Behind the Scenes of DexCom's Latest Options Trends

Behind the Scenes of DexCom's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on DexCom.

有很多钱可以花的鲸鱼对DexCom采取了明显的看跌立场。

Looking at options history for DexCom (NASDAQ:DXCM) we detected 17 trades.

查看DexCom(纳斯达克股票代码:DXCM)的期权历史记录,我们发现了17笔交易。

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 47% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有41%的投资者以看涨的预期开盘,47%的投资者持看跌预期。

From the overall spotted trades, 9 are puts, for a total amount of $680,373 and 8, calls, for a total amount of $608,895.

在已发现的全部交易中,有9笔是看跌期权,总额为680,373美元,8笔看涨期权,总额为608,895美元。

Expected Price Movements

预期的价格走势

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $110.0 for DexCom over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将DexCom的价格范围从45.0美元扩大到110.0美元。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

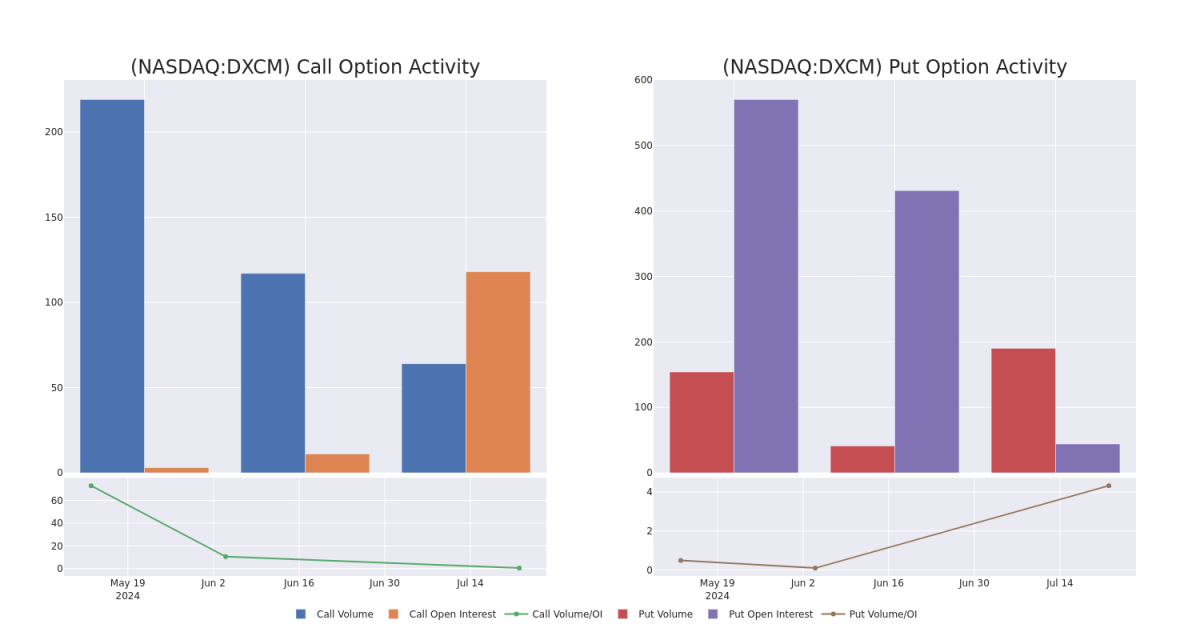

In terms of liquidity and interest, the mean open interest for DexCom options trades today is 694.29 with a total volume of 2,476.00.

就流动性和利息而言,今天德克斯康期权交易的平均未平仓合约为694.29,总交易量为2,476.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for DexCom's big money trades within a strike price range of $45.0 to $110.0 over the last 30 days.

