Alibaba Rival Temu's Aggressive Model Shift Sparks Supplier Protests: Report

Alibaba Rival Temu's Aggressive Model Shift Sparks Supplier Protests: Report

Alibaba Group Holding (NYSE:BABA) and Amazon.Com Inc (NASDAQ:AMZN) rival online marketplace Temu faces backlash from suppliers in China over its aggressive effort to reshape its business model radically.

阿里巴巴集团控股(NYSE:baba n3411)和亚马逊公司(NASDAQ:AMZN)的竞争对手在线市场平台特木面临来自中国供应商的反感,这是因为它极力改变其商业模式。

The Chinese group, owned by the $177 billion e-commerce giant PDD Holdings Inc (NASDAQ:PDD), recently sought to recruit Amazon merchants with goods in warehouses in the U.S. and EU, the Financial Times reports.

这个中国集团,由1770亿美元的电子商务巨头PDD Holdings Inc(NASDAQ:PDD)拥有,最近试图招募在美国和欧盟仓库内有货物的亚马逊商家,据《金融时报》报道。

This move aims to protect Temu's business if governments close a tax loophole that has fueled its growth.

此举旨在保护特木的业务,以防政府关闭支撑其增长的税收漏洞。

Also Read: Alibaba Stock Soars As New Service Fees Boost Revenue

阅读更多:随着新的服务费推高营收,阿里巴巴股票飙升

It would also reduce delivery times by storing goods closer to shoppers, enabling Temu to sell bulkier and higher-margin products such as furniture and home appliances.

这也将通过将商品储存在离购物者更近的地方来缩短交货时间,使特木能够销售较庞大和利润较高的产品,如家具和家电股。

The pivot to suppliers with overseas warehouses marks a transition from a "fully managed" to a "semi-managed" model, where merchants take on shipping, warehousing, and last-mile delivery costs previously handled by Temu.

转向在海外拥有仓库的供应商,标志着从“完全管理”模式到“半管理”模式的转变,商家需要承担运费、仓储和末端交付成本,这些成本之前由特木承担。

Several Chinese suppliers in Guangzhou have expressed doubts about this change, citing increased risks.

广州的几家中国供应商对这种变化表示怀疑,称风险增加。

Dozens of suppliers have protested at Temu's offices in Guangzhou over the fines, with one showing evidence of 279 fines totaling 114 million Chinese yuan ($16 million).

数十家供应商在广州的特木办公室抗议罚款,其中一家公司出示了279个罚款证据,总计1.14亿人民币(1600万美元)。

To overcome this resistance, Temu promises to promote sellers by giving their products top slots on its platform if they sign up for the new model and offers a $3 subsidy per order for specific clothing items.

为了克服这种阻力,特木承诺通过在其平台上给予产品最高槽位来促进卖家达成订购新模式,并为特定服装产品每个订单提供3美元的补贴。

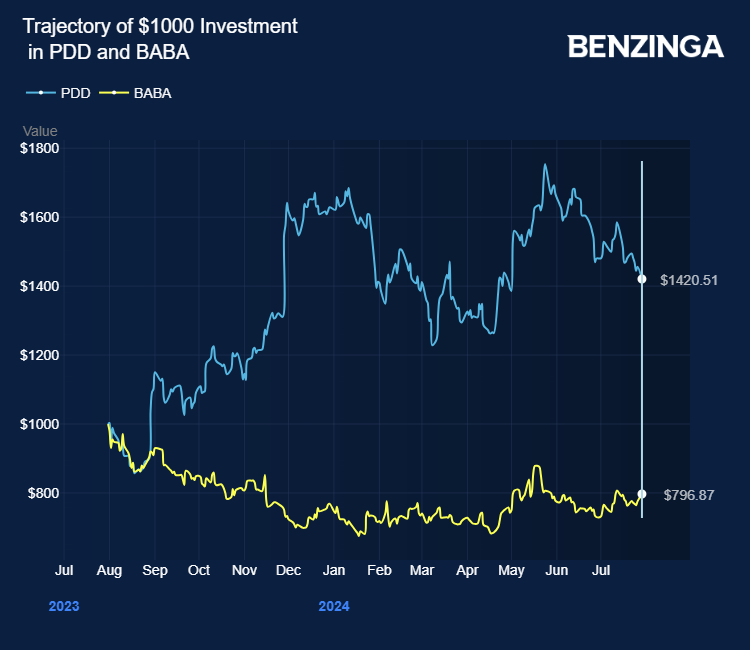

PDD Holdings stock gained over 42% in the last 12 months. Alibaba stock lost over 23%.

过去的12个月里,PDD Holdings股票上涨了逾42%,阿里巴巴股票下跌了逾23%。

Price Action: PDD shares traded lower by 1.68% at $125.45 at the last check on Tuesday.

价格行动:根据周二的最新数据,PDD股票以125.45美元的价格下跌了1.68%。

Also Read:

还阅读:

- Alibaba's Taobao Introduces Free Overseas Shipping to Compete with Rivals

- 阿里巴巴的淘宝推出免费海外运输以竞争对手

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:本内容部分使用人工智能工具生成,并经Benzinga编辑审核发布。

Photo via Shutterstock

图片来自shutterstock。