REIT Watch - Maintaining Balance Sheet Strengths as S-REITs Average 39% Gearing

REIT Watch - Maintaining Balance Sheet Strengths as S-REITs Average 39% Gearing

With almost full certainty that the Federal Reserve will cut interest rates this September (based on CME Fed Watch Tool showing a 100 per cent probability as of Jul 26, 2024), interest rates continue to remain in the spotlight for REITs.

随着CME Fed Watch工具于2024年7月26日显示100%的概率,美联储有几乎完全的把握会在今年9月份削减利率期货,利率仍然是REITs的焦点。

The Monetary Authority of Singapore (MAS) announced last week a proposal to simplify the leverage requirements for all Singapore REITs (S-REITs) – it proposes for a single aggregate leverage limit of 50 per cent and a minimum interest coverage ratio (ICR) of 1.5 times to be applied for all S-REITs.

新加坡金融管理局(MAS)上周宣布了一项提议,旨在为所有新加坡房地产投资信托(S-REITs)简化资本杠杆要求——提议将适用于所有S-REITs的单一综合杠杆限制设定为50%,最低利息覆盖率(ICR)为1.5倍。

Currently, S-REITs have a leverage limit ratio of 45 per cent if the ICR is 2.5 times or below, and a limit of 50 per cent if the ICR is above 2.5 times. MAS last increased the leverage limit in April 2020 to provide more flexibility for S-REITs to manage their capital structures during the Covid period.

目前,如果ICR低于或等于2.5倍,则S-REITs的资本杠杆限制比率为45%,如果ICR高于2.5倍,则限制为50%。 MAS在2020年4月份最后一次提高了杠杆限制以为S-REITs在Covid期间管理其资本结构提供更大的灵活性。该提议旨在简化资本杠杆要求,促进审慎借贷,并确保信托基金有足够的收益来支付其利息费用并履行其债务义务。

The latest proposal is aimed at simplifying the leverage requirements, foster prudent borrowings, and ensures that REITs can adequately service debt obligations and have sufficient earnings to pay their interest expenses.

