Hengbao Co.,Ltd. (SZSE:002104) Stock Goes Ex-Dividend In Just Two Days

Hengbao Co.,Ltd. (SZSE:002104) Stock Goes Ex-Dividend In Just Two Days

It looks like Hengbao Co.,Ltd. (SZSE:002104) is about to go ex-dividend in the next 2 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. In other words, investors can purchase HengbaoLtd's shares before the 29th of July in order to be eligible for the dividend, which will be paid on the 29th of July.

看起来,恒宝股份有限公司(SZSE:002104)将在未来2天内进行除息。除息日是记录日的一个工作日,该日是股东必须存在于公司记录中以有资格获得红利支付的截止日期。了解除息日非常重要,因为股票上的任何交易都需要在记录日之前进行结算。换句话说,投资者可以在7月29日前购买恒宝股份有限公司的股票,以有资格获得将在7月29日支付的红利。

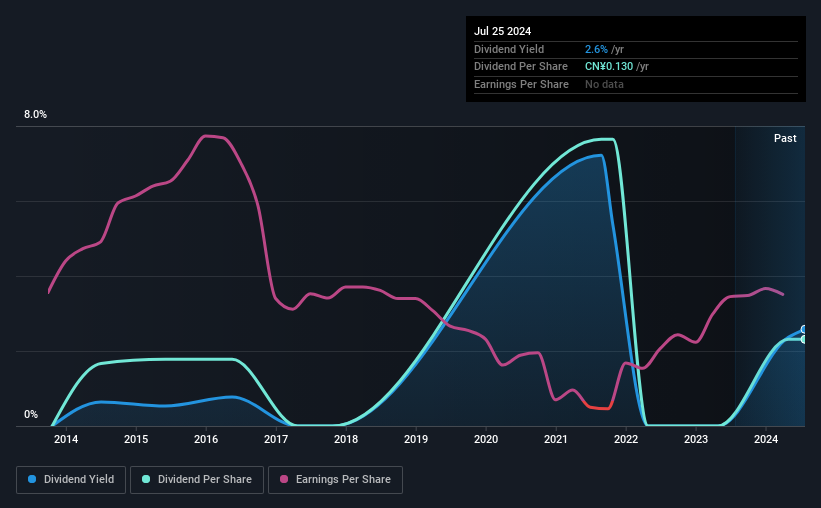

The company's next dividend payment will be CN¥0.13 per share, on the back of last year when the company paid a total of CN¥0.13 to shareholders. Calculating the last year's worth of payments shows that HengbaoLtd has a trailing yield of 2.6% on the current share price of CN¥5.04. If you buy this business for its dividend, you should have an idea of whether HengbaoLtd's dividend is reliable and sustainable. So we need to investigate whether HengbaoLtd can afford its dividend, and if the dividend could grow.

该公司的下一笔股息支付将是每股CN¥0.13,而去年该公司向股东支付了总额为CN¥0.13的股息。计算过去一年的付款情况表明,恒宝股份的股息收益率为目前每股CN¥5.04的股价的2.6%。如果您购买此业务以获得股息,您应该了解恒宝股份的股息是否可靠和可持续。因此,我们需要调查恒宝股份是否负担得起其股息以及股息是否可以增长。

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. HengbaoLtd is paying out an acceptable 61% of its profit, a common payout level among most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. The good news is it paid out just 0.9% of its free cash flow in the last year.

如果一家公司支付的股息超过其收入,那么股息可能变得不可持续 - 这绝不是理想的情况。恒宝股份支付出了可接受的61%的利润,这是大多数公司的普遍支付水平。也就是说,即使是高盈利的公司有时也可能无法产生足够的现金来支付股息,这就是为什么我们应该始终检查股息是否由现金流覆盖的原因。好消息是,去年它只支付了0.9%的自由现金流。

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

看到股息既有盈利也有现金流的覆盖是令人鼓舞的。这通常表明股息是可持续的,只要收益没有急剧下降。

Click here to see how much of its profit HengbaoLtd paid out over the last 12 months.

点击这里,查看恒宝股份在过去12个月中支付的利润金额。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That explains why we're not overly excited about HengbaoLtd's flat earnings over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share. Earnings per share growth has been slim, and the company is already paying out a majority of its earnings. While there is some room to both increase the payout ratio and reinvest in the business, generally the higher a payout ratio goes, the lower a company's prospects for future growth.

即使企业没有增长收益,它们仍然可能具有价值,但是如果看起来公司将难以增长,则评估股息的可持续性更为重要。如果业务进入衰退并且股息被削减,公司可能会看到其价值急剧下降。这就解释了为什么我们对过去五年中恒宝股份的盈利不增反降并不是特别兴奋。当然,这比看到它们的收益下降要好,但从长远来看,所有最好的股息股票都能够有意义地增加其每股收益。每股收益的增长很少,而该公司已经支付了大部分收益。虽然在业务上有一些提高分红比率和重投资的空间,但一般而言,分红比率越高,公司未来增长的前景就越低。

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, HengbaoLtd has lifted its dividend by approximately 3.3% a year on average.

衡量公司分红前景的另一个关键方法是测量其历史股息增长率。自我们的数据开始以来的10年中,恒宝股份的股息平均每年约增长3.3%。

The Bottom Line

还有一件事需要注意的是,我们已经确定了上海医药的2个警告信号,了解这些信号应该成为你的投资过程的一部分。

Is HengbaoLtd worth buying for its dividend? It's unfortunate that earnings per share have not grown, and we'd note that HengbaoLtd is paying out lower percentage of its cashflow than its profit, but overall the dividend looks well covered by earnings. In summary, it's hard to get excited about HengbaoLtd from a dividend perspective.

您是否值得购买恒宝股份以获得股息?很遗憾,每股收益没有增长,我们注意到恒宝公司的现金流低于其利润,但总的来说,股息看起来受盈利很好的覆盖。总之,从股息角度来看,恒宝股份难以引起我们的兴趣。

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Our analysis shows 1 warning sign for HengbaoLtd and you should be aware of this before buying any shares.

考虑到这一点,彻底的股票研究的一个关键部分是了解该股票目前面临的任何风险。我们的分析表明,恒宝股份存在1项警告,并且在购买任何股票之前,您应该了解这一点。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般来说,我们不建议仅仅购买第一个股息股票。下面是一个经过策划的有趣的、股息表现良好的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.