Tech Stocks Slide On Earnings, US Economy Flexes Muscles, Small-Cap Rally Continues: This Week In The Markets

Tech Stocks Slide On Earnings, US Economy Flexes Muscles, Small-Cap Rally Continues: This Week In The Markets

The tech earnings season started with disappointments for investors as shares of the Magnificent Seven companies all declined during the trading week.

科技七巨头在交易周期间全部下挫,投资者在技术财报季的开始感到失望。

Alphabet Inc. (NASDAQ:GOOGL) reported stronger-than-expected earnings and revenue, but missed analysts' targets on YouTube advertising revenue, leading to the worst week of the year for the Google parent company's stock.

Alphabet Inc.(纳斯达克股票代码为GOOGL)报告了超出预期的盈利和营业收入,但错过了分析师对YouTube广告收入的目标,导致Google母公司股票今年表现最差的一周。

Tesla Inc. (NASDAQ:TSLA) missed quarterly earnings forecasts due to thinner profit margins impacted by lower vehicle prices and restructuring charges. The electric-vehicle giant also postponed the announcement of the Robotaxi to October. Shares fell 12.3% in reaction to the earnings report on Wednesday, marking the worst one-day performance since September 2020.

由于汽车价格下降和重组费用影响减薄利润率,Tesla Inc.(纳斯达克股票代码为TSLA)未能达到季度财务预期。这家电动汽车巨头还将Robotaxi的发布推迟到10月份。周三财报公布后,股价下跌了12.3%,这是自2020年9月以来最糟糕的一天表现。

The tech-heavy Nasdaq 100 index notched the second-straight week in the red for the first time since April.

在4月以来首次出现红色两周之后,科技创业板100指数再次下跌。

Among mega-cap stocks, Ford Motor Company (NYSE:F) and United Parcel Service Inc. (NYSE:UPS) experienced the largest declines this week, followed by General Motors (NYSE:GM) , amid disappointing earnings reports. The top performers among mega caps were 3M Company (NYSE:MMM) and Bristol-Myers Squibb Company (NYSE:BMY), buoyed by surprising results.

在巨型市值股中,福特汽车公司(纽交所股票代码为F)和联合包裹服务公司(纽交所股票代码为UPS)本周跌幅最大,其次是通用汽车(纽交所股票代码为GM),财报不及预期。在巨型市值股中表现最好的是300万公司(纽交所股票代码为MMM)和施贵宝公司(纽交所股票代码为BMY),这些公司取得了意外的业绩。

Small-cap stocks outperformed once again this week, with the Russell 2000 Index marking its third straight week of gains, supported by high expectations for upcoming interest rate cuts.

小盘股再次表现优秀,罗素2000指数连续第三周上涨,得益于市场对即将到来的降息的高期望。

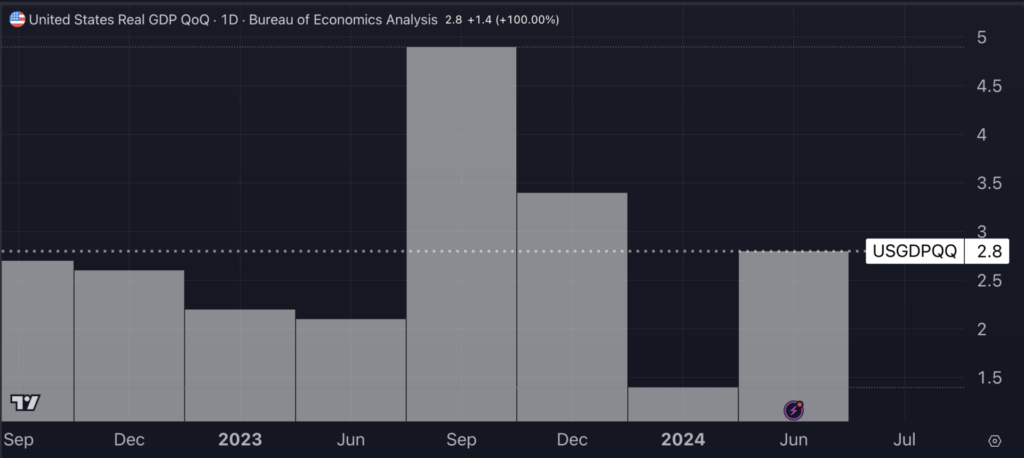

On the macroeconomic front, the U.S. economy grew at an annualized pace of 2.8% in the second quarter, accelerating from the first quarter and topping expectations of 2% growth.

在宏观经济方面,美国经济在第二季度以年化2.8%的速度增长,加速自第一季度,超过2%的增长预期。

Chart Of The Week: US GDP Growth Doubled From Q1 To Q2 2024

本周图表:美国GDP从2024年第一季度翻了一倍到第二季度。

You might have missed...

你可能错过了...。

Inflation Gauge Falls: An inflation measure followed by the Federal Reserve fell to 2.5% in June, hitting the lowest levels since February 2021 and cementing market expectations of a rate cut in September.

通胀衡量指标下降:美联储关注的通胀衡量指标在6月份下降到2.5%,达到2021年2月份以来的最低水平,巩固了市场对9月份降息的预期。

Yet the Fed is seeking a more "durable downward trend" before deciding to cut rates, according to a Comerica Bank economist.

但Comerica Bank一位经济学家表示,美联储在决定降息之前正在寻求更持久的下降趋势。

Alphabet Shares Drop: OpenAI plans to launch SearchGPT, a tool aimed at challenging Google's search dominance, opening a 10,000-person waiting list to test the new product.

Alphabet股价下滑:OpenAI计划推出SearchGPt,这是一个旨在挑战谷歌搜索统治地位的工具,开放了一个1万人的等待名单来测试这个新产品。

Mortgage Rates Ease: Mortgage rates have declined to the lowest levels since February, with the average 30-year fixed interest rate falling to 6.62%, driven by investor anticipation of future interest rate cuts. Despite this, demand among homebuyers remains weak.

抵押贷款利率下降:抵押贷款利率降至自2月份以来的最低水平,平均30年固定利率降至6.62%,受投资者对未来利率下降的预期推动。尽管如此,购房者的需求仍然疲软。

Read now:

立即阅读:

- Investors Go All In On Small Caps, Pour Over $6 Billion Into Russell 2000 ETF This Month: They 'Will Return To Larger-Cap Alternatives,' Veteran Analyst Says

- 投资者全力以赴投资小型股,本月向拉塞尔2000 etf流入60亿美元:退役分析师表示,他们将回归更大的股票选择。

Image created using artificial intelligence via Midjourney.

图像由Midjourney通过人工智能创建。