Unpacking the Latest Options Trading Trends in Lam Research

Unpacking the Latest Options Trading Trends in Lam Research

Deep-pocketed investors have adopted a bullish approach towards Lam Research (NASDAQ:LRCX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LRCX usually suggests something big is about to happen.

财力雄厚的投资者对Lam Research(纳斯达克股票代码:LRCX)采取了看涨态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是LRCX的如此重大变动通常表明即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Lam Research. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Lam Research的14项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 12 are puts, totaling $788,230, and 2 are calls, amounting to $235,055.

这些重量级投资者的总体情绪存在分歧,50%的人倾向于看涨,50%的人看跌。在这些值得注意的期权中,有12个是看跌期权,总额为788,230美元,2个是看涨期权,总额为235,055美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $810.0 to $1180.0 for Lam Research during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注Lam Research在过去一个季度的价格范围从810.0美元到1180.0美元不等。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

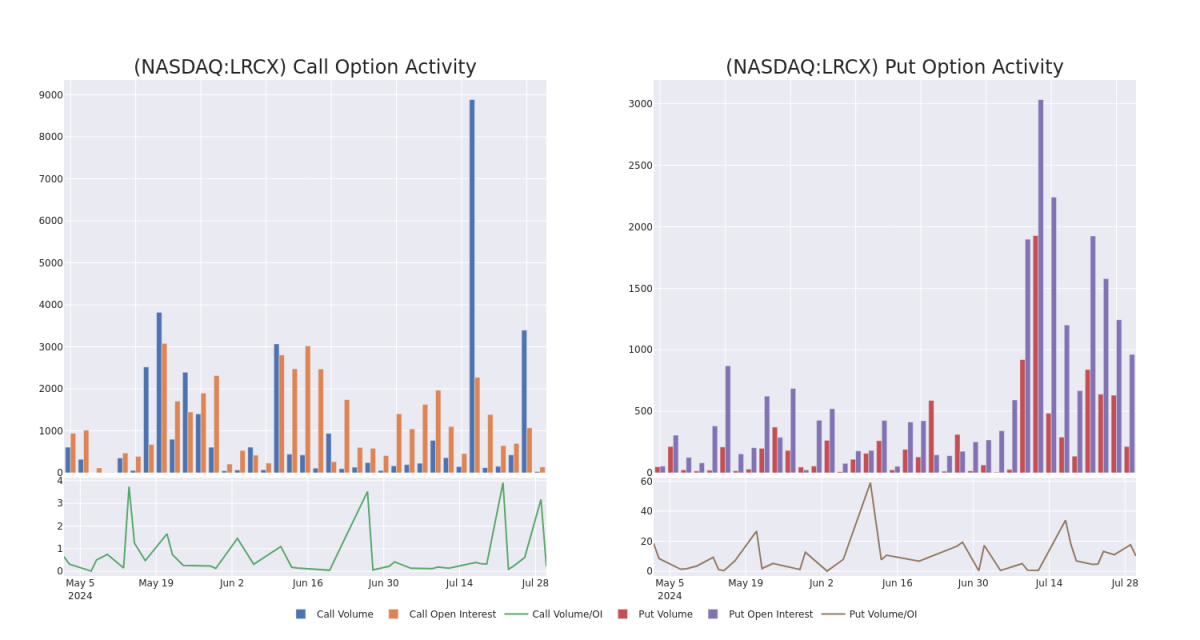

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lam Research's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lam Research's substantial trades, within a strike price spectrum from $810.0 to $1180.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了Lam Research期权在指定行使价下的流动性和投资者对他们的兴趣。即将发布的数据可视化了与Lam Research的大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从810.0美元到1180.0美元不等。

Lam Research Call and Put Volume: 30-Day Overview

Lam Research 看涨和看跌交易量:30 天概览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | CALL | TRADE | BEARISH | 09/20/24 | $70.6 | $68.95 | $68.95 | $880.00 | $199.9K | 68 | 30 |

| LRCX | PUT | TRADE | BULLISH | 09/20/24 | $48.2 | $47.7 | $47.7 | $880.00 | $162.1K | 95 | 4 |

| LRCX | PUT | TRADE | BULLISH | 09/20/24 | $47.95 | $47.25 | $47.25 | $880.00 | $113.4K | 95 | 62 |

| LRCX | PUT | SWEEP | BEARISH | 08/02/24 | $22.0 | $21.95 | $22.0 | $870.00 | $103.4K | 70 | 61 |

| LRCX | PUT | TRADE | BEARISH | 08/02/24 | $111.3 | $102.8 | $107.9 | $1000.00 | $64.7K | 81 | 6 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | 打电话 | 贸易 | 粗鲁的 | 09/20/24 | 70.6 美元 | 68.95 美元 | 68.95 美元 | 880.00 美元 | 199.9 万美元 | 68 | 30 |

| LRCX | 放 | 贸易 | 看涨 | 09/20/24 | 48.2 美元 | 47.7 美元 | 47.7 美元 | 880.00 美元 | 162.1 万美元 | 95 | 4 |

| LRCX | 放 | 贸易 | 看涨 | 09/20/24 | 47.95 美元 | 47.25 美元 | 47.25 美元 | 880.00 美元 | 113.4 万美元 | 95 | 62 |

| LRCX | 放 | 扫 | 粗鲁的 | 08/02/24 | 22.0 美元 | 21.95 美元 | 22.0 美元 | 870.00 美元 | 103.4 万美元 | 70 | 61 |

| LRCX | 放 | 贸易 | 粗鲁的 | 08/02/24 | 111.3 美元 | 102.8 美元 | 107.9 美元 | 1000.00 美元 | 64.7 万美元 | 81 | 6 |

About Lam Research

关于林氏研究

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Lam Research是世界上最大的半导体晶圆制造设备(WFE)制造商之一。它专门研究沉积和蚀刻的细分市场,这包括在半导体上积聚层,然后选择性地去除每层上的图案。林在蚀刻领域占有最大的市场份额,在沉积领域占有明显的第二份额。它更容易受到DRAM和NAND芯片的内存芯片制造商的影响。它将全球最大的芯片制造商视为顶级客户,包括台积电、三星、英特尔和美光。

Having examined the options trading patterns of Lam Research, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Lam Research的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Current Position of Lam Research

Lam Research的现状

- Currently trading with a volume of 164,457, the LRCX's price is down by -0.64%, now at $886.61.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 1 days.

- LRCX目前的交易量为164,457美元,价格下跌了-0.64%,目前为886.61美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计收益将在 1 天后发布。

What Analysts Are Saying About Lam Research

分析师对Lam Research的看法

In the last month, 1 experts released ratings on this stock with an average target price of $1200.0.

上个月,1位专家发布了该股的评级,平均目标价为1200.0美元。

- Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Neutral rating on Lam Research with a target price of $1200.

- 坎托·菲茨杰拉德的一位分析师在评估中保持对Lam Research的中性评级,目标价为1200美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。