿病品牌市场三分之一的领先者,丹麦的Novo Nordisk公司是世界上提供糖尿病护理产品的主要制造商和市场推广者。该公司制造和销售各种人体和现代胰岛素、GLP-1疗法等可注射糖尿病治疗药物、口服降糖药以及肥胖症治疗药物。Novo Nordisk还有一个生物制药部门(约占营收的10%),专门从事血友病和其他疾病的蛋白质疗法。

In light of the recent options history for Novo Nordisk, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到诺和诺德的最近期权历史,现在适合集中关注该公司本身。我们旨在探讨其当前的表现。

Present Market Standing of Novo Nordisk

Novo Nordisk的现有市场地位

- Trading volume stands at 1,568,565, with NVO's price down by -3.0%, positioned at $127.65.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 13 days.

- 交易量为1,568,565股,NVO股价下跌3.0%,报价127.65美元。

- RSI指标显示该股票可能正接近超卖。

- 预计13天后发布盈利公告。

Expert Opinions on Novo Nordisk

诺和诺德专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $160.0.

在过去的一个月里,有1个专家对这只股票发布了评级,平均目标价为160.0美元。

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $160.

- 来自Cantor Fitzgerald的分析师将其评级调降为超配,目标价为160美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。