Behind the Scenes of ServiceNow's Latest Options Trends

Behind the Scenes of ServiceNow's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on ServiceNow.

有很多钱可以花的鲸鱼对ServiceNow采取了明显的看跌立场。

Looking at options history for ServiceNow (NYSE:NOW) we detected 36 trades.

查看ServiceNow(纽约证券交易所代码:NOW)的期权历史记录,我们发现了36笔交易。

If we consider the specifics of each trade, it is accurate to state that 27% of the investors opened trades with bullish expectations and 47% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有27%的投资者以看涨的预期开盘,47%的投资者持看跌预期。

From the overall spotted trades, 9 are puts, for a total amount of $1,125,721 and 27, calls, for a total amount of $1,642,293.

在已发现的全部交易中,有9笔是看跌期权,总额为1,125,721美元;27笔看涨期权,总额为1,642,293美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $747.5 to $1000.0 for ServiceNow during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注ServiceNow在过去一个季度的价格范围从747.5美元到1000美元不等。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

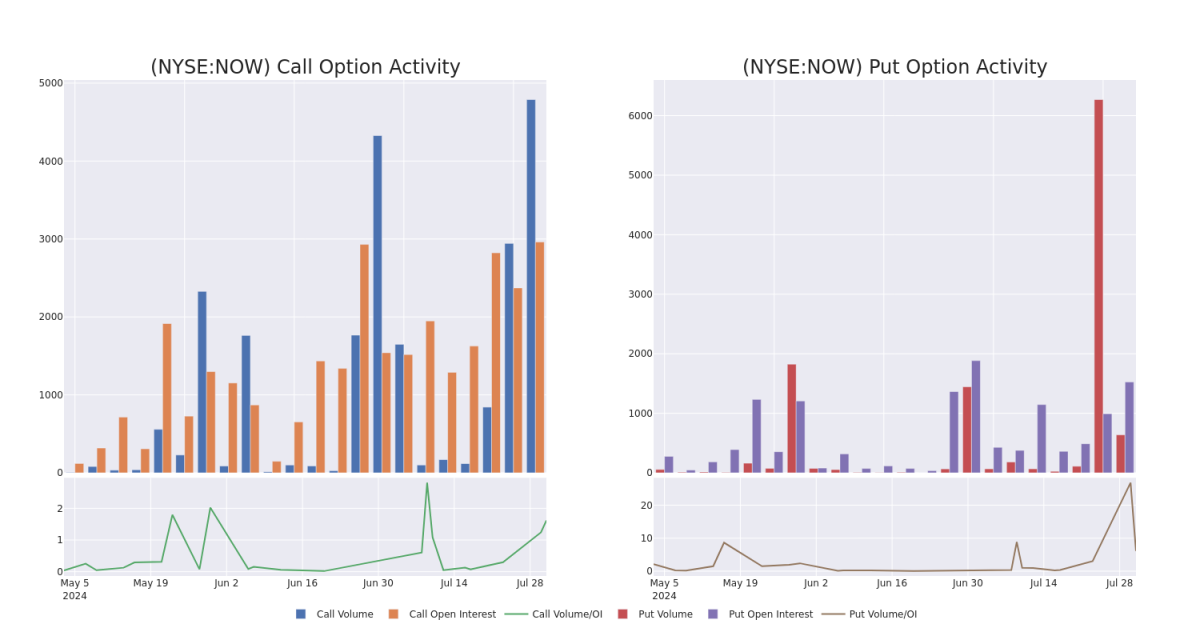

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ServiceNow's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ServiceNow's significant trades, within a strike price range of $747.5 to $1000.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量ServiceNow期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月ServiceNow重大交易的看涨期权和未平仓合约的趋势,行使价区间为747.5美元至1000美元。

ServiceNow Option Activity Analysis: Last 30 Days

ServiceNow 期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | PUT | SWEEP | NEUTRAL | 01/17/25 | $58.2 | $57.5 | $57.85 | $800.00 | $519.7K | 187 | 95 |

| NOW | CALL | SWEEP | BEARISH | 01/16/26 | $122.3 | $120.8 | $121.55 | $900.00 | $363.1K | 54 | 40 |

| NOW | PUT | SWEEP | BULLISH | 01/16/26 | $80.6 | $77.6 | $79.1 | $750.00 | $237.4K | 48 | 30 |

| NOW | CALL | SWEEP | NEUTRAL | 01/16/26 | $123.0 | $121.3 | $121.35 | $900.00 | $133.5K | 54 | 61 |

| NOW | CALL | SWEEP | BULLISH | 09/20/24 | $19.2 | $18.5 | $19.2 | $860.00 | $128.6K | 129 | 71 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 现在 | 放 | 扫 | 中立 | 01/17/25 | 58.2 美元 | 57.5 美元 | 57.85 美元 | 800.00 美元 | 519.7 万美元 | 187 | 95 |

| 现在 | 打电话 | 扫 | 粗鲁的 | 01/16/26 | 122.3 美元 | 120.8 美元 | 121.55 美元 | 900.00 美元 | 363.1 万美元 | 54 | 40 |

| 现在 | 放 | 扫 | 看涨 | 01/16/26 | 80.6 美元 | 77.6 美元 | 79.1 美元 | 750.00 美元 | 237.4 万美元 | 48 | 30 |

| 现在 | 打电话 | 扫 | 中立 | 01/16/26 | 123.0 美元 | 121.3 美元 | 121.35 美元 | 900.00 美元 | 133.5 万美元 | 54 | 61 |

| 现在 | 打电话 | 扫 | 看涨 | 09/20/24 | 19.2 美元 | 18.5 美元 | 19.2 美元 | 860.00 美元 | 128.6 万美元 | 129 | 71 |

About ServiceNow

关于 ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

ServiceNow Inc提供软件解决方案,通过SaaS交付模式构建和自动化各种业务流程。该公司主要专注于为企业客户提供IT职能。ServiceNow从IT服务管理开始,扩展到IT职能部门,最近将其工作流程自动化逻辑引向了IT以外的职能领域,尤其是客户服务、人力资源服务交付和安全运营。ServiceNow 还提供应用程序开发平台即服务。

Present Market Standing of ServiceNow

ServiceNow 目前的市场地位

- Trading volume stands at 705,430, with NOW's price up by 2.33%, positioned at $817.4.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 84 days.

- 交易量为705,430美元,NOW的价格上涨了2.33%,为817.4美元。

- RSI指标显示该股可能接近超买。

- 预计将在84天内公布财报。

What Analysts Are Saying About ServiceNow

分析师对ServiceNow的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $876.0.

5位市场专家最近发布了该股的评级,共识目标价为876.0美元。

- Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for ServiceNow, targeting a price of $850.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for ServiceNow, targeting a price of $900.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on ServiceNow with a target price of $850.

- An analyst from Baird has decided to maintain their Outperform rating on ServiceNow, which currently sits at a price target of $900.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on ServiceNow with a target price of $880.

- JMP Securities的一位分析师坚持其立场,继续维持ServiceNow的市场跑赢大盘评级,目标价格为850美元。

- Stifel的一位分析师保持立场,继续维持ServiceNow的买入评级,目标价格为900美元。

- 派珀·桑德勒的一位分析师在评估中保持对ServiceNow的增持评级,目标价为850美元。

- 贝尔德的一位分析师已决定维持对ServiceNow的跑赢大盘评级,该评级目前的目标股价为900美元。

- 加拿大皇家银行资本的一位分析师在评估中保持ServiceNow的跑赢大盘评级,目标价为880美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ServiceNow options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的ServiceNow期权交易。