Markets Weekly Update (July 26): US Q2 GDP Expanded by a Robust 2.8% Rate, Significantly Surpassing Expectations

Markets Weekly Update (July 26): US Q2 GDP Expanded by a Robust 2.8% Rate, Significantly Surpassing Expectations

Macro Matters

宏观很重要

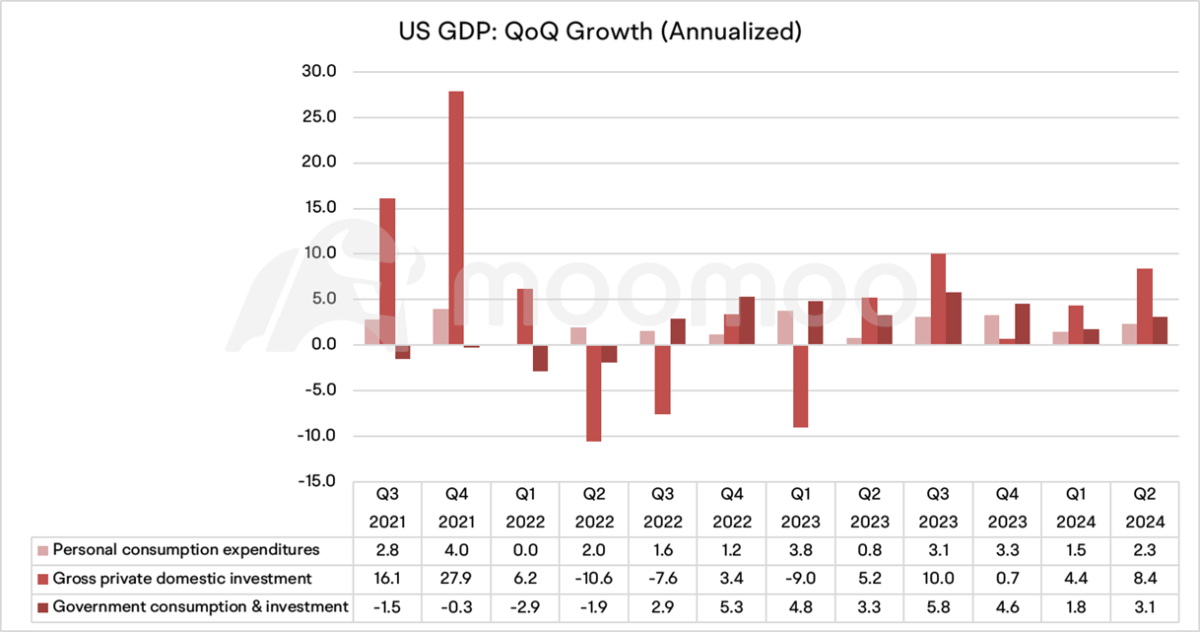

US Q2 GDP Expanded by a Robust 2.8% Rate, Significantly Surpassing Expectations

美国第二季度国内生产总值强劲增长2.8%,大大超出预期

Real GDP increased at an annual rate of 2.8 percent in the second quarter of 2024. Economists polled by Dow Jones anticipated a 2.1% growth rate following a 1.4% rise in the first quarter.

2024年第二季度,实际国内生产总值年增长率为2.8%。道琼斯调查的经济学家预计,继第一季度上涨1.4%之后,增长率为2.1%。

Bureau of Economic Analysis noted that, compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in consumer spending.

