Decoding Freeport-McMoRan's Options Activity: What's the Big Picture?

Decoding Freeport-McMoRan's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bearish stance on Freeport-McMoRan.

有很多钱可以花的鲸鱼对弗里波特-麦克莫兰铜金采取了明显的看跌立场。

Looking at options history for Freeport-McMoRan (NYSE:FCX) we detected 22 trades.

查看弗里波特-麦克莫兰铜金(纽约证券交易所代码:FCX)的期权历史记录,我们发现了22笔交易。

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 59% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,31%的投资者以看涨的预期开盘,59%的投资者持看跌预期。

From the overall spotted trades, 13 are puts, for a total amount of $1,037,123 and 9, calls, for a total amount of $434,778.

在已发现的全部交易中,有13笔是看跌期权,总额为1,037,123美元,9笔看涨期权,总额为434,778美元。

Expected Price Movements

预期的价格走势

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $50.0 for Freeport-McMoRan, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者正在关注弗里波特麦克莫兰金在过去三个月中介于30.0美元至50.0美元之间的价格区间。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

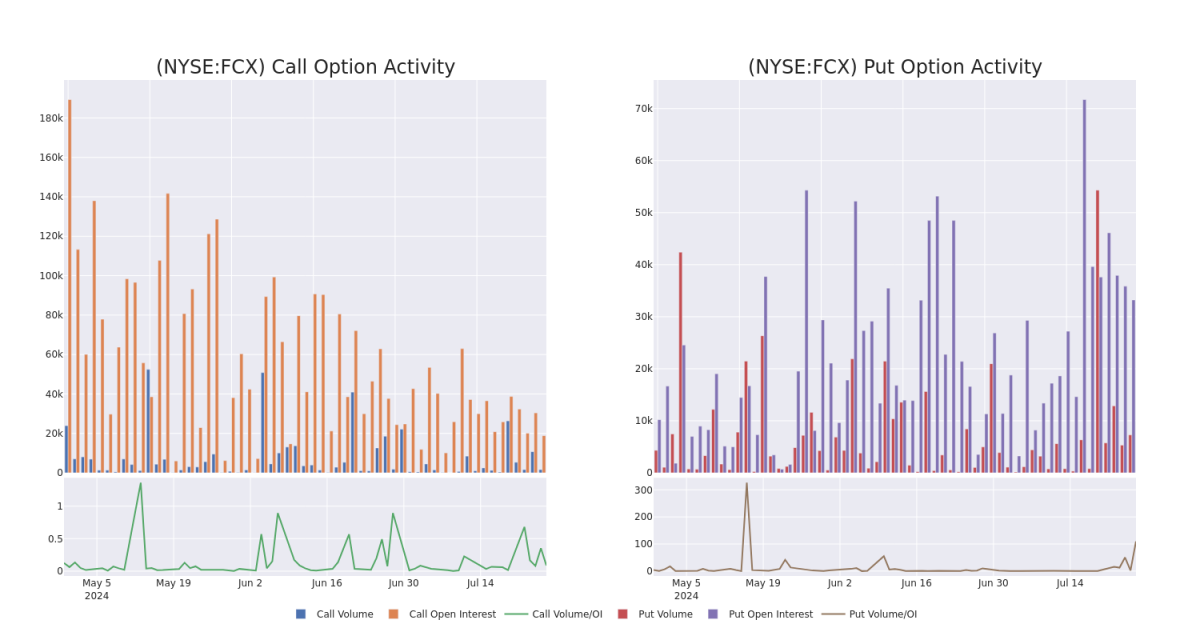

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Freeport-McMoRan's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Freeport-McMoRan's substantial trades, within a strike price spectrum from $30.0 to $50.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了Freeport-McMoran期权在指定行使价下的流动性和投资者对Freeport-McMoran期权的兴趣。即将发布的数据可视化了与Freeport-McMoran的大量交易相关的看涨期权和未平仓合约的波动,在过去30天内,行使价范围从30.0美元到50.0美元不等。

