Market Whales and Their Recent Bets on EQIX Options

Market Whales and Their Recent Bets on EQIX Options

Financial giants have made a conspicuous bearish move on Equinix. Our analysis of options history for Equinix (NASDAQ:EQIX) revealed 9 unusual trades.

金融巨头对Equinix做出了明显的看淡举动。我们对Equinix(纳斯达克)的期权历史进行分析发现有9次非正常交易。

Delving into the details, we found 22% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $1,048,310, and 2 were calls, valued at $78,543.

具体来说,我们发现22%的交易者看好,而66%的交易者偏向看淡。在我们发现的所有交易中,有7种看跌期权,价值为1048310美元,有2种看涨期权,价值78543美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $730.0 and $820.0 for Equinix, spanning the last three months.

在评估交易量和未平仓合约后,Equinix的主要市场搬运工正在关注Equinix价格区间为730.0至820.0美元,涵盖了过去三个月。

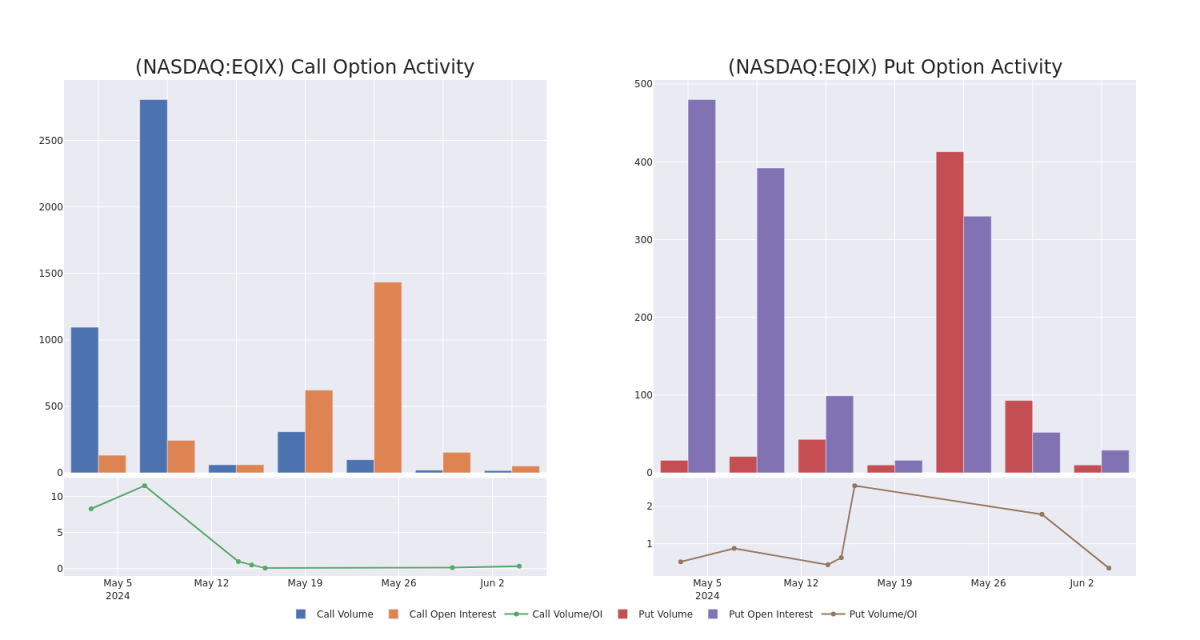

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Equinix's options for a given strike price.

这些数据可以帮助您跟踪Equinix某个行权价格的期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Equinix's whale activity within a strike price range from $730.0 to $820.0 in the last 30 days.