经济分析局指出,与第一季度相比,第二季度实际国内生产总值的加速主要反映了私人库存投资的回升和消费者支出的加速。

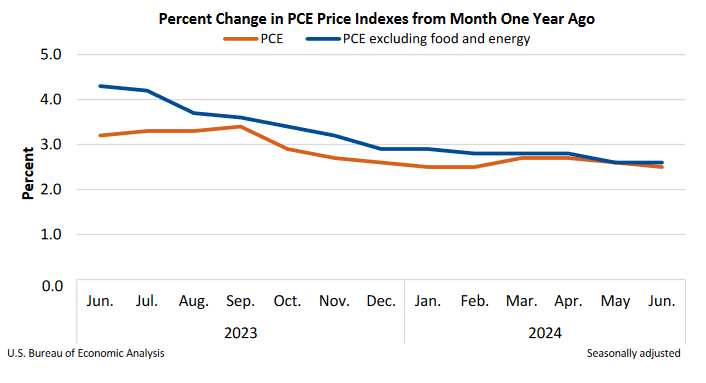

US PCE Inflation Slows to 2.5% in Jun, But Core PCE Unchanged at 2.6%

美国6月份个人消费支出通胀率放缓至2.5%,但核心个人消费支出维持在2.6%

The annual PCE inflation rate in the US decreased to 2.5% in June 2024 from 2.6% in May, in line with market forecasts. On a monthly basis, the PCE price index rose 0.1% mom in June, matched expectations.

美国的个人消费支出年通胀率从5月份的2.6%降至2024年6月的2.5%,与市场预测一致。按月计算,6月份个人消费支出价格指数环比上涨0.1%,符合预期。

The core PCE inflation gauge for the US economy was unchanged at 2.6% in June 2024, the same as in May and above market forecasts of 2.5%. On a monthly basis, core PCE prices rose by 0.2% in June, accelerating from 0.1% in May and above market estimates of 0.1%.

2024年6月,美国经济的核心个人消费支出通胀指标保持不变,为2.6%,与5月份相同,高于市场预期的2.5%。按月计算,6月份核心个人消费支出价格上涨0.2%,高于5月份的0.1%,高于市场预期的0.1%。

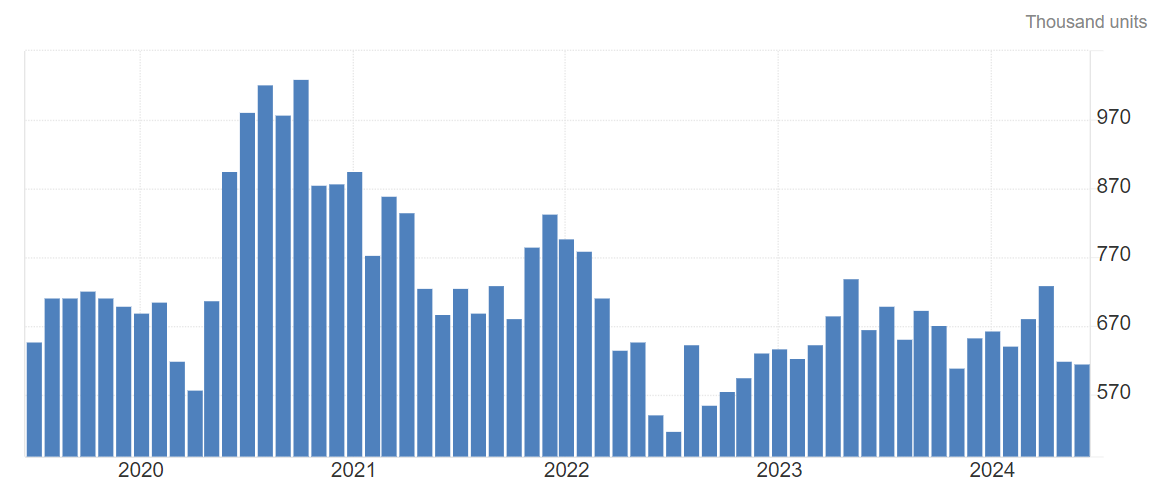

US New Home Sales Fell to a Seven-Month Low in June

6月份美国新屋销售降至七个月低点

Sales of new single-family houses in the United States fell 0.6% month-over-month to a seasonally adjusted annualized rate of 617K in June 2024, as high prices and mortgage rates continued to weigh on buyers' affordability. It is the lowest reading in seven months and well below forecasts of 640K.

