Top 3 Risk Off Stocks That Are Set To Fly In July

Top 3 Risk Off Stocks That Are Set To Fly In July

7月份即将飞涨的前3只风险股票

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies. `

消费板块中最过度卖出的股票提供了买入低估公司的机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

Lamb Weston Holdings Inc (NYSE:LW)

Lamb Weston Holdings Inc (纽交所:LW)

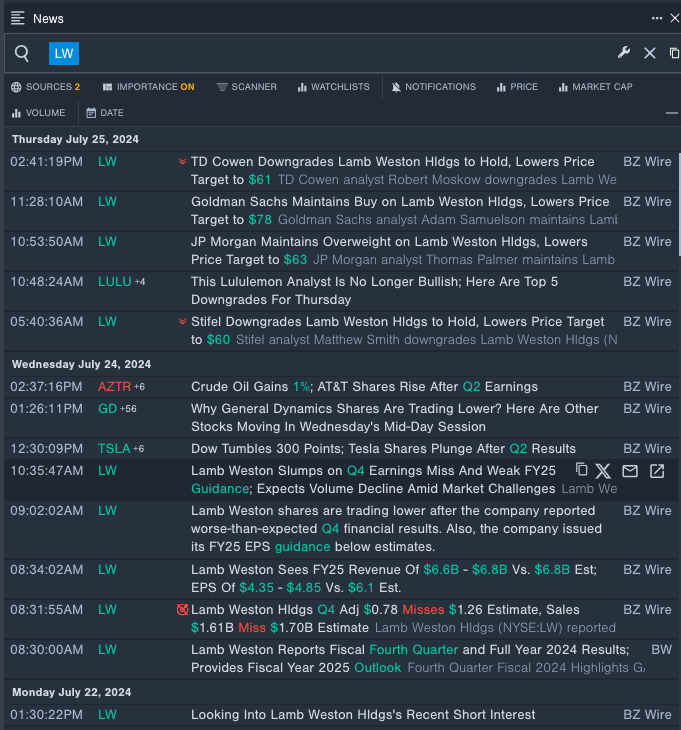

- On July 24, Lamb Weston reported worse-than-expected fourth-quarter financial results and issued its FY25 earnings per share guidance below estimates. "We expect fiscal 2025 to be another challenging year. The operating environment has changed rapidly over the past twelve months as global restaurant traffic and frozen potato demand softened due to menu price inflation continuing to negatively affect global restaurant traffic," said Tom Werner, President and CEO. The company's stock fell around 33% over the past five days and has a 52-week low of $52.99.

- RSI Value: 15.59

- LW Price Action: Shares of Lamb Weston fell 6% to close at $53.01 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest Lamb Weston news.

- 7月24日,Lamb Weston公布了低于预期的第四季度财务业绩,并将其FY25每股收益指导下调至预期之下。公司总裁兼CEO Tom Werner表示:“我们预计2025财年将是另一个充满挑战的年份。过去12个月中,全球餐厅流量和冷冻土豆需求因菜单价格通胀的持续影响而下降,经营环境已经迅速发生变化。”该公司股价在过去五天内下跌了约33%,并创下了52周的最低点$52.99。

- RSI值:15.59

- LW股价走势:周四Lamb Weston股价下跌6%,收于$53.01。

- Benzinga Pro的实时新闻提醒了最新的Lamb Weston新闻。

Boston Beer Company Inc (NYSE:SAM)

Boston Beer Company Inc (纽交所:SAM)

- On July 25, Boston Beer Company reported worse-than-expected second-quarter financial results. "Our gross margin improvement initiatives continue to take hold, with gross margin expanding over 250 basis points year-to-date, and strong cash flow generation," said chairman and founder Jim Koch. "Depletions were soft in April, but improved as we moved through the quarter. The company's stock fell around 11% over the past month. It has a 52-week low of $254.40.

- RSI Value: 24.15

- SAM Price Action: Shares of Boston Beer fell 0.5% to close at $270.52 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in SAM stock.

- 7月25日,波士顿啤酒公司报告了低于预期的第二季度财务业绩。公司创始人兼董事长Jim Koch表示:“我们的毛利率改进计划继续取得进展,截至目前,毛利率已扩张250个基点,并实现了强劲的现金流生成。4月份降低了啤酒的库存,但在季度内得到了改善。”该公司股价在过去一个月内下降了约11%,并创下了52周的最低点$254.40。

- RSI值:24.15

- SAM股价走势:周四波士顿啤酒公司的股价下跌了0.5%,收于270.52美元。

- Benzinga Pro的图表工具帮助识别了SAM股票的趋势。

Celsius Holdings, Inc (NASDAQ:CELH)

Celsius Holdings, Inc (纳斯达克:CELH)

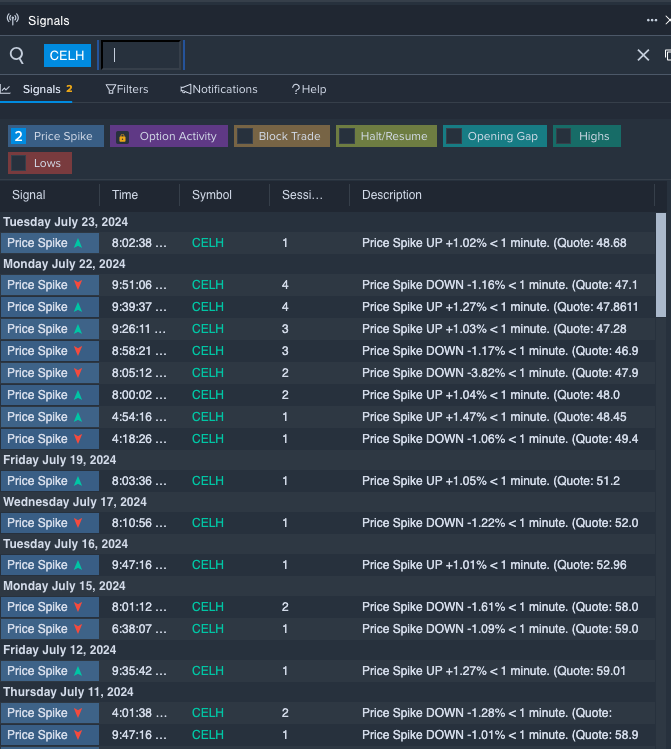

- On July 22, B. Riley Securities maintained a Buy rating on the stock but lowered its price target from $110 to $80. The company's stock dipped around 18% over the past month and has a 52-week low of $44.70.

- RSI Value: 29.12

- CELH Price Action: Shares of Celsius Holdings gained 1.7% to close at $46.40 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in CELH shares.

- 7月22日,Celsius Holdings公布了其第二季度财务业绩,销售额创下历史新高,但该公司仍未盈利。William Blair重申了买入股票的评级,但将其价格目标从110美元下调至80美元。该公司股价在过去一个月内下跌了约18%,并创下了52周的最低点44.70美元。

- RSI值:29.12

- CELH股价走势:周四Celsius Holdings的股价上涨1.7%,收于46.40美元。

- Benzinga Pro的信号功能通知了CELH股票的潜在突破。

- S&P 500, Nasdaq Settle Lower As Tech Stocks Continue To Falter: Greed Index In 'Fear' Zone

- 标普500、纳斯达克破位下跌,科技股持续疲弱:贪婪指数处于“恐惧”区间。