Investigating Cheniere Energy's Standing In Oil, Gas & Consumable Fuels Industry Compared To Competitors

Investigating Cheniere Energy's Standing In Oil, Gas & Consumable Fuels Industry Compared To Competitors

In the fast-paced and highly competitive business world of today, conducting thorough company analysis is essential for investors and industry observers. In this article, we will conduct an extensive industry comparison, evaluating Cheniere Energy (NYSE:LNG) in relation to its major competitors in the Oil, Gas & Consumable Fuels industry. Through a detailed examination of key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and illuminate company's performance in the industry.

在当今快节奏和竞争激烈的商业世界中,进行全面的公司分析对投资者和行业观察者至关重要。在本文中,我们将进行广泛的行业比较,评估Cheniere Energy(纽约证券交易所代码:LNG)与其在石油、天然气和消耗性燃料行业的主要竞争对手的关系。通过对关键财务指标、市场地位和增长前景的详细研究,我们的目标是提供有价值的见解并阐明公司在行业中的表现。

Cheniere Energy Background

切尼尔能源背景

Cheniere Energy owns and operates the Sabine Pass liquefied natural gas terminal via its stake in Cheniere Partners. It also owns the Corpus Christi LNG terminals as well as Cheniere Marketing, which markets LNG using Cheniere's gas volumes.

Cheniere Energy通过其在Cheniere Partners的股份拥有并运营Sabine Pass液化天然气接收站。它还拥有科珀斯克里斯蒂液化天然气接收站以及Cheniere Marketing,后者使用切尼尔的天然气量销售液化天然气。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Cheniere Energy Inc | 8.50 | 9.50 | 2.44 | 10.78% | $1.52 | $1.26 | -41.82% |

| Enterprise Products Partners LP | 11.59 | 2.32 | 1.25 | 5.21% | $2.38 | $1.79 | 18.61% |

| Energy Transfer LP | 14.80 | 1.51 | 0.64 | 3.0% | $3.76 | $3.78 | 13.87% |

| Williams Companies Inc | 17.14 | 4.11 | 4.82 | 5.09% | $1.75 | $1.69 | -10.06% |

| ONEOK Inc | 19.24 | 2.89 | 2.36 | 3.88% | $1.4 | $1.63 | 5.75% |

| Kinder Morgan Inc | 19.33 | 1.54 | 3.05 | 1.88% | $1.58 | $2.02 | 2.03% |

| MPLX LP | 10.96 | 3.23 | 4.06 | 14.84% | $1.57 | $1.15 | 2.16% |

| Targa Resources Corp | 27.21 | 10.82 | 1.84 | 10.11% | $0.98 | $1.0 | 0.93% |

| Western Midstream Partners LP | 11.26 | 4.70 | 4.70 | 18.24% | $0.84 | $0.68 | 20.95% |

| Plains All American Pipeline LP | 15.40 | 1.22 | 0.26 | 1.96% | $0.71 | $0.47 | -2.8% |

| Antero Midstream Corp | 18 | 3.22 | 6.15 | 4.83% | $0.25 | $0.19 | 7.06% |

| EnLink Midstream LLC | 39 | 6.87 | 0.93 | 1.53% | $0.28 | $0.36 | -4.48% |

| Frontline Plc | 8.34 | 2.23 | 2.82 | 7.77% | $0.34 | $0.22 | 16.3% |

| Ultrapar Participacoes SA | 9.45 | 1.76 | 0.20 | 3.16% | $1.24 | $2.06 | -0.51% |

| New Fortress Energy Inc | 9.25 | 2.50 | 1.66 | 3.27% | $0.2 | $0.38 | 19.2% |

| Scorpio Tankers Inc | 6.76 | 1.44 | 2.88 | 8.07% | $0.3 | $0.26 | 1.8% |

| Hafnia Ltd | 4.87 | 1.73 | 1.45 | 7.97% | $0.24 | $0.68 | 74.09% |

| Plains GP Holdings LP | 21.83 | 2.47 | 0.08 | 2.74% | $0.71 | $0.82 | -2.8% |

| TORM PLC | 4.73 | 1.71 | 2.11 | 11.22% | $0.27 | $0.29 | 13.81% |

| Hess Midstream LP | 16.91 | 8.41 | 1.71 | 11.98% | $0.27 | $0.3 | 16.56% |

| International Seaways Inc | 5.16 | 1.53 | 2.57 | 8.23% | $0.19 | $0.17 | -4.43% |

