Market Whales and Their Recent Bets on Edwards Lifesciences Options

Market Whales and Their Recent Bets on Edwards Lifesciences Options

Deep-pocketed investors have adopted a bullish approach towards Edwards Lifesciences (NYSE:EW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in EW usually suggests something big is about to happen.

财力雄厚的投资者对爱德华兹生命科学(纽约证券交易所代码:EW)采取了看涨态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是EW的如此重大变动通常表明即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Edwards Lifesciences. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时本辛加的期权扫描仪重点介绍了爱德华兹生命科学的14项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 64% leaning bullish and 14% bearish. Among these notable options, 6 are puts, totaling $403,470, and 8 are calls, amounting to $528,444.

这些重量级投资者的总体情绪存在分歧,64%的人倾向于看涨,14%的人倾向于看跌。在这些值得注意的期权中,有6个是看跌期权,总额为403,470美元,8个是看涨期权,总额为528,444美元。

Predicted Price Range

预测的价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $72.5 for Edwards Lifesciences over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将爱德华兹生命科学的价格定在50.0美元至72.5美元之间。

Volume & Open Interest Trends

交易量和未平仓合约趋势

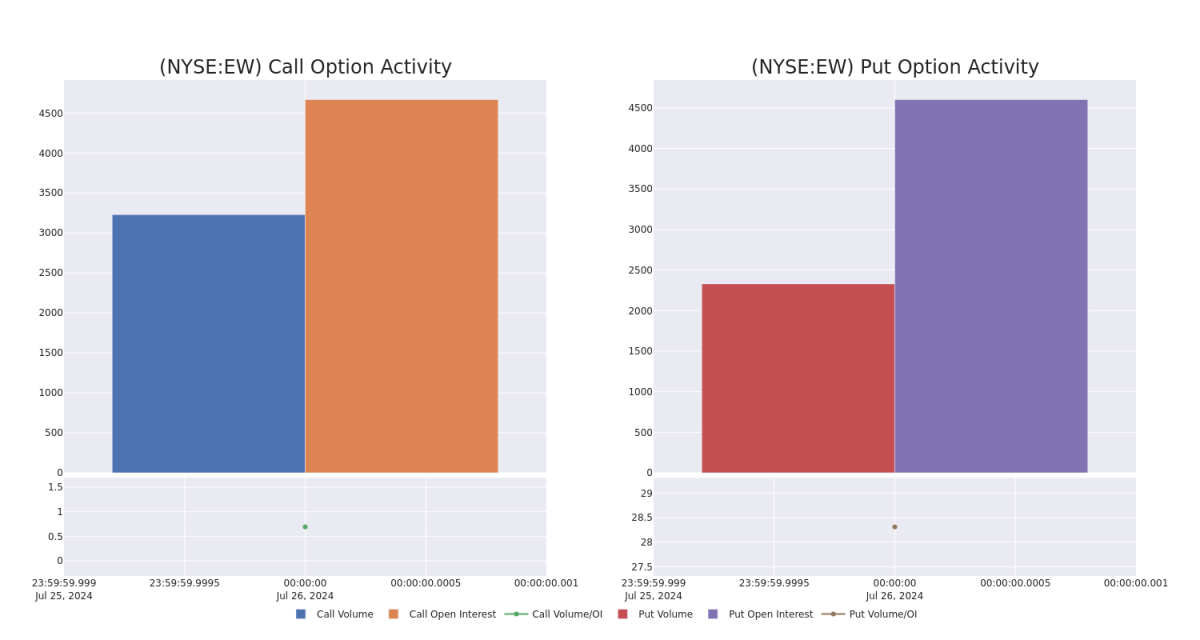

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Edwards Lifesciences's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Edwards Lifesciences's substantial trades, within a strike price spectrum from $50.0 to $72.5 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了以指定行使价计算的爱德华兹生命科学期权的流动性和投资者对他们的兴趣。即将发布的数据可视化了与爱德华兹生命科学的大量交易相关的看涨期权和未平仓合约的波动,在过去30天内,行使价范围从50.0美元到72.5美元不等。