在下图中,我们可以跟踪过去30天在45.0美元至110.0美元行使价区间内,DexCom大额资金交易的看涨期权和未平仓合约的发展情况。

DexCom Option Volume And Open Interest Over Last 30 Days

过去 30 天的 DexCom 期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DXCM | PUT | SWEEP | BULLISH | 06/20/25 | $12.2 | $11.8 | $12.2 | $70.00 | $245.2K | 32 | 201 |

| DXCM | PUT | TRADE | BEARISH | 06/20/25 | $2.8 | $1.8 | $2.7 | $45.00 | $189.0K | 63 | 700 |

| DXCM | CALL | TRADE | BEARISH | 09/20/24 | $19.5 | $16.6 | $17.5 | $50.00 | $105.0K | 7 | 120 |

| DXCM | CALL | SWEEP | BEARISH | 01/17/25 | $10.3 | $10.0 | $10.0 | $65.00 | $100.0K | 1.0K | 40 |

| DXCM | CALL | TRADE | BULLISH | 09/20/24 | $17.8 | $13.1 | $16.0 | $50.00 | $96.0K | 7 | 0 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DXCM | 放 | 扫 | 看涨 | 06/20/25 | 12.2 美元 | 11.8 美元 | 12.2 美元 | 70.00 美元 | 245.2 万美元 | 32 | 201 |

| DXCM | 放 | 贸易 | 粗鲁的 | 06/20/25 | 2.8 美元 | 1.8 美元 | 2.7 美元 | 45.00 美元 | 189.0 万美元 | 63 | 700 |

| DXCM | 打电话 | 贸易 | 粗鲁的 | 09/20/24 | 19.5 美元 | 16.6 美元 | 17.5 美元 | 50.00 美元 | 105.0 万美元 | 7 | 120 |

| DXCM | 打电话 | 扫 | 粗鲁的 | 01/17/25 | 10.3 美元 | 10.0 美元 | 10.0 美元 | 65.00 美元 | 10.0K | 1.0K | 40 |

| DXCM | 打电话 | 贸易 | 看涨 | 09/20/24 | 17.8 美元 | 13.1 美元 | 16.0 美元 | 50.00 美元 | 96.0 万美元 | 7 | 0 |

About DexCom

关于 DexCom

Dexcom designs and commercializes continuous glucose monitoring systems for diabetic patients. CGM systems serve as an alternative to the traditional blood glucose meter process, and the company is evolving its CGM systems to provide integration with insulin pumps from Insulet and Tandem for automatic insulin delivery.

Dexcom为糖尿病患者设计和商业化持续血糖监测系统。CGM系统是传统血糖仪流程的替代方案,该公司正在发展其CGM系统,以提供与Insulet和Tandem的胰岛素泵的集成,以实现胰岛素的自动输送。

Present Market Standing of DexCom

DexCom 目前的市场地位

- Trading volume stands at 6,824,913, with DXCM's price up by 7.0%, positioned at $68.48.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 87 days.

- 交易量为6,824,913美元,其中DXCM的价格上涨了7.0%,为68.48美元。

- RSI指标显示该股可能被超卖。

- 预计将在87天内公布财报。

What Analysts Are Saying About DexCom

分析师对德克斯康的看法

In the last month, 5 experts released ratings on this stock with an average target price of $104.0.

上个月,5位专家发布了该股的评级,平均目标价为104.0美元。

- An analyst from Canaccord Genuity has decided to maintain their Buy rating on DexCom, which currently sits at a price target of $145.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on DexCom with a target price of $120.

- In a cautious move, an analyst from JP Morgan downgraded its rating to Neutral, setting a price target of $75.

- An analyst from Stifel persists with their Buy rating on DexCom, maintaining a target price of $90.

- An analyst from Piper Sandler persists with their Overweight rating on DexCom, maintaining a target price of $90.

- Canaccord Genuity的一位分析师已决定维持对DexCom的买入评级,目前的目标股价为145美元。

- 摩根士丹利的一位分析师在评估中保持对DexCom的同等权重评级,目标价为120美元。

- 摩根大通的一位分析师谨慎地将其评级下调至中性,将目标股价定为75美元。

- Stifel的一位分析师坚持对DexCom的买入评级,将目标价维持在90美元。

- 派珀·桑德勒的一位分析师坚持对德克斯康的增持评级,维持90美元的目标价格。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。