Should You Investigate Goertek Inc. (SZSE:002241) At CN¥21.62?

Should You Investigate Goertek Inc. (SZSE:002241) At CN¥21.62?

Let's talk about the popular Goertek Inc. (SZSE:002241). The company's shares led the SZSE gainers with a relatively large price hike in the past couple of weeks. While good news for shareholders, the company has traded much higher in the past year. As a large-cap stock with high coverage by analysts, you could assume any recent changes in the company's outlook is already priced into the stock. But what if there is still an opportunity to buy? Today we will analyse the most recent data on Goertek's outlook and valuation to see if the opportunity still exists.

让我们一起来探讨受欢迎的Goertek Inc. (SZSE:002241)吧。过去几周,该公司的股价领涨深交所,涨幅相对较大。股东获得好消息,但公司在过去一年中的交易有很大提高。作为一家市值较大、被分析师高度覆盖的大盘股,你可能会认为公司未来前景的任何变化都已经被反映在了股票价格之中。但如果仍有买入的机会呢?今天我们将分析Goertek最近的前景和估值数据,看看是否仍存在买入的机会。

What Is Goertek Worth?

Goertek的价值是多少?

Goertek appears to be expensive according to our price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average. In this instance, we've used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock's cash flows. We find that Goertek's ratio of 53.72x is above its peer average of 36.88x, which suggests the stock is trading at a higher price compared to the Electronic industry. If you like the stock, you may want to keep an eye out for a potential price decline in the future. Given that Goertek's share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

根据我们的价格倍数模型,Goertek的估值较高。该模型比较公司的市盈率与同行业平均水平。在这种情况下,我们使用了市盈率作为比较指标,因为没有足够的信息可靠地预测股票的现金流。我们发现,Goertek的市盈率为53.72倍,高于其同行业平均水平36.88倍,这表明该股票的价格较电子行业的其他股票更高。如果你喜欢这只股票,你可能要密切关注未来的价格走势。由于Goertek的股价波动较大(即其价格波动与市场其他部分相比更加明显),这可能意味着价格会下跌,从而给我们在未来再次买入的机会。这是基于它的高贝塔值,这是一个很好的股价波动指标。

Can we expect growth from Goertek?

我们能从Goertek获得增长吗?

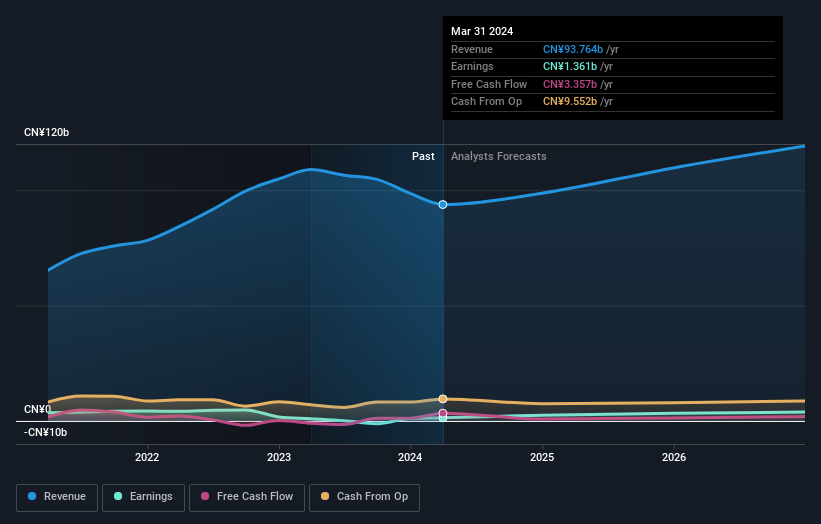

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also take a look at the company's future expectations. Goertek's earnings over the next few years are expected to double, indicating a very optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value.

投资者在购买股票之前,可能会考虑公司的前景。以便以便在便宜的价格买入未来前景良好的公司,这总是一个很好的投资。因此,让我们也来看一下公司未来的预期。Goertek的未来几年的收益预计会翻一番,这表明前景非常乐观。这应该将导致更强的现金流,进一步推动股票的价格上涨。

What This Means For You

这对您意味着什么?

Are you a shareholder? It seems like the market has well and truly priced in 002241's positive outlook, with shares trading above industry price multiples. However, this brings up another question – is now the right time to sell? If you believe 002241 should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. But before you make this decision, take a look at whether its fundamentals have changed.

你是股东吗?市场似乎已经充分考虑到了002241的正面前景,因此股票交易价格高于同行业价格倍数。然而,这又引出了另一个问题:现在是卖出的合适时机吗?如果你认为002241的股价应该低于目前的市场价格,那么在股票价格回落到行业市盈率时的高点卖出,然后再买回来,可以获得盈利。但在做出这个决定之前,需要看一下公司的基本面是否发生了变化。

Are you a potential investor? If you've been keeping an eye on 002241 for a while, now may not be the best time to enter into the stock. The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. However, the optimistic prospect is encouraging for 002241, which means it's worth diving deeper into other factors in order to take advantage of the next price drop.

你是一位潜在投资者吗?如果你一直在关注002241的情况,现在可能不是进入该股票的最佳时机。该股票的价格已经超过了同行业水平,这意味着不能再通过错价获得更多收益了。然而,乐观的前景对002241来说是鼓舞人心的,这意味着有必要深入研究其他因素,以便利用下一次的价格下跌。

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 1 warning sign for Goertek and we think they deserve your attention.

需要记住的是,在分析一个股票时,需要注意风险。在Simply Wall St上,我们发现Goertek有1个警告信号,我们认为它们值得引起你的注意。

If you are no longer interested in Goertek, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

如果你对Goertek不再感兴趣,你可以使用我们的免费平台查看我们超过50只其他有高成长潜力的股票的列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。