Check Out What Whales Are Doing With CRM

Check Out What Whales Are Doing With CRM

Whales with a lot of money to spend have taken a noticeably bullish stance on Salesforce.

有大量资金可以花的鲸鱼对Salesforce采取了明显的看涨立场。

Looking at options history for Salesforce (NYSE:CRM) we detected 30 trades.

查看Salesforce(纽约证券交易所代码:CRM)的期权历史记录,我们发现了30笔交易。

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 33% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有56%的投资者以看涨的预期开盘,33%的投资者持看跌预期。

From the overall spotted trades, 16 are puts, for a total amount of $867,792 and 14, calls, for a total amount of $1,254,075.

在所有已发现的交易中,有16笔是看跌期权,总额为867,792美元,14笔是看涨期权,总额为1,254,075美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $300.0 for Salesforce over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将Salesforce的价格定在100.0美元至300.0美元之间。

Volume & Open Interest Trends

交易量和未平仓合约趋势

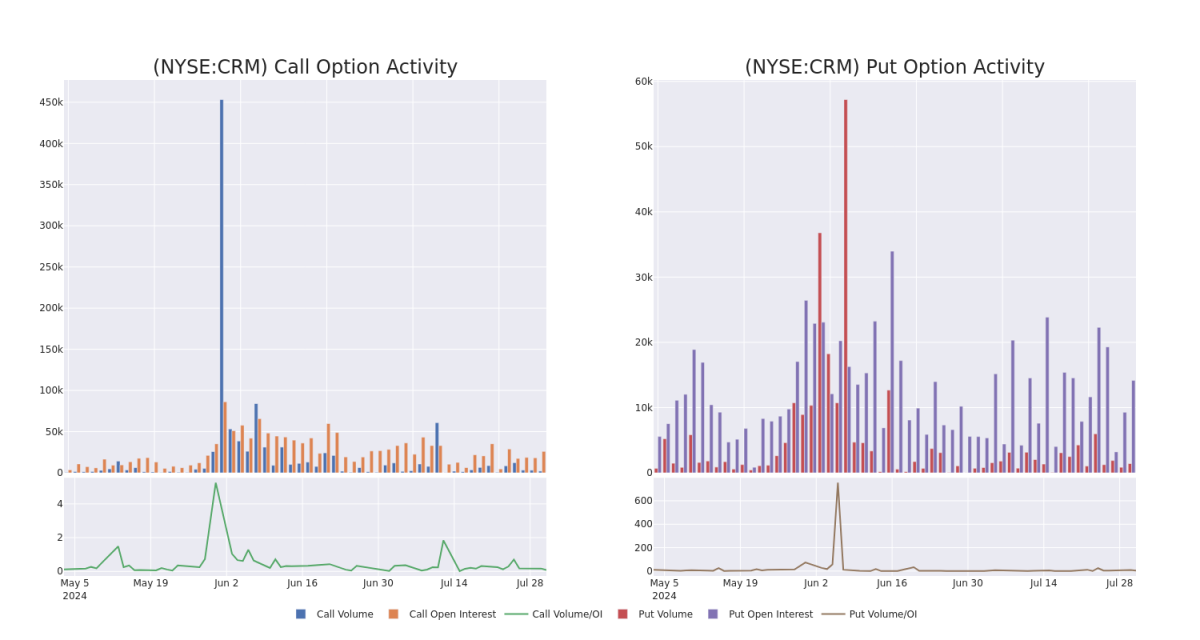

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Salesforce's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Salesforce's significant trades, within a strike price range of $100.0 to $300.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量Salesforce期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月Salesforce在行使价区间内进行看涨期权和看跌期权交易的交易量和未平仓合约的趋势,行使价在100.0美元至300.0美元之间。

Salesforce Option Volume And Open Interest Over Last 30 Days

过去 30 天的 Salesforce 期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | TRADE | BEARISH | 09/20/24 | $11.05 | $10.8 | $10.9 | $270.00 | $327.0K | 3.6K | 304 |

| CRM | CALL | SWEEP | NEUTRAL | 08/16/24 | $0.89 | $0.8 | $0.85 | $280.00 | $219.2K | 3.0K | 271 |

| CRM | CALL | SWEEP | BULLISH | 08/16/24 | $3.95 | $3.9 | $3.95 | $265.00 | $189.2K | 986 | 157 |

| CRM | PUT | SWEEP | BULLISH | 01/16/26 | $58.65 | $58.0 | $58.0 | $300.00 | $133.4K | 1.5K | 36 |

| CRM | PUT | SWEEP | BEARISH | 10/18/24 | $15.1 | $14.9 | $15.1 | $260.00 | $128.3K | 1.1K | 85 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | 打电话 | 贸易 | 粗鲁的 | 09/20/24 | 11.05 美元 | 10.8 美元 | 10.9 美元 | 270.00 美元 | 327.0 万美元 | 3.6K | 304 |

| CRM | 打电话 | 扫 | 中立 | 08/16/24 | 0.89 美元 | 0.8 美元 | 0.85 美元 | 280.00 美元 | 219.2 万美元 | 3.0K | 271 |

| CRM | 打电话 | 扫 | 看涨 | 08/16/24 | 3.95 美元 | 3.9 美元 | 3.95 美元 | 265.00 美元 | 189.2 万美元 | 986 | 157 |

| CRM | 放 | 扫 | 看涨 | 01/16/26 | 58.65 美元 | 58.0 美元 | 58.0 美元 | 300.00 美元 | 133.4 万美元 | 1.5K | 36 |

| CRM | 放 | 扫 | 粗鲁的 | 10/18/24 | 15.1 美元 | 14.9 美元 | 15.1 美元 | 260.00 美元 | 128.3 万美元 | 1.1K | 85 |

About Salesforce

Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

Salesforce 提供企业云计算解决方案。该公司提供客户关系管理技术,将公司和客户联系在一起。其Customer 360平台帮助该集团提供单一事实来源,连接系统、应用程序和设备上的客户数据,以帮助公司进行销售、服务、营销和开展商务。它还提供用于客户支持的服务云,用于数字营销活动的营销云,作为电子商务引擎的商务云,允许企业构建应用程序的Salesforce平台以及其他解决方案,例如用于数据集成的MuleSoft。

Following our analysis of the options activities associated with Salesforce, we pivot to a closer look at the company's own performance.

在分析了与Salesforce相关的期权活动之后,我们开始仔细研究公司自身的业绩。

Current Position of Salesforce

Salesforce 的当前位置

- Currently trading with a volume of 2,588,764, the CRM's price is down by -1.68%, now at $253.59.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 28 days.

- 该CRM目前的交易量为2588,764美元,价格下跌了-1.68%,目前为253.59美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计收益将在28天后发布。

What The Experts Say On Salesforce

专家对Salesforce的看法

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $250.0.

在过去的一个月中,1位行业分析师分享了他们对该股的见解,提出平均目标价为250.0美元。

- An analyst from Piper Sandler persists with their Neutral rating on Salesforce, maintaining a target price of $250.

- 派珀·桑德勒的一位分析师坚持对Salesforce的中性评级,维持250美元的目标价格。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Salesforce with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解Salesforce的最新期权交易情况,获取实时提醒。