Alibaba Stock Soars As New Service Fees Boost Revenue

Alibaba Stock Soars As New Service Fees Boost Revenue

Alibaba Group Holding Ltd (NYSE:BABA) shares surged the most in two months as investors welcomed the company's new strategy to increase merchant service fees.

阿里巴巴集团控股有限公司(纽交所:BABA)股票价格上涨,这是两个月以来的最大涨幅。投资者对该公司增加商户服务费的新策略表示欢迎。

Following the announcement of this new revenue model, the stock jumped as much as 5.8% in Hong Kong and close to 3% in the U.S. market.

在新营收模型公布后,该股票在香港上涨了多达5.8%,在美国市场上涨接近3%。

Starting in September, Alibaba will implement a basic software service fee of 0.6% on confirmed transactions for vendors using its Tmall and Taobao platforms, Bloomberg reports. According to an insider, the company may waive this fee for smaller merchants.

从9月份开始,阿里巴巴将向使用其天猫和淘宝平台的卖家收取0.6%的确认交易基础软件服务费,彭博社报道。据内部人士透露,该公司可能会对较小的商家免除此费用。

Also Read: Alibaba's Taobao Introduces Free Overseas Shipping to Compete with Rivals

此外:阿里巴巴的淘宝平台推出了免费境外运输以与竞争对手竞争

This new fee structure will significantly boost Alibaba's core merchant revenue, adding to the stock's positive outlook.

这种新的计费方式将会显著提升阿里巴巴的核心商家收入,从而增加股票的发展前景。

Jefferies Financial Group analysts noted that Alibaba earns most of its Taobao and Tmall revenue through customer management fees, which merchants pay to advertise and tailor their product offerings.

杰富瑞证券集团分析师指出,阿里巴巴通过客户管理费获得了大部分淘宝和天猫的营业收入,商家通过支付此费用可以广告和定制其产品。

Currently, Alibaba charges Tmall merchants a fixed annual fee, which will cease to exist once the new policy takes effect on September 1.

目前,阿里巴巴向天猫商家收取固定的年度费用,而这个政策一旦于9月1日实行就不复存在。

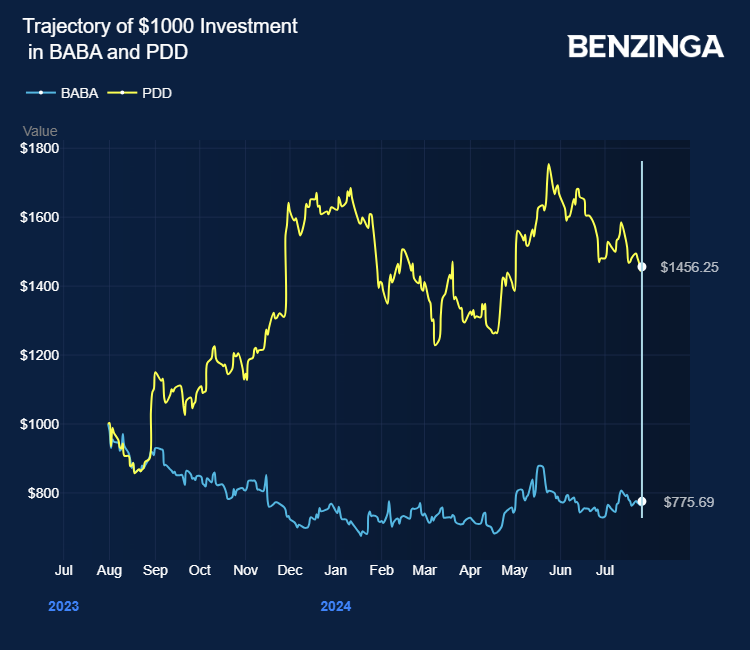

The shift to a percentage-based fee structure aligns Alibaba with other major e-commerce platforms, including PDD Holdings Inc (NASDAQ:PDD), JD.com Inc (NASDAQ:JD), and ByteDance.

转而采取基于百分比的计费方式,将阿里巴巴与其他主要的电子商务平台如PDD Holdings Inc(纳斯达克:PDD)、JD.com Inc(纳斯达克:JD)和字节跳动保持一致。

Alibaba stock lost over 25% as it battled intense domestic e-commerce rivalry in a weak economy. Investors can gain exposure to the stock through Avantis Emerging Markets Equity ETF (NYSE:AVEM) and Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ).

在竞争激烈的经济环境中,阿里巴巴的股票大幅下跌超过25%。投资者可以通过Avantis Emerging Markets Equity ETF(纽交所:AVEM)和Global X Artificial Intelligence & Technology ETF(纳斯达克:AIQ)获得该公司的曝光度。

Price Action: BABA shares traded higher by 3.06% at $78.87 premarket at the last check on Monday.

股市行情:截至上周一,BABA股票在盘前交易中上涨3.06%,报78.87美元。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:本内容部分使用人工智能工具生成,并经Benzinga编辑审核发布。

Photo courtesy Alibaba

照片提供:阿里巴巴。