| Transportadora de Gas del Sur SA | 42.06 | 1.79 | 5.31 | 5.06% | $120.58 | $88.44 | 6.15% |

| Average | 15.87 | 3.24 | 2.42 | 6.67% | $6.66 | $5.16 | 9.25% |

| 公司 | P/E | P/B | 市销率 | 罗伊 | 息税折旧摊销前利润(单位:十亿) | 毛利(单位:十亿) | 收入增长 |

|---|---|---|---|---|---|---|---|

| 切尼尔能源公司 | 8.50 | 9.50 | 2.44 | 10.78% | 1.52 美元 | 1.26 美元 | -41.82% |

| 企业产品合作伙伴 LP | 11.59 | 2.32 | 1.25 | 5.21% | 2.38 美元 | 1.79 美元 | 18.61% |

| 能量传输 LP | 14.80 | 1.51 | 0.64 | 3.0% | 3.76 美元 | 3.78 美元 | 13.87% |

| 威廉姆斯公司 | 17.14 | 4.11 | 4.82 | 5.09% | 1.75 美元 | 1.69 美元 | -10.06% |

| ONEOK Inc. | 19.24 | 2.89 | 2.36 | 3.88% | 1.4 美元 | 1.63 | 5.75% |

| 金德摩根公司 | 19.33 | 1.54 | 3.05 | 1.88% | 1.58 美元 | 2.02 美元 | 2.03% |

| MPLX LP | 10.96 | 3.23 | 4.06 | 14.84% | 1.57 | 1.15 美元 | 2.16% |

| 塔尔加资源公司 | 27.21 | 10.82 | 1.84 | 10.11% | 0.98 美元 | 1.0 美元 | 0.93% |

| 西部中游合作伙伴有限责任公司 | 11.26 | 4.70 | 4.70 | 18.24% | 0.84 美元 | 0.68 美元 | 20.95% |

| Plains 全美管道唱片 | 15.40 | 1.22 | 0.26 | 1.96% | 0.71 美元 | 0.47 美元 | -2.8% |

| Antero Midstream Corp | 18 | 3.22 | 6.15 | 4.83% | 0.25 美元 | 0.19 美元 | 7.06% |

| EnLink 中游有限责任公司 | 39 | 6.87 | 0.93 | 1.53% | 0.28 | 0.36 美元 | -4.48% |

| 前线集团 | 8.34 | 2.23 | 2.82 | 7.77% | 0.34 美元 | 0.22 美元 | 16.3% |

| Ultrapar Particapoes SA | 9.45 | 1.76 | 0.20 | 3.16% | 1.24 美元 | 2.06 美元 | -0.51% |

| 新堡垒能源公司 | 9.25 | 2.50 | 1.66 | 3.27% | 0.2 美元 | 0.38 美元 | 19.2% |

| 天蝎座油轮公司 | 6.76 | 1.44 | 2.88 | 8.07% | 0.3 美元 | 0.26 美元 | 1.8% |

| Hafnia Ltd | 4.87 | 1.73 | 1.45 | 7.97% | 0.24 美元 | 0.68 美元 | 74.09% |

| Plains GP 控股有限公司 | 21.83 | 2.47 | 0.08 | 2.74% | 0.71 美元 | 0.82 美元 | -2.8% |

| TORM PLC | 4.73 | 1.71 | 2.11 | 11.22% | 0.27 | 0.29 美元 | 13.81% |

| Hess Midstream LP | 16.91 | 8.41 | 1.71 | 11.98% | 0.27 | 0.3 美元 | 16.56% |

| 国际海运公司 | 5.16 | 1.53 | 2.57 | 8.23% | 0.19 美元 | 0.17 美元 | -4.43% |

| 南澳天然气输送机 | 42.06 | 1.79 | 5.31 | 5.06% | 120.58 美元 | 88.44 美元 | 6.15% |

| 平均值 | 15.87 | 3.24 | 2.42 | 6.67% | 6.66 美元 | 5.16 美元 | 9.25% |

By analyzing Cheniere Energy, we can infer the following trends:

通过分析切尼尔能源,我们可以推断出以下趋势:

The stock's Price to Earnings ratio of 8.5 is lower than the industry average by 0.54x, suggesting potential value in the eyes of market participants.

