Affirm's Growth Boosted by Apple and Amazon Partnerships, Lower Interest Rates: Analyst

Affirm's Growth Boosted by Apple and Amazon Partnerships, Lower Interest Rates: Analyst

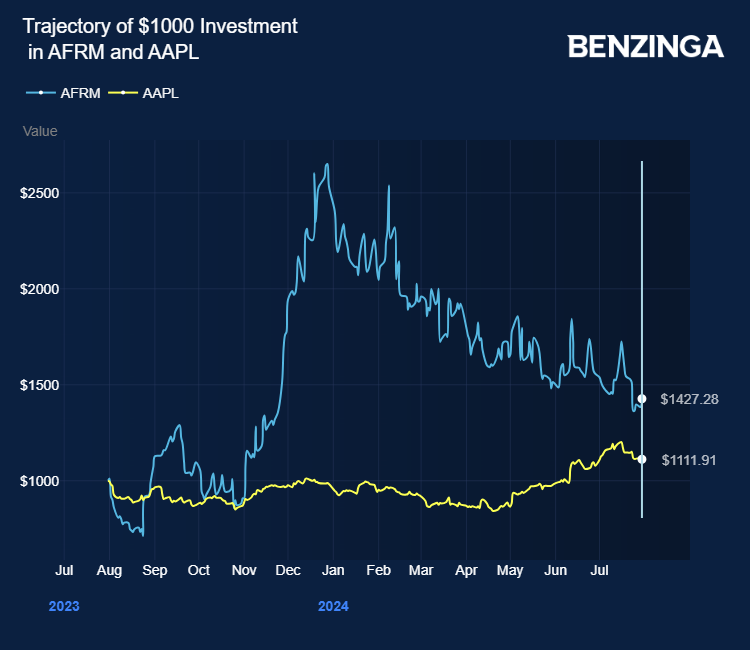

Affirm Holdings Inc (NASDAQ:AFRM) stock gained after B of A Securities analyst Jason Kupferberg upgraded the stock from Neutral to Buy with a price target of $36.

贝利商控(NASDAQ:AFRM)股票在美国银行证券(BofA Securities)分析师Jason Kupferberg将其评级从中立升级为买入,并设立36美元的目标价后走高。

Kupferberg noted GAAP profitability may be closer than expected by consensus.

Kupferberg指出,GAAP盈利可能会比共识预期更接近。

The analyst said the fourth-quarter print and guide could be a positive catalyst, and fiscal 2025 forecasts seem achievable.

该分析师表示,第四季度业绩与预测有望成为积极因素,并且2025财年的预测似乎是可以实现的。

Also Read: Affirm Faces Regulatory Shake-Up with New CFPB Rules

还需了解:Affirm面临新的CFPb规则调整。

A lower interest rate regime should also support RLTC (revenue minus transaction costs, the most crucial P&L metric), Kupferberg said, who is bullish on new and expanded partnerships, i.e., Apple Inc (NASDAQ:AAPL).

Kupferberg看好与苹果公司(NASDAQ:AAPL)等新伙伴和扩大合作伙伴关系后,RLTC(营收减去交易成本,最关键的收益与损失指标)将得到更低的利率环境支持。

Credit risk continues to be well-controlled, the analyst noted.

该分析师指出,信贷风险仍然得到了良好的控制。

At its November 2023 investor forum, Affirm Holdings detailed a medium-term profitability framework that Kupferberg noted as achievable given expense prudence year-to-date. In the context of this framework, Kupferberg said the Street is mis-modeling warrant expense and share-based compensation.

在其2023年11月的投资者论坛上,Affirm Holdings详细介绍了中期盈利能力框架,Kupferberg指出,鉴于今年的费用审慎,这是可以实现的。在这个框架的背景下,Kupferberg表示,市场对认股权凭证费用和股份奖励支出的建模存在误差。

As warrant expense and Stock-based compensation (SBC) expense grind lower, the analyst forecasted GAAP profitability to arrive in fiscal 2026 faster than consensus.

认股权凭证和股份奖励支出不断降低,该分析师预测,与共识相比,GAAP的盈利能在2026年财年更快地实现。

Kupferberg flagged the increasing market expectations of three rate cuts in 2024 and four in 2025. A lower interest rate environment would be beneficial to Affirm Holdings' funding costs and for gain on loan sales.

Kupferberg表示,市场预期2024年将进行三次利率削减,而2025年将进行四次。较低的利率环境将对Affirm Holdings的资金成本和贷款销售所获得的收益有益。

As per the analyst, Affirm Holdings recently moved its merchants to a 36% annual percentage rate (APR) cap on loans, up from 30% previously, which should remain a tailwind for yields and Gross Merchandise Value (GMV) growth.

根据该分析师的说法,Affirm Holdings最近将其商户的年利率上限从之前的30%提高到了36%,这将为收益率和商品总价值(GMV)的增长提供有利条件。

Given recent share price underperformance, Kupferberg noted the fourth-quarter print could be a positive catalyst.

鉴于最近股价表现不佳,Kupferberg指出,第四季度的业绩可能会成为积极因素。

Affirm Holdings may communicate a more bullish message on profitability while delivering fourth-quarter upside and guiding fiscal 2025 solidly in line, as per the analyst.

该分析师认为,在交付四季度业绩的同时,Affirm Holdings可能会对盈利能力传递更为看好的信息,并引导2025财年的业绩达到坚实的预期。

New Apple relationships, further scaling of Affirm Card, and potential geographic expansion of existing large partnerships like Amazon.Com Inc (NASDAQ:AMZN) and Shopify Inc (NYSE:SHOP) should all support fiscal 2025 and 2026 forecasts, Kupferberg added.

苹果公司(NASDAQ:AAPL)的新关系、Affirm Card的进一步扩展以及诸如亚马逊(NASDAQ:AMZN)和Shopify Inc(NYSE:SHOP)等现有大型合作伙伴的潜在地理扩张都将支持2025年和2026年的预测。

The analyst projected fiscal 2024 sales of $2.27 billion, fiscal 2025 sales of $2.75 billion and fiscal 2026 sales of $3.24 billion.

该分析师预计2024财年销售额为22.7亿美元,2025财年为27.5亿美元,2026财年为32.4亿美元。

Price Action: AFRM shares closed trading higher by 2.31% at $27.46 on Tuesday.

价格走势:周二,AFRm股价以2.31%的涨幅报收于27.46美元。

Photo via Company

照片来自公司