最新的提案旨在简化杠杆要求,促进审慎借款,并确保信托基金能够充分偿还债务并拥有足够的收益来支付其利息费用。

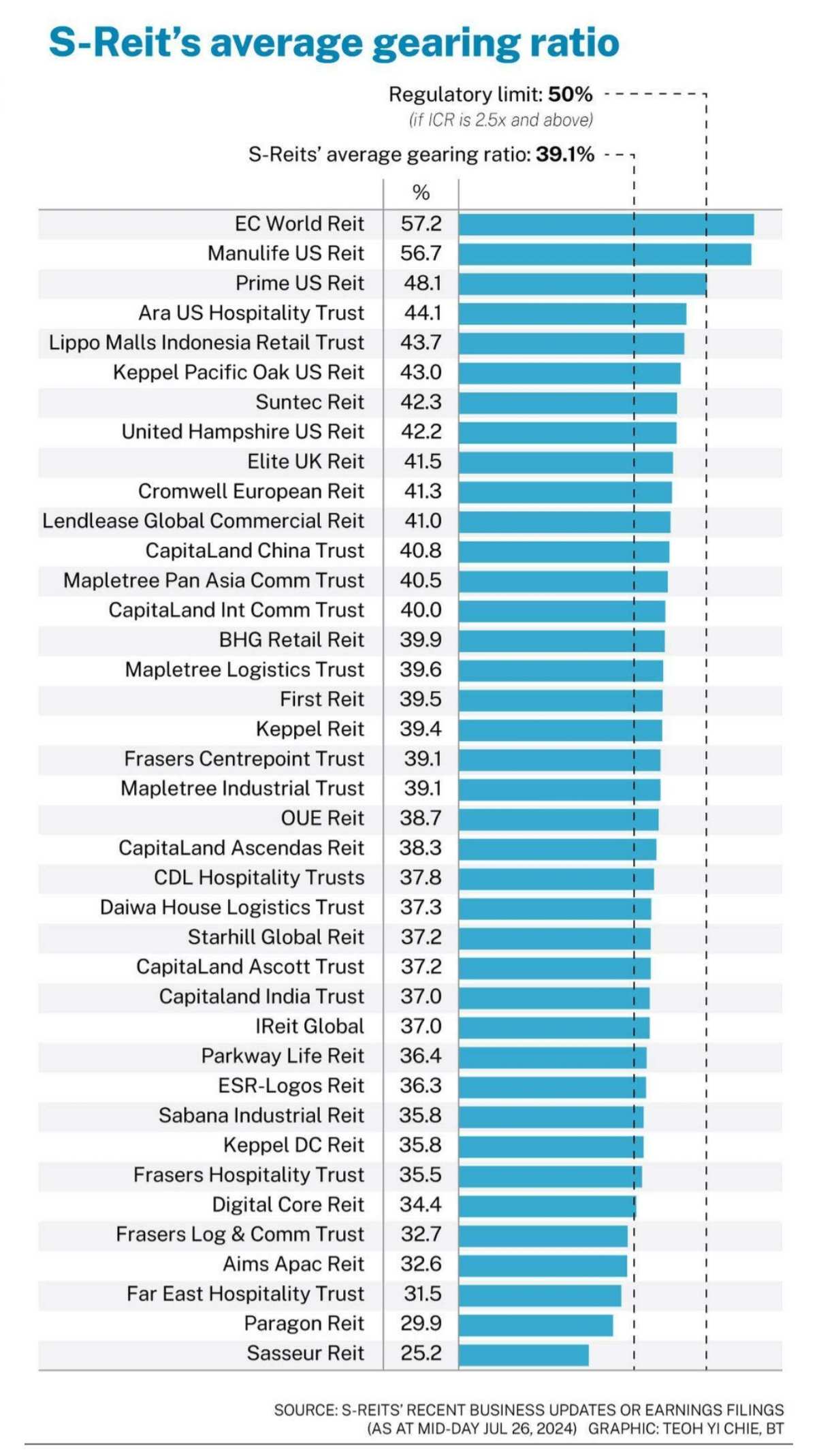

Today, S-REITs maintain an average gearing ratio of 39.1 per cent, based on latest company filings which were extracted on mid-day Jul 26, 2024. More than half the sector has gearing ratios below its average.

截至2024年7月26日中午公布的最新公司文件显示,今天,S-REITs的平均杠杆率为39.1%,超过一半的板块的杠杆率低于其平均水平。

Five S-REITs that maintain the lowest gearing ratios are Sasseur REIT (25.2 per cent), Paragon REIT (29.9 per cent), Far East Hospitality Trust (31.5 per cent), AIMS APAC REIT (32.6 per cent), and Frasers Logistics & Commercial Trust (32.7 per cent).

维持最低负债率的五个S-REITs是砂之船房地产投资信托(25.2%),百利保房地产投资信托(29.9%),远东酒店信托(31.5%),宝泽安保资本工业房地产信托(32.6%)和辉煌物流商业信托(32.7%)。

At 39.1 per cent and a regulatory limit of 50 per cent, this translates into over S$20 billion of potential debt headroom for the sector to fund capital-intensive acquisitions. Most S-REITs today also report the ICR figures – which measure a REIT's ability to pay interest on its outstanding debt – with the sector's ICR at 3.8 times on average. 33 trusts have ICRs at 2.5 times and above, all trusts (based on reported ICR) have ICRs above 1.5 times.

在39.1%和50%的监管限制下,这意味着该板块有超过200亿新加坡元的潜在债务空间,用于资本密集型收购。今天,大多数S-REITs也报告了ICR数据,ICR是评估信托基金偿付未偿还债务利息能力的重要指标,该板块的ICR平均为3.8倍。有33个信托的ICR高于2.5倍,所有基金(根据ICR报告)的ICR都高于1.5倍。

Five S-REITs with the highest ICR (adjusted ICR used where available) were Daiwa House Logistics Trust (12.0x), ParkwayLife REIT (11.1x), IREIT Global (7.1x), Frasers Logistics & Commercial Trust (5.9x), and Keppel DC REIT (5.1x).

五个拥有最高ICR(如有可用,使用调整后的ICR)的S-REITs分别是大和房屋物流基金信托(12.0x),百汇生命产业信托(11.1x),IREIt Global(7.1x),辉煌物流商业信托(5.9x)和吉宝数据中心房地产信托(5.1x)。

Sabana Industrial REIT, which was the first S-REIT to report this earnings season, updated that its portfolio valuation had improved 3.3 per cent year-on-year (YoY) to S$914.5 million, supported by asset enhancement initiatives, asset rejuvenation and higher rentals. Sabana REIT's distributions per unit (DPU) for 1H24 was at 1.34 cents and 16.8 per cent lower YoY, however rental reversions improved 16.8 per cent for the period, marketing its 14th consecutive quarter of positive reversions. Sabana REIT has an aggregate leverage ratio of 35.8 per cent, an ICR of 3.3 times, and 80.1 per cent of its borrowings on fixed rates.

胜宝工业信托是本季度报告的第一个S-REIT,更新了其组合估值,同比改善3.3%,达到了91450万新加坡元,得到了资产优化计划、资产更新和更高的出租率的支持。胜宝工业信托在2024年上半年的每股分配为1.34美分,同比降低16.8%,但该期租金回转率提高了16.8%,标志着连续14个季度的正回转。胜宝工业信托的综合授信比率为35.8%,ICR为3.3倍,80.1%的借款为固定利率。

Gearing ratio, also known as aggregated leverage, is the ratio of a REIT's total debt to its total assets. This metric, used to assess a REIT's financial leverage, is closely monitored by investors. A low gearing ratio could point to greater capacity to undertake more debt for future acquisitions while a high gearing ratio could lead to credit concerns especially during economic downturns.

负债率,也称为综合授信额,是一家REIT的总债务与总资产之比。投资者会密切关注这项度量指标,用于评估REIT的资本杠杆。低负债率可能意味着未来可承担更多债务用于收购,而高负债率可能会在经济低迷期间导致信用问题。

For more research and information on Singapore's REIT sector, visit sgx.com/research-education/sectors for the monthly SREITs & Property Trusts Chartbook.

有关新加坡房地产投资信托板块的更多研究和信息,请访问sgx.com/research-education/sectors了解每月SREITs和房地产信托基金总览。

REIT Watch is a regular column on The Business Times, read the original version.

REIT Watch 是《商业时报》的定期专栏,请阅读原始版本。

Enjoying this read?

喜欢这篇文章吗?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅SGX My Gateway通讯,以获取最新市场资讯、板块表现、新产品发布更新以及新交易所上市公司的研报汇编。

- 保持更新,查看我们的SGX Invest Telegram频道。