下面我们可以观察Equinix所有鲸鱼活动的看涨期权和看跌期权的成交量和未平仓合约的演变,分别在730.0美元至820.0美元的行权价格范围内,时间跨度为过去30天。

Equinix Option Volume And Open Interest Over Last 30 Days

Equinix过去30天的期权成交量和未平仓合约

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQIX | PUT | TRADE | NEUTRAL | 12/19/25 | $66.0 | $56.2 | $60.51 | $730.00 | $508.2K | 0 | 32 |

| EQIX | PUT | TRADE | BEARISH | 01/17/25 | $74.0 | $71.6 | $74.0 | $820.00 | $288.6K | 46 | 40 |

| EQIX | PUT | SWEEP | BEARISH | 12/19/25 | $66.0 | $56.2 | $60.7 | $730.00 | $121.2K | 0 | 30 |

| EQIX | CALL | SWEEP | BULLISH | 09/20/24 | $25.3 | $24.3 | $25.3 | $820.00 | $50.6K | 35 | 31 |

| EQIX | PUT | TRADE | BEARISH | 08/16/24 | $21.5 | $19.9 | $21.2 | $780.00 | $40.2K | 14 | 29 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQIX | 看跌 | 交易 | 中立 | 2025年12月19日 | $66.0 | $56.2 | $60.51 | 730.00美元 | $508.2K | 0 | 32 |

| EQIX | 看跌 | 交易 | 看淡 | 01/17/25 | $74.0 | $71.6 | $74.0 | $820.00 | $288.6K | 46 | 40 |

| EQIX | 看跌 | SWEEP | 看淡 | 2025年12月19日 | $66.0 | $56.2 | $60.7 | 730.00美元 | $121.2K | 0 | 30 |

| EQIX | 看涨 | SWEEP | 看好 | 09/20/24 | $25.3 | $24.3 | $25.3 | $820.00 | $50.6K | 35 | 31 |

| EQIX | 看跌 | 交易 | 看淡 | 08/16/24 | 21.5美元 | $19.9 | $21.2 | $780.00 | $40.2K | 14 | 29 |

About Equinix

关于Equinix

Equinix operates 260 data centers in 71 markets worldwide. It generates 44% of total revenue in the Americas, 35% in Europe, the Middle East, and Africa, and 21% in Asia-Pacific. The firm has more than 10,000 customers, including 2,100 network providers, that are dispersed over five verticals: cloud and IT services, content providers, network and mobile services, financial services, and enterprise. About 70% of Equinix's revenue comes from renting space to tenants and related services, and more than 15% comes from interconnection. Equinix operates as a real estate investment trust.

Equinix在全球71个市场中运营260个数据中心。其营业收入的44%来自美洲,35%来自欧洲、中东和非洲,21%来自亚太地区。该公司拥有超过10,000个客户,包括2,100个网络提供商,分布在五个垂直领域:云和IT服务、内容提供商、网络和移动服务、金融服务和企业。约70%的Equinix营收来自租赁给租户的空间和相关服务,超过15%的营收来自互连。Equinix作为房地产投资信托公司运营。

Following our analysis of the options activities associated with Equinix, we pivot to a closer look at the company's own performance.

在我们对Equinix的期权交易活动进行分析后,我们转向更仔细地观察该公司自身的表现。

Present Market Standing of Equinix

Equinix的当前市场地位

- Trading volume stands at 395,400, with EQIX's price up by 3.66%, positioned at $796.93.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 7 days.

- 交易量为395,400股,EQIX的价格上涨3.66%,位于796.93美元。

- RSI指标显示该股票可能接近超买。

- 7天内预计发布收益公告。

Expert Opinions on Equinix

关于Equinix的专家意见

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $874.0.

过去30天有2位专业分析师对该股票发表了看法,平均目标价格为874美元。

- In a cautious move, an analyst from Mizuho downgraded its rating to Outperform, setting a price target of $873.

- In a positive move, an analyst from Wells Fargo has upgraded their rating to Overweight and adjusted the price target to $875.

- 谨慎起见,来自瑞穗证券的分析师将其评级下调为跑赢大盘,目标价为873美元。

- 来自富国银行的分析师积极看待此股并将其评级升至增持,并将目标价调整至875美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.