由于高房价和抵押贷款利率继续压制买家的负担能力,美国新单户住宅的销售量在2024年6月同比下降0.6%,经季节性调整后的年化率为61.7万。这是七个月来的最低水平,远低于预期的64万。

The median price of new houses sold in the period was $417,300, while the average sales price was $487,200, lower than $417,600 and $507,800 a year earlier, respectively. Meanwhile, there were 476K new homes listed for sale during the period, representing about 9.3 months of supply at the latest sales rate.

该期间售出的新房的中位数价格为417,300美元,而平均销售价格为487,200美元,分别低于去年同期的417,600美元和507,800美元。同时,在此期间有47.6万套新房上市出售,按最新销售率计算,相当于约9.3个月的供应量。

Exhibit: United States New Home Sales, Trading Economics

展品:美国新屋销售、贸易经济学

US Mortgage Rates Climb Slightly, Holding Near a Four-Month Low

美国抵押贷款利率略有上升,保持在四个月低点附近

Mortgage rates in the US increased slightly, with the average for a 30-year fixed loan rising to 6.78% from 6.77% last week, according to Freddie Mac. Despite being down from recent highs, elevated borrowing costs continue to deter house hunters amid record-high prices. Sales of previously owned homes fell for the fourth consecutive month in June, and new-home purchases also declined. Consequently, listings are staying on the market longer, and more sellers are reducing their asking prices.

房地美的数据显示,美国的抵押贷款利率略有上升,30年期固定贷款的平均利率从上周的6.77%升至6.78%。尽管低于近期高点,但在房价创纪录的高位的情况下,较高的借贷成本继续阻碍购房者。6月份,二手房销售连续第四个月下降,新房购买量也有所下降。因此,房源在市场上的停留时间更长,越来越多的卖家降低了要价。

Smart Money Flow

智能资金流

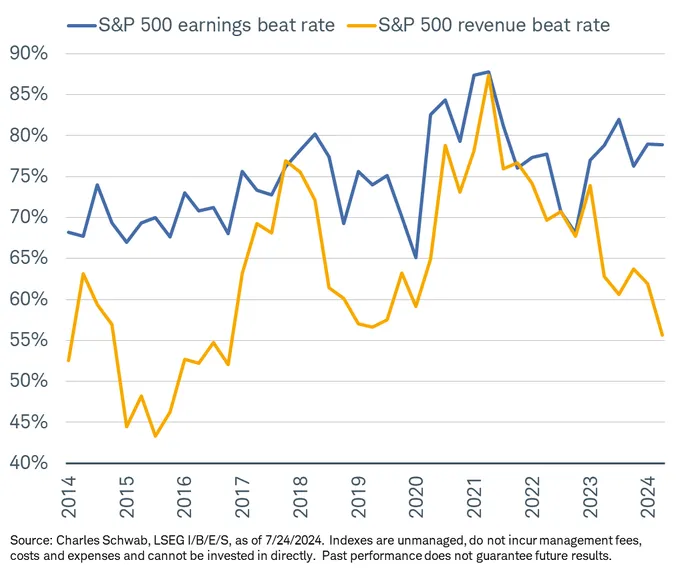

S&P 500's earnings beat rate is still healthy at nearly 79%, but the revenue beat rate is currently at its lowest since the fourth quarter of 2016.

标准普尔500指数的盈利超过率仍然良好,接近79%,但收入超过率目前处于2016年第四季度以来的最低水平。

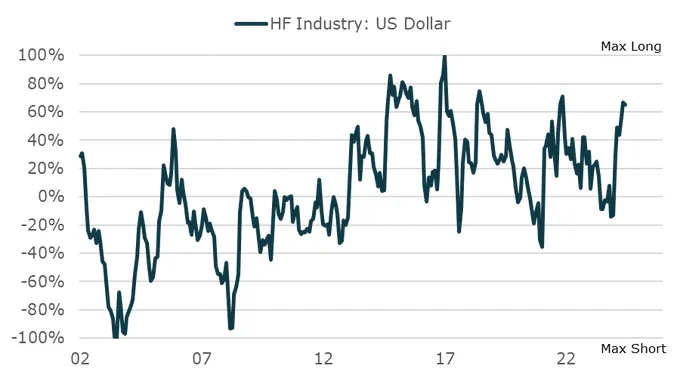

Hedge funds have increased their long dollar positions in recent months reflecting their relative optimism on the US economy and likely tighter monetary policy ahead.