Edwards Lifesciences Call and Put Volume: 30-Day Overview

爱德华兹生命科学看涨期权和看跌期权交易量:30 天概述

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EW | CALL | TRADE | BEARISH | 01/17/25 | $2.7 | $2.5 | $2.55 | $72.50 | $178.2K | 33 | 801 |

| EW | PUT | TRADE | BEARISH | 01/17/25 | $4.5 | $4.2 | $4.5 | $60.00 | $135.0K | 1.2K | 300 |

| EW | PUT | TRADE | BULLISH | 01/17/25 | $4.4 | $4.1 | $4.2 | $60.00 | $126.0K | 1.2K | 600 |

| EW | CALL | SWEEP | BULLISH | 11/15/24 | $2.7 | $2.45 | $2.6 | $70.00 | $94.6K | 100 | 502 |

| EW | CALL | TRADE | BULLISH | 01/17/25 | $6.7 | $6.5 | $6.7 | $62.50 | $53.6K | 98 | 1 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 新的 | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 2.7 美元 | 2.5 美元 | 2.55 美元 | 72.50 美元 | 178.2 万美元 | 33 | 801 |

| 新的 | 放 | 贸易 | 粗鲁的 | 01/17/25 | 4.5 美元 | 4.2 美元 | 4.5 美元 | 60.00 美元 | 135.0K | 1.2K | 300 |

| 新的 | 放 | 贸易 | 看涨 | 01/17/25 | 4.4 美元 | 4.1 美元 | 4.2 美元 | 60.00 美元 | 126.0K | 1.2K | 600 |

| 新的 | 打电话 | 扫 | 看涨 | 11/15/24 | 2.7 美元 | 2.45 美元 | 2.6 美元 | 70.00 美元 | 94.6 万美元 | 100 | 502 |

| 新的 | 打电话 | 贸易 | 看涨 | 01/17/25 | 6.7 美元 | 6.5 美元 | 6.7 美元 | 62.50 美元 | 53.6 万美元 | 98 | 1 |

About Edwards Lifesciences

关于爱德华兹生命科学

Spun off from Baxter International in 2000, Edwards Lifesciences designs, manufactures, and markets a range of medical devices and equipment for advanced stages of structural heart disease. It has established itself as a leader across key products, including surgical tissue heart valves, transcatheter valve technologies, surgical clips, and catheters. The firm derives about 55% of its total sales from outside the US.

爱德华兹生命科学于2000年从百特国际分拆出来,设计、制造和销售一系列用于结构性心脏病晚期的医疗器械和设备。它已成为关键产品的领导者,包括手术组织心脏瓣膜、经导管瓣膜技术、手术夹和导管。该公司约有55%的总销售额来自美国以外的地区。

Current Position of Edwards Lifesciences

爱德华兹生命科学的现状

- Trading volume stands at 8,101,822, with EW's price up by 4.18%, positioned at $62.2.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 89 days.

- 交易量为8,101,822美元,EW的价格上涨了4.18%,为62.2美元。

- RSI指标显示该股可能被超卖。

- 预计将在89天后公布财报。

Expert Opinions on Edwards Lifesciences

关于爱德华兹生命科学的专家意见

In the last month, 5 experts released ratings on this stock with an average target price of $76.4.

上个月,5位专家发布了该股的评级,平均目标价为76.4美元。

- An analyst from TD Cowen has revised its rating downward to Hold, adjusting the price target to $70.

- An analyst from Baird downgraded its action to Neutral with a price target of $70.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Edwards Lifesciences, targeting a price of $85.

- An analyst from Truist Securities has revised its rating downward to Hold, adjusting the price target to $82.

- An analyst from B of A Securities downgraded its action to Neutral with a price target of $75.

- 道明考恩的一位分析师已将其评级下调至持有,将目标股价调整为70美元。

- 贝尔德的一位分析师将其行动评级下调至中性,目标股价为70美元。

- 加拿大皇家银行资本的一位分析师保持立场,继续维持爱德华兹生命科学跑赢大盘的评级,目标股价为85美元。

- Truist Securities的一位分析师已将其评级下调至持有,将目标股价调整为82美元。

- A证券b的一位分析师将其股票评级下调至中性,目标股价为75美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Edwards Lifesciences options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解爱德华兹生命科学的最新期权交易。