Unpacking the Latest Options Trading Trends in Wells Fargo

Unpacking the Latest Options Trading Trends in Wells Fargo

Whales with a lot of money to spend have taken a noticeably bearish stance on Wells Fargo.

大量资金的鲸鱼们对富国银行持看淡态度。

Looking at options history for Wells Fargo (NYSE:WFC) we detected 12 trades.

查看富国银行(纽交所:WFC)期权历史记录,我们检测到了12次交易。

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 50% with bearish.

若我们将每次交易的细节一一考虑,恰如其分地发现41%的投资者持有看涨期权,50%的投资者持有看跌期权。

From the overall spotted trades, 9 are puts, for a total amount of $351,182 and 3, calls, for a total amount of $147,352.

在所有标注的交易中,9次为看跌期权,总金额为351,182美元,3次为看涨期权,总金额为147,352美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $57.5 to $70.0 for Wells Fargo over the recent three months.

根据交易活动,重要投资者似乎瞄准富国银行在近三个月内的目标价区间为57.5到70.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

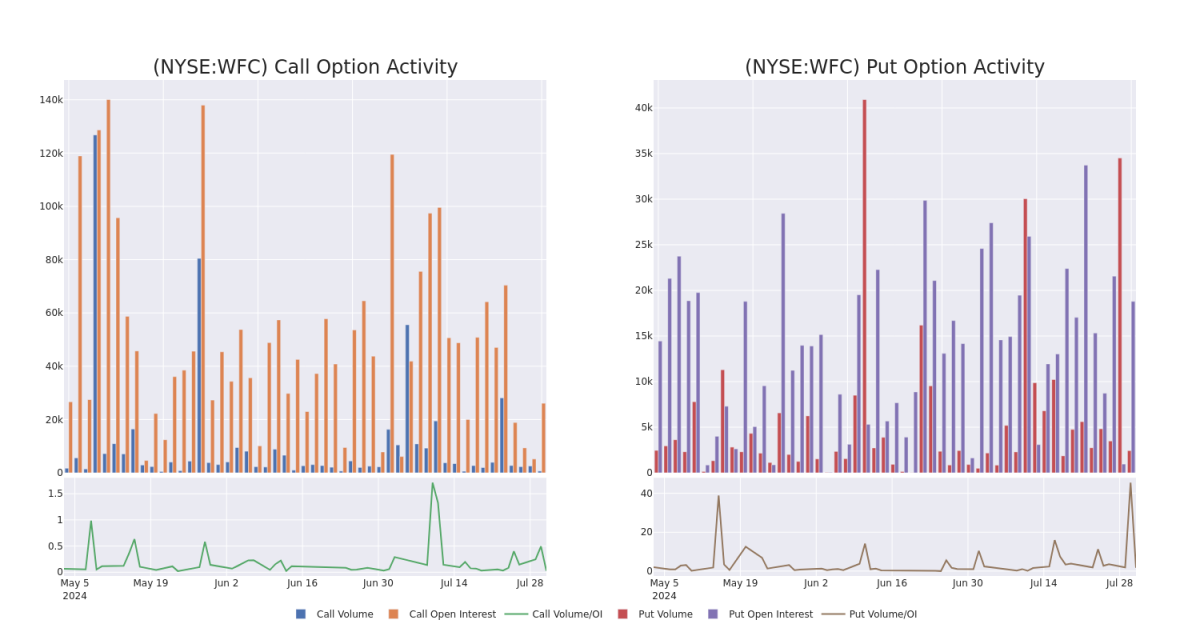

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Wells Fargo's options for a given strike price.

这些数据可以帮助您跟踪给定执行价格的富国银行期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wells Fargo's whale activity within a strike price range from $57.5 to $70.0 in the last 30 days.