近几个月来,对冲基金增加了美元多头头寸,这反映了他们对美国经济的相对乐观以及未来可能收紧的货币政策。

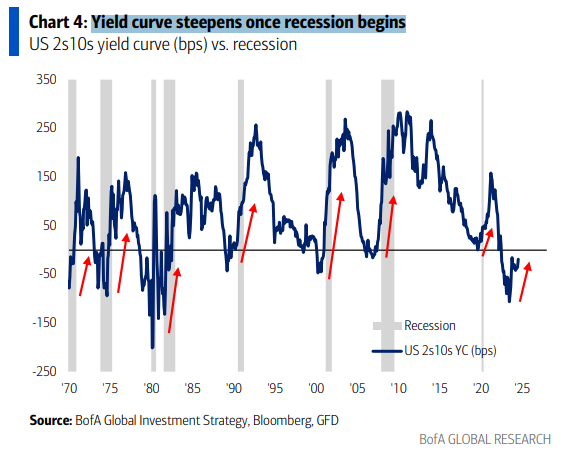

Yield Curve Steepens Once Recession Begins.

经济衰退开始后,收益率曲线变陡了。

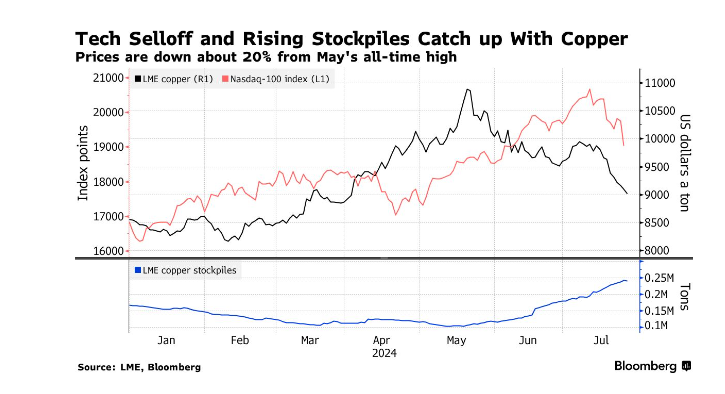

Copper Sinks Below $9,000 Threshold as Metals Selloff Deepens

随着金属抛售的加深,铜价跌破9,000美元的门槛

Copper prices fell below $9,000 a ton for the first time since early April due to a global stock market selloff and rising pessimism about demand in China. The industrial metal is down about 20% since its mid-May peak, as initial bullish bets on tightening supply and increased usage have shifted to concerns about rising inventories and weak conditions in China's spot market. Additionally, a selloff in global technology stocks has cast doubt on the strength of the artificial intelligence industry, which investors had expected to drive a surge in copper usage for data centers and power infrastructure.

由于全球股市抛售以及对中国需求的悲观情绪加剧,铜价自4月初以来首次跌破每吨9,000美元。自5月中旬达到峰值以来,工业金属已下跌约20%,原因是最初对供应紧缩和使用量增加的看涨押注已转向对库存增加和中国现货市场疲软状况的担忧。此外,全球科技股的抛售使人们对人工智能行业的实力产生了怀疑,投资者原本预计人工智能行业将推动数据中心和电力基础设施铜的使用量激增。

Top Corporate News

热门企业新闻

Alphabet Margin Fears, Youtube Slowdown Eclipse AI Boost

对Alphabet利润的担忧,Youtube放缓

In the second quarter, Alphabet's capital expenditure rose to $13.2 billion, exceeding expectations as it invested heavily in AI and competed with Microsoft. Despite cost-cutting measures, such as layoffs, analysts noted that higher seasonal hiring and the earlier-than-usual Pixel launch could impact third-quarter margins. Additionally, YouTube faces tough year-on-year comparisons and competition from Amazon.com in the online ad video market.

