Lennox International Inc. (NYSE:LII) Second-Quarter Results: Here's What Analysts Are Forecasting For This Year

Lennox International Inc. (NYSE:LII) Second-Quarter Results: Here's What Analysts Are Forecasting For This Year

It's been a good week for Lennox International Inc. (NYSE:LII) shareholders, because the company has just released its latest quarterly results, and the shares gained 3.1% to US$573. The result was positive overall - although revenues of US$1.5b were in line with what the analysts predicted, Lennox International surprised by delivering a statutory profit of US$6.87 per share, modestly greater than expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

对于Lennox International Inc. (NYSE:LII) 股东来说,上周表现良好,因为公司刚刚发布了最新季度业绩报告,股价上涨3.1%,达到了美元573美元。 总体来说,结果是积极的 - 尽管15亿美元的营业收入符合分析师的预测,Lennox International的法定利润为每股6.87美元,略高于预期。 对于投资者来说,这是一个重要的时刻,他们可以通过公司的报告跟踪公司的业绩,查看专家对明年的预测,并查看业务预期是否有任何变化。 我们认为读者会发现分析师最新的(法定的)盈利后预测很有趣。

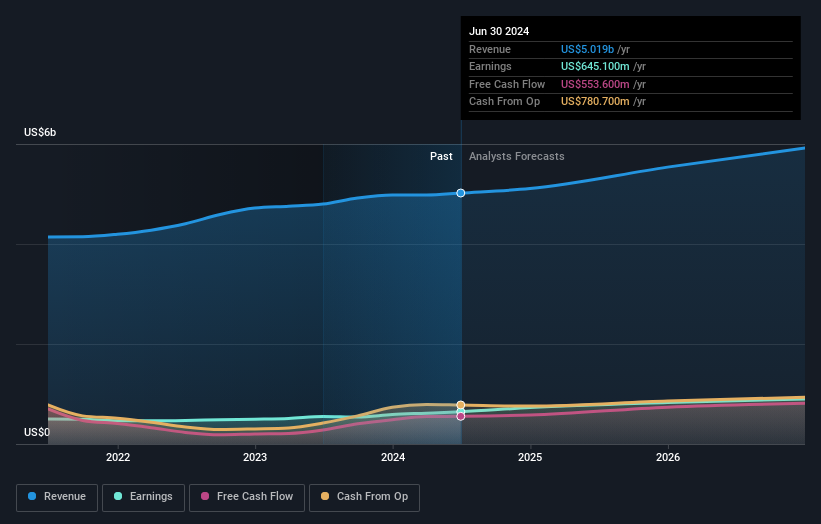

Following last week's earnings report, Lennox International's 15 analysts are forecasting 2024 revenues to be US$5.11b, approximately in line with the last 12 months. Statutory earnings per share are predicted to expand 12% to US$20.31. In the lead-up to this report, the analysts had been modelling revenues of US$5.13b and earnings per share (EPS) of US$19.99 in 2024. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

在上周的业绩报告之后,Lennox International的15位分析师预计2024年营业收入达到511亿美元,与过去12个月基本持平。 预计法定每股收益将扩大12%,达到20.31美元。 在发布业绩报告之前,分析师们一直在对2024年的营业收入进行预测,预计为513亿美元,每股收益为19.99美元。 所以很明显,尽管分析师更新了预测,但最新业绩报告之后业务预期并没有发生重大变化。

The analysts reconfirmed their price target of US$547, showing that the business is executing well and in line with expectations. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Lennox International at US$675 per share, while the most bearish prices it at US$380. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

分析师再次确认了美元547的价格目标,表明业务表现良好,符合预期。 此外,查看分析师估计的范围可能也有帮助,以评估离群值意见与平均值意见之间的差异。 目前,最看好的分析师将Lennox International的价值估计为每股美元675,而最看淡的价格为每股美元380。 可以看出,分析师们并不都同意该股票的未来前景,但预测范围仍然相当狭窄,这可能表明结果并不完全不可预测。

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that Lennox International's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 3.6% growth on an annualised basis. This is compared to a historical growth rate of 7.5% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 5.3% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Lennox International.

现在来看一个更大的图片,我们可以通过比较过去的业绩和行业增长预测来理解这些预测。 显然,人们期望Lennox International的营业收入增长会大幅放缓,预计到2024年底,年化基础上将显示3.6%的增长。 这与过去五年的历史增长率7.5%相比。 将其与行业中其他公司(具有分析师预测)进行比较,预计这些公司的年平均营收增长率为5.3%。 因此,尽管预计营收增长将放缓,但整个行业也必须比Lennox International增长更快。

The Bottom Line

最重要的事情是分析师增加了它对下一年每股亏损的估计。令人欣慰的是,营收预测未发生重大变化,业务仍有望比整个行业增长更快。共识价格目标稳定在28.50美元,最新估计不足以对价格目标产生影响。

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

最重要的是,没有主要的情绪变化,分析师重申该业务的表现符合他们以前的每股盈利预期。好的一面是,营业收入预测没有发生重大变化,尽管预测表明他们的表现将低于整个行业。对共识股价目标没有真正的改变,表明最新的估计值没有使该业务的内在价值发生重大变化。

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Lennox International going out to 2026, and you can see them free on our platform here.

请记住,我们仍认为考虑业务的长期轨迹对投资者来说更加重要。 我们对Lennox International的预测可以追溯到2026年,您可以在此免费查看它们。

You still need to take note of risks, for example - Lennox International has 1 warning sign we think you should be aware of.

您仍需要注意风险,例如 - Lennox International有1个警告标志,我们认为您应该注意。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that Lennox International's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 3.6% growth on an annualised basis. This is compared to a historical growth rate of 7.5% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 5.3% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Lennox International.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that Lennox International's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 3.6% growth on an annualised basis. This is compared to a historical growth rate of 7.5% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 5.3% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Lennox International.