The elevated Price to Book ratio of 9.5 relative to the industry average by 2.93x suggests company might be overvalued based on its book value.

With a relatively high Price to Sales ratio of 2.44, which is 1.01x the industry average, the stock might be considered overvalued based on sales performance.

With a Return on Equity (ROE) of 10.78% that is 4.11% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $1.52 Billion is 0.23x below the industry average, suggesting potential lower profitability or financial challenges.

With lower gross profit of $1.26 Billion, which indicates 0.24x below the industry average, the company may experience lower revenue after accounting for production costs.

With a revenue growth of -41.82%, which is much lower than the industry average of 9.25%, the company is experiencing a notable slowdown in sales expansion.

该股的市盈率为8.5,比行业平均水平低0.54倍,这表明在市场参与者眼中具有潜在价值。

与行业平均水平相比,账面价格比率为9.5倍,上涨了2.93倍,这表明该公司的账面价值可能会被高估。

由于市售比率相对较高,为2.44,是行业平均水平的1.0倍,因此根据销售业绩,该股可能被视为估值过高。

该公司的股本回报率(ROE)为10.78%,比行业平均水平高出4.11%,看来该公司表现出有效利用股权来创造利润。

扣除利息、税项、折旧和摊销前的收益(EBITDA)为15.2亿美元,比行业平均水平低0.23倍,这表明潜在的盈利能力下降或面临财务挑战。

该公司的毛利润较低,为12.6亿美元,比行业平均水平低0.24倍,扣除生产成本后,该公司的收入可能会减少。

该公司的收入增长为-41.82%,远低于行业平均水平的9.25%,销售扩张明显放缓。

Debt To Equity Ratio

负债权益比率

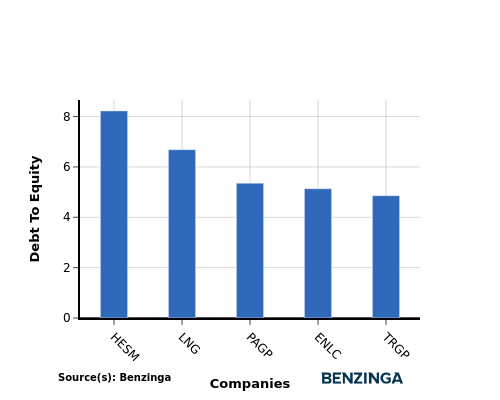

The debt-to-equity (D/E) ratio indicates the proportion of debt and equity used by a company to finance its assets and operations.

债务与权益(D/E)比率表示公司用于为其资产和运营融资的债务和权益比例。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行业比较中考虑债务与权益比率可以对公司的财务状况和风险状况进行简明的评估,从而有助于做出明智的决策。

When assessing Cheniere Energy against its top 4 peers using the Debt-to-Equity ratio, the following comparisons can be made:

在使用债务与权益比率评估Cheniere Energy与排名前四的同行时,可以进行以下比较:

Cheniere Energy is positioned in the middle in terms of the debt-to-equity ratio compared to its top 4 peers.

This suggests a balanced financial structure, where the company maintains a moderate level of debt while also relying on equity financing with a debt-to-equity ratio of 6.69.

与前四名同行相比,Cheniere Energy的债务与权益比率处于中间位置。

这表明财务结构平衡,公司保持适度的债务水平,同时也依赖股权融资,债务与权益比率为6.69。

Key Takeaways

关键要点

For Cheniere Energy in the Oil, Gas & Consumable Fuels industry, the PE, PB, and PS ratios indicate that the company is undervalued compared to its peers. However, the high ROE suggests strong profitability potential. The low EBITDA and gross profit may indicate operational challenges, while the low revenue growth suggests limited expansion opportunities.

对于石油、天然气和消耗性燃料行业的Cheniere Energy而言,市盈率、铅率和市盈率表明,与同行相比,该公司的估值被低估了。但是,高投资回报率表明了强大的盈利潜力。低息税折旧摊销前利润和毛利润可能表明运营挑战,而低收入增长表明扩张机会有限。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。