在第二季度,Alphabet的资本支出增至132亿美元,超出了预期,因为它在人工智能上进行了大量投资并与微软竞争。尽管采取了裁员等削减成本的措施,但分析师指出,更高的季节性招聘和比平时更早推出Pixel可能会影响第三季度的利润率。此外,YouTube在在线广告视频市场上面临着激烈的同比比较和来自亚马逊的竞争。

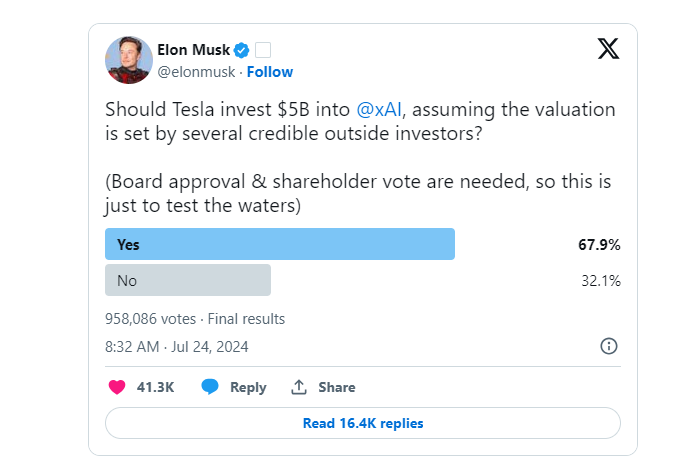

Musk Says Tesla Board to Discuss $5 Billion xAI Investment

马斯克说特斯拉董事会将讨论50亿美元的xAi投资

Elon Musk announced that Tesla Inc.'s board will discuss a potential $5 billion investment in his AI startup, xAI. Earlier this week, Musk conducted a poll on X, where over two-thirds of respondents supported the idea. Following the favorable public response, Musk stated on Thursday that Tesla would consider the investment. He also noted that Tesla board approval and a shareholder vote would be required before proceeding.

埃隆·马斯克宣布,特斯拉公司董事会将讨论对他的人工智能初创公司xAi的50亿美元潜在投资。本周早些时候,马斯克对X进行了一项民意调查,超过三分之二的受访者支持这一想法。在公众的积极回应之后,马斯克周四表示,特斯拉将考虑这项投资。他还指出,在继续进行之前,需要特斯拉董事会批准和股东投票。

Ford Falls Most in 15 Years as Warranty Costs Erode Profit

由于保修成本侵蚀利润,福特15年来跌幅最大

Ford Motor Co. shares plummeted 18% on Thursday, their worst drop in over 15 years, following a significant earnings miss due to an $800 million surge in warranty repair costs for older vehicles. Ford reported adjusted earnings per share of 47 cents, falling short of the 67-cent average estimate from analysts surveyed by Bloomberg. This decline wiped out the company's 2024 gains, leaving the stock down more than 8% for the year.

福特汽车公司股价周四暴跌18%,为15年来最严重的跌幅,此前由于旧车的保修维修成本激增8亿美元而导致收益严重亏损。福特公布调整后的每股收益为47美分,低于彭博社调查的分析师平均估计的67美分。这种下跌抵消了该公司2024年的涨幅,使该股全年下跌了8%以上。