下面,我们可以观察过去30天内,在57.5到70.0美元执行价格范围内,所有富国银行鲸鱼交易的看跌期权和看涨期权的成交量和未平仓利益的变化情况。

Wells Fargo 30-Day Option Volume & Interest Snapshot

富国银行30天期权成交量和利润快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | SWEEP | BULLISH | 01/17/25 | $1.24 | $1.03 | $1.24 | $70.00 | $62.2K | 11.9K | 500 |

| WFC | CALL | SWEEP | BEARISH | 12/20/24 | $5.4 | $5.3 | $5.3 | $57.50 | $58.3K | 2.0K | 1 |

| WFC | PUT | SWEEP | BULLISH | 10/18/24 | $4.0 | $3.85 | $3.85 | $62.50 | $47.3K | 3.2K | 246 |

| WFC | PUT | SWEEP | BEARISH | 10/18/24 | $5.9 | $5.8 | $5.86 | $65.00 | $45.1K | 1.2K | 231 |

| WFC | PUT | TRADE | BEARISH | 10/18/24 | $5.85 | $5.75 | $5.82 | $65.00 | $44.8K | 1.2K | 77 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 富国银行 | 看涨 | SWEEP | 看好 | 01/17/25 | $1.24 | $1.03 | $1.24 | 70.00美元 | $62.2K | 11.9K | 500 |

| 富国银行 | 看涨 | SWEEP | 看淡 | 12/20/24 | $5.4 | $5.3 | $5.3 | $57.50 | $58.3K | 2.0K | 1 |

| 富国银行 | 看跌 | SWEEP | 看好 | 10/18/24 | $4.0 | $3.85 | $3.85 | $62.50 | $47.3K | 3.2K | 246 |

| 富国银行 | 看跌 | SWEEP | 看淡 | 10/18/24 | $5.9 | $5.8 | 5.86美元 | $65.00 | $45.1K | 1.2K | 231 |

| 富国银行 | 看跌 | 交易 | 看淡 | 10/18/24 | $5.85 | $5.75 | $5.82 | $65.00 | $44.8千 | 1.2K | 77 |

About Wells Fargo

关于富国银行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富国银行是美国最大的银行之一,资产负债表资产约为1.9万亿美元。该公司有四个主要业务板块:消费银行、商业银行、公司和投资银行以及财富和投资管理。它几乎完全专注于美国市场。

Present Market Standing of Wells Fargo

富国银行现市场状况

- With a volume of 3,090,364, the price of WFC is down -0.02% at $59.99.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 72 days.

- 富国银行的成交量为3,090,364,价格下跌了0.02%,报59.99美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下一次收益预期将在72天内发布。

What The Experts Say On Wells Fargo

专家们对富国银行持什么看法?

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $63.8.

在过去的30天里,共有5位专业分析师对这只股票发表了评论,设定了平均目标价为63.8美元。

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Wells Fargo with a target price of $68.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Wells Fargo with a target price of $59.

- Maintaining their stance, an analyst from Keefe, Bruyette & Woods continues to hold a Market Perform rating for Wells Fargo, targeting a price of $61.

- An analyst from Jefferies persists with their Hold rating on Wells Fargo, maintaining a target price of $64.

- An analyst from Evercore ISI Group downgraded its action to Outperform with a price target of $67.

- 摩根士丹利的分析师一直持有富国银行的“增持”评级,目标价为68美元。

- BMO Capital的分析师一直认为Wells Fargo的市场表现为中性,目标价为59美元。

- Keefe、Bruyette & Woods的分析师保持Wells Fargo的市场表现评级,目标价为61美元。

- Jefferies的一位分析师坚持对Wells Fargo保持持有评级,目标价为64美元。

- Evercore ISI Group的分析师将其行动降级为“跑赢大盘”,目标价为67美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Wells Fargo with Benzinga Pro for real-time alerts.

交易期权具有更大的风险,但也具有更高的潜在利润。精明的交易者通过持续的教育、战略性的交易调整、利用各种指标和保持对市场动态的关注来减轻这些风险。通过Benzinga Pro实时警报随时了解富国银行的最新期权交易。

From the overall spotted trades, 9 are puts, for a total amount of $351,182 and 3, calls, for a total amount of $147,352.

From the overall spotted trades, 9 are puts, for a total amount of $351,182 and 3, calls, for a total amount of $147,352.