What the Options Market Tells Us About Dell Technologies

What the Options Market Tells Us About Dell Technologies

Whales with a lot of money to spend have taken a noticeably bullish stance on Dell Technologies.

有大量资金的鲸鱼已经对戴尔科技持明显的看好态度。

Looking at options history for Dell Technologies (NYSE:DELL) we detected 9 trades.

查看戴尔科技(NYSE:DELL)期权历史记录后,我们发现了9次交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 22% with bearish.

如果我们考虑每个交易的细节,准确地说,44%的投资者持看好预期打开交易,而22%持看淡。

From the overall spotted trades, 5 are puts, for a total amount of $251,010 and 4, calls, for a total amount of $1,170,479.

在所有被发现的交易中,5个是看跌期权,总金额为$251,010,而4个是看涨期权,总金额为$1,170,479。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $140.0 for Dell Technologies over the last 3 months.

考虑到这些合约的成交量和未平仓合约数量,它看起来鲸鱼们一直在将戴尔科技的目标价锁定在$110.0到$140.0这一区间内,这种趋势持续了3个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

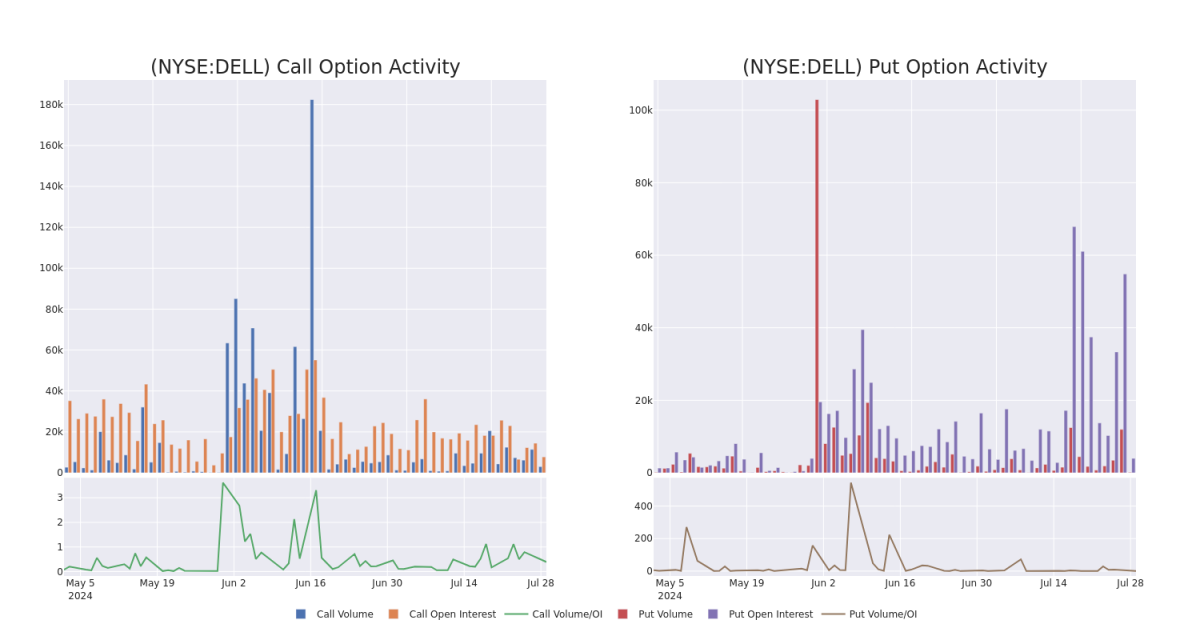

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Dell Technologies's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Dell Technologies's whale trades within a strike price range from $110.0 to $140.0 in the last 30 days.

在交易期权时,分析成交量和未平仓合约数量是关键。这些数据可以帮助您追踪给定执行价下戴尔科技期权的流动性和利率。下面,我们可以观察到在过去30天内,所有戴尔科技鲸鱼交易的看涨期权和看跌期权的成交量和未平仓合约的变化趋势。

Dell Technologies 30-Day Option Volume & Interest Snapshot

戴尔科技30天期权成交量&兴趣快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | TRADE | NEUTRAL | 09/20/24 | $10.2 | $9.6 | $9.85 | $115.00 | $985.0K | 3.2K | 1.0K |

| DELL | CALL | SWEEP | BULLISH | 08/02/24 | $0.9 | $0.85 | $0.9 | $120.00 | $99.0K | 3.0K | 1.2K |

| DELL | PUT | TRADE | BEARISH | 09/06/24 | $8.6 | $8.4 | $8.6 | $114.00 | $86.0K | 10 | 0 |

| DELL | PUT | TRADE | BULLISH | 12/20/24 | $31.7 | $30.5 | $30.8 | $140.00 | $64.6K | 163 | 21 |

| DELL | CALL | TRADE | BEARISH | 08/02/24 | $2.05 | $2.0 | $2.0 | $115.00 | $49.8K | 1.2K | 753 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | 看涨 | 交易 | 中立 | 09/20/24 | $10.2 | 9.6 | $9.85 | $115.00 | $985.0K | 3.2K | 1.0K |

| DELL | 看涨 | SWEEP | 看好 | 08/02/24 | $0.9 | $0.85 | $0.9 | $120.00 | $99.0千 | 3.0K | 1.2K |

| DELL | 看跌 | 交易 | 看淡 | 09/06/24 | $8.6美元 | $8.4 | $8.6美元 | $114.00 | $86.0K | 10 | 0 |

| DELL | 看跌 | 交易 | 看好 | 12/20/24 | $31.7 | $30.5 | $30.8 | $140.00 | $64.6K | 163 | 21 |

| DELL | 看涨 | 交易 | 看淡 | 08/02/24 | $2.05 | $2.0 | $2.0 | $115.00 | $49.8K | 1.2K | 753 |

About Dell Technologies

关于戴尔科技

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium personal computers and enterprise on-premises data center hardware. It holds top-three shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell is vertically integrated but has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

戴尔科技是一个广泛的信息技术供应商,主要为企业提供硬体。它专注于高端个人电脑和企业机房资讯应用硬体。它在个人电脑、外围显示器、主流服务器和外部存储器的核心市场中占据前三个份额。戴尔虽然垂直整合,但拥有强大的组件和装配伙伴生态系统,也严重依赖渠道伙伴来完成其销售。

Having examined the options trading patterns of Dell Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在检查戴尔科技的期权交易模式后,我们现在转向该公司,深入了解其当前的市场位置和表现。

Where Is Dell Technologies Standing Right Now?

Dell Technologies现在处于什么位置?

- With a trading volume of 475,253, the price of DELL is up by 0.95%, reaching $114.64.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 31 days from now.

- 戴尔科技的交易量为475,253股,涨幅为0.95%,达到$114.64。

- 当前RSI指标表明该股可能被超卖。

- 下一个财报发布日期距离现在31天。

What The Experts Say On Dell Technologies

关于戴尔科技的专家意见

1 market experts have recently issued ratings for this stock, with a consensus target price of $165.0.

1位市场专家最近对该股票发表了评级,并给出了$165.0的共识目标价。

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Dell Technologies, which currently sits at a price target of $165.

- 来自Evercore ISI Group的分析师已决定维持对戴尔科技的跑赢市场评级,当前的目标价为$165。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。