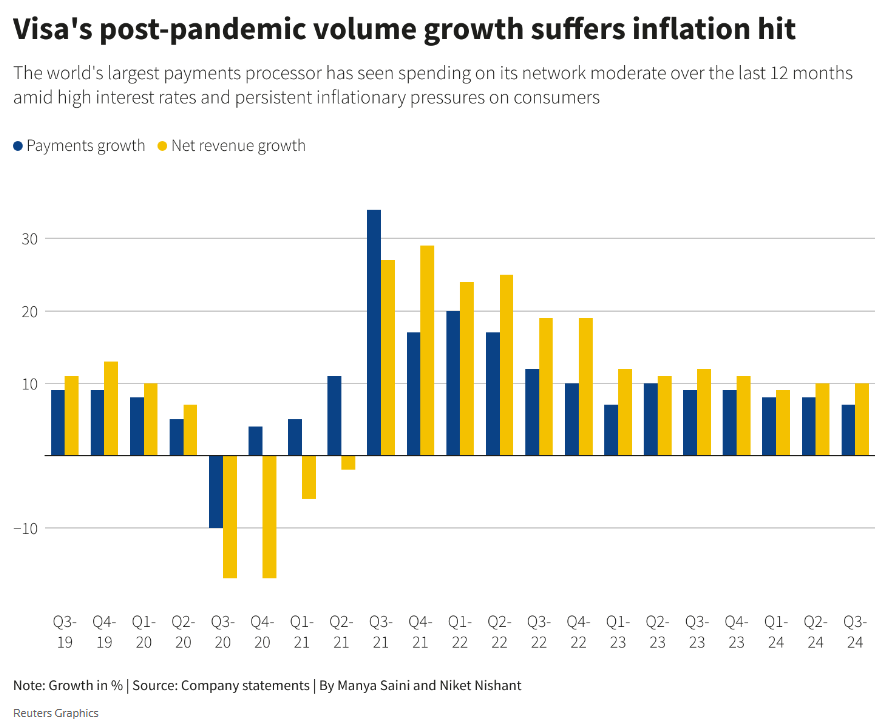

Visa's Revenue Miss Prompts Caution on Wall Street

Visa的收入失误促使华尔街谨慎行事

Visa's underwhelming third-quarter revenue led several brokerages to cut their price targets on the stock, raising concerns about slowing customer spending and impacting the broader U.S. payments industry. The disappointing results highlight industry challenges, as inflation and high borrowing costs cause customers to reduce purchases, and wage growth slows.

Visa第三季度收入惨淡,导致几家经纪商下调了该股的目标股价,这引发了人们对客户支出放缓和影响整个美国支付行业的担忧。令人失望的结果凸显了行业挑战,因为通货膨胀和高借贷成本导致客户减少购买,工资增长放缓。

No Sign Microsoft Plans to Limit Crowdstrike Access to Windows After Outage, Source Says

消息人士称,没有迹象表明微软计划在停机后限制Crowdstrike访问Windows

There is no sign Microsoft Corp plans to limit Crowdstrike's access to the Windows operating system, a person familiar with the issue said, after a global tech outage caused by the cybersecurity software product caused many computers running Windows to crash.

一位知情人士说,没有迹象表明微软公司计划限制Crowdstrike对Windows操作系统的访问,此前网络安全软件产品造成的全球技术中断导致许多运行Windows的计算机崩溃。

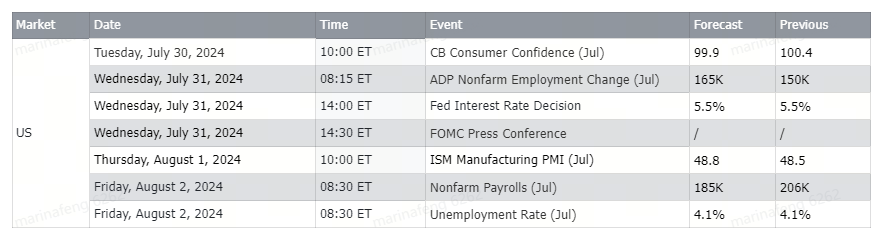

Upcoming Economic Data

即将公布的经济数据

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免责声明:本演示文稿仅用于信息和教育用途,不是对任何特定投资或投资策略的推荐或认可。本内容中提供的投资信息属于一般性质,仅用于说明目的,可能并不适合所有投资者。它是在不考虑个人投资者的财务复杂程度、财务状况、投资目标、投资时间范围或风险承受能力的情况下提供的。在做出任何投资决定之前,您应根据您的相关个人情况考虑这些信息的适当性。过去的投资表现并不能预示或保证未来的成功。回报会有所不同,所有投资都有风险,包括本金损失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo是由Moomoo Technologies Inc.提供的财务信息和交易应用程序。在美国,Moomoo上的投资产品和服务由FINRA/SIPC成员Moomoo Financial Inc. 提供。