Top 3 Health Care Stocks That May Explode In Q3

Top 3 Health Care Stocks That May Explode In Q3

The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies. `

医疗保健板块中最超卖的股票提供了买入低估公司的机会。`

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

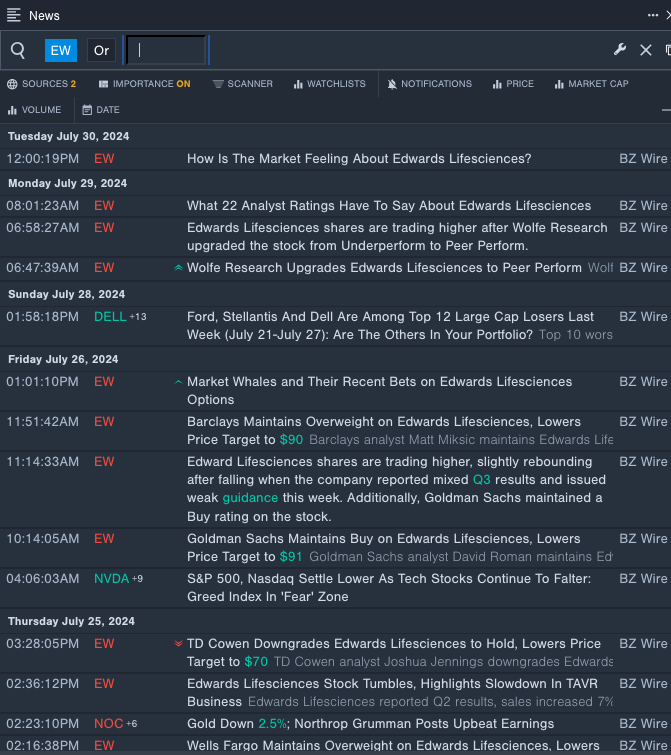

Edwards Lifesciences Corp (NYSE:EW)

爱德华生命科学公司(纽交所:EW)

- On July 24, Edwards Lifesciences reported worse-than-expected second-quarter sales results and issued third-quarter guidance below estimates. Also, the company acquired JenaValve and Endotronix. The company's stock fell around 27% over the past five days and has a 52-week low of $58.93 .

- RSI Value: 24.03

- EW Price Action: Shares of Edwards Lifesciences fell 0.2% to close at $63.64 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest EW news.

- 爱德华生命科学于7月24日公布了次季度营收低于预期及第三季度的预测指导不及预估。此外,公司还收购了JenaValve和Endotronix公司。公司的股票在过去5天下跌了近27%,并创下了52周内的最低价$ 58.93。

- RSI值:24.03

- EW股票行情:爱德华生命科学的股票在周二下跌了0.2%,收于$ 63.64。

- Benzinga Pro的实时新闻提醒了最新的爱德华生命科学资讯。

DexCom Inc (NASDAQ:DXCM)

DexCom Inc(纳斯达克:DXCM)

- On July 25, DexCom reported worse-than-expected second-quarter revenue results and issued weak revenue guidance. "While Dexcom advanced several key strategic initiatives in the second quarter, our execution did not meet our high standards," said Kevin Sayer, Dexcom's CEO. "We have a unique opportunity to serve millions of more customers around the world with our differentiated product portfolio and we are taking action to improve our execution and best position ourselves for continued long-term growth." The company's stock fell around 38% over the past five days. It has a 52-week low of $62.34.

- RSI Value: 20.25

- DXCM Price Action: Shares of DexCom gained 3.3% to close at $69.70 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in DXCM stock.

- 德康医疗于7月25日公布了次季度营收低于预期及弱势营收预测。德康医疗的首席执行官Kevin Sayer表示:「虽然德康在第二季度推进了几项关键战略举措,但我们的执行并未达到高标准。我们有独特的机会为全球数百万客户提供差异化的产品组合,并采取行动改善我们的执行,以最佳姿态继续实现长期增长。」公司的股票在过去5天下跌了近38%,并创下了52周内的最低价$ 62.34。

- RSI值:20.25

- DXCm股票行情:德康医疗的股票在周二上涨了3.3%,收于$ 69.70。

- Benzinga Pro的图表工具帮助识别DXCm股票的趋势。

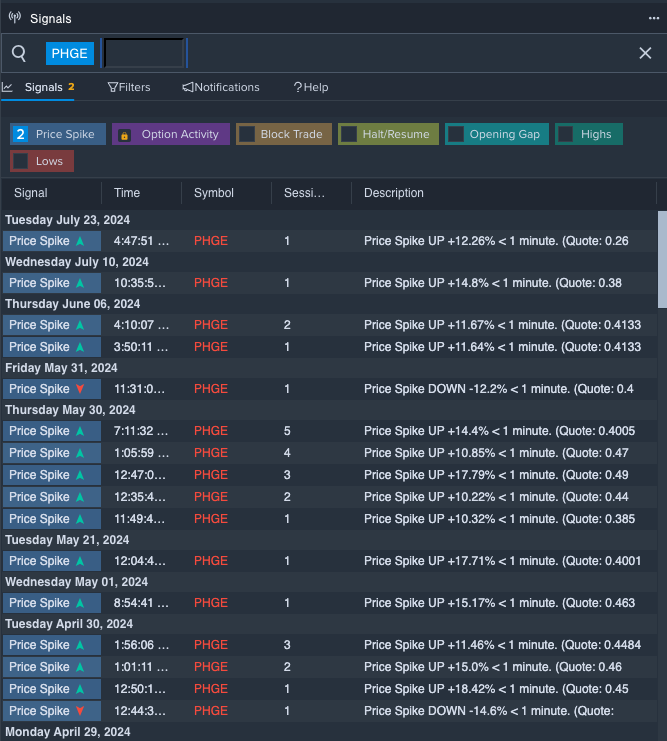

Biomx Inc (NYSE:PHGE)

biomx Inc(纽交所:PHGE)。

- On July 29, BiomX announced NYSE American acceptance of plan to regain listing compliance. The company's stock dipped around 43% over the past month and has a 52-week low of $0.19.

- RSI Value: 24.28

- PHGE Price Action: Shares of Biomx fell 8.5% to close at $0.19 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in Biomx shares.

- BiomX于7月29日宣布接受纽约证交所美国交易所的计划以恢复上市资格。该公司的股价在过去一个月内下跌了近43%,并创下了52周内的最低价$ 0.19。

- RSI值:24.28。

- PHGE股票行情:Biomx的股票在周二下跌了8.5%,收于$ 0.19。

- Benzinga Pro的信号功能通知了Biomx股票潜在突破的可能性。

Read More:

阅读更多:

- Nasdaq Tumbles As Microsoft, Nvidia And Other Tech Stocks Decline: Greed Index Moves To 'Fear' Zone

- 微软、英伟达和其他科技股下跌,纳斯达克指数下跌:贪婪指数降至“恐惧”区域