Freeport-McMoRan Call and Put Volume: 30-Day Overview

弗里波特-麦克莫兰铜金看涨和看跌交易量:30天概述

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | PUT | TRADE | BEARISH | 06/20/25 | $3.4 | $3.25 | $3.39 | $40.00 | $508.5K | 9.7K | 1.5K |

| FCX | CALL | TRADE | BEARISH | 01/17/25 | $15.4 | $14.15 | $14.3 | $32.00 | $97.2K | 5.6K | 69 |

| FCX | PUT | SWEEP | NEUTRAL | 03/21/25 | $4.9 | $4.85 | $4.85 | $45.00 | $82.3K | 2.6K | 170 |

| FCX | PUT | SWEEP | BULLISH | 01/16/26 | $5.55 | $5.45 | $5.45 | $42.00 | $81.7K | 1.9K | 250 |

| FCX | CALL | SWEEP | BULLISH | 11/15/24 | $6.8 | $6.7 | $6.8 | $40.00 | $81.6K | 649 | 255 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | 放 | 贸易 | 粗鲁的 | 06/20/25 | 3.4 美元 | 3.25 | 3.39 美元 | 40.00 美元 | 508.5 万美元 | 9.7K | 1.5K |

| FCX | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 15.4 美元 | 14.15 美元 | 14.3 美元 | 32.00 美元 | 97.2 万美元 | 5.6K | 69 |

| FCX | 放 | 扫 | 中立 | 03/21/25 | 4.9 美元 | 4.85 美元 | 4.85 美元 | 45.00 美元 | 82.3 万美元 | 2.6K | 170 |

| FCX | 放 | 扫 | 看涨 | 01/16/26 | 5.55 美元 | 5.45 美元 | 5.45 美元 | 42.00 美元 | 81.7 万美元 | 1.9K | 250 |

| FCX | 打电话 | 扫 | 看涨 | 11/15/24 | 6.8 美元 | 6.7 美元 | 6.8 美元 | 40.00 美元 | 81.6 万美元 | 649 | 255 |

About Freeport-McMoRan

关于弗里波特-麦克莫兰铜金

Freeport-McMoRan Inc is an international mining company. It has organized its mining operations into four primary divisions: North America copper mines, South America mining, Indonesia mining and Molybdenum mines. Its reportable segments include the Morenci, Cerro Verde and Grasberg (Indonesia mining) copper mines, the Rod & Refining operations and Atlantic Copper Smelting and Refining. It derives key revenue from the sale of Copper.

弗里波特-麦克莫兰铜金公司是一家国际矿业公司。它已将其采矿业务分为四个主要部门:北美铜矿、南美采矿、印度尼西亚采矿和钼矿。其应报告的细分市场包括莫伦奇、佛得角山和格拉斯伯格(印度尼西亚矿业)铜矿、棒材和炼油业务以及大西洋铜冶炼和提炼。它从铜的销售中获得关键收入。

Following our analysis of the options activities associated with Freeport-McMoRan, we pivot to a closer look at the company's own performance.

在分析了与弗里波特-麦克莫兰铜金相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Current Position of Freeport-McMoRan

弗里波特-麦克莫兰铜金的现状

- With a volume of 6,291,596, the price of FCX is up 0.79% at $44.88.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 83 days.

- FCX的交易量为6,291,596美元,上涨0.79%,至44.88美元。

- RSI 指标暗示标的股票可能已接近超卖。

- 下一份财报预计将在83天后公布。

Expert Opinions on Freeport-McMoRan

关于弗里波特-麦克莫兰铜金的专家意见

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $57.0.

在过去的30天中,共有3位专业分析师对该股发表了看法,将平均目标股价设定为57.0美元。

- Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Freeport-McMoRan with a target price of $53.

- An analyst from Scotiabank persists with their Sector Outperform rating on Freeport-McMoRan, maintaining a target price of $58.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $60.

- 雷蒙德·詹姆斯的一位分析师在评估中保持了对弗里波特麦克莫兰金跑赢大盘的评级,目标价为53美元。

- 丰业银行的一位分析师坚持对弗里波特麦克莫兰金的行业跑赢大盘评级,将目标价维持在58美元。

- 加拿大皇家银行资本的一位分析师谨慎地将其评级下调至行业绩效,将目标股价定为60美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。