Companies Like Kura Sushi USA (NASDAQ:KRUS) Are In A Position To Invest In Growth

Companies Like Kura Sushi USA (NASDAQ:KRUS) Are In A Position To Invest In Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

仅因企业不盈利并不意味着股票会下跌。例如,生物科技和采矿勘探公司经常在发现新治疗方法或矿物质之前多年亏损。然而,只有愚不可及之人才会忽视一家输钱的公司很快就会耗尽其资金的风险。

So, the natural question for Kura Sushi USA (NASDAQ:KRUS) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

因此,Kura Sushi USA(纳斯达克股票代码:KRUS)的股东们自然会问是否应该担心其现金流量状况。在本文中,我们将负自由现金流定义为其年度(负)自由现金流,即公司每年用于资助其增长的资金。我们将首先将其现金流与其现金储备进行比较,以计算其现金运行时间。

When Might Kura Sushi USA Run Out Of Money?

Kura Sushi USA 什么时侯耗尽所有现金?

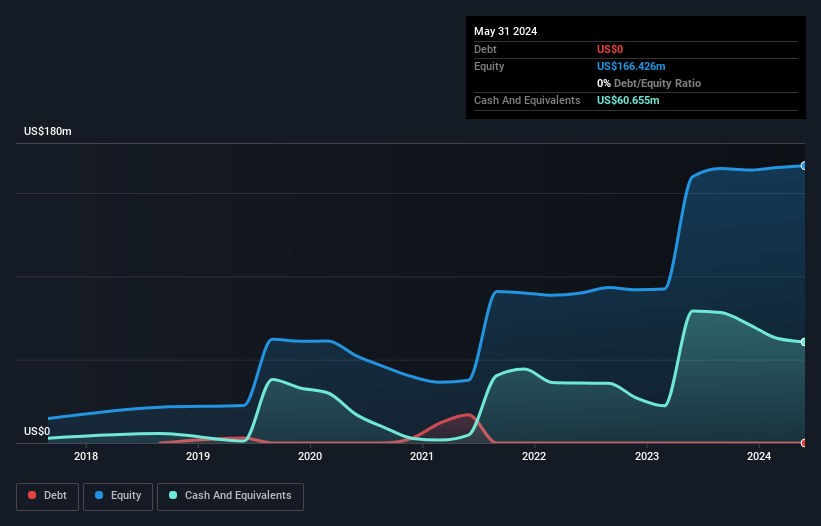

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Kura Sushi USA last reported its May 2024 balance sheet in July 2024, it had zero debt and cash worth US$61m. Importantly, its cash burn was US$21m over the trailing twelve months. So it had a cash runway of about 2.9 years from May 2024. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

现金运营时间被定义为:如果公司按其当前的现金流烧钱速度继续支出资金,其将耗尽资金所需的时间。当Kura Sushi USA于2024年5月公布其2024年5月财报表时,其债务为零,现金价值为6100万美元。重要的是,其过去12个月的现金流为2100万美元。这意味着从2024年5月开始,其现金运行时间约为2.9年。可以说这是一个谨慎而明智的衡量时间长度。下面的图片展示了它的现金余额在过去几年中的变化。

How Well Is Kura Sushi USA Growing?

Kura Sushi USA 的业务增长情况如何?

Kura Sushi USA reduced its cash burn by 4.1% during the last year, which points to some degree of discipline. And considering that its operating revenue gained 30% during that period, that's great to see. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Kura Sushi USA 在过去一年中将其自由现金流降低了4.1%,这表明其存在一定程度的纪律。考虑到其营业收入在该阶段增长了30%,这是一个好的迹象。总的来说,我们认为公司正在不断改善。然而,关键因素显然在于公司是否会在未来扩展其业务。出于这个原因,检查分析师对公司的预测非常有意义。

How Hard Would It Be For Kura Sushi USA To Raise More Cash For Growth?

Kura Sushi USA 接下来该如何为增长筹集资金?

There's no doubt Kura Sushi USA seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

当涉及管理现金流烧钱问题时,毫无疑问,Kura Sushi USA 似乎处于相当良好的位置,但即使它只是虚构的,了解它是否能轻松筹集更多资金来资助其增长也是值得的。企业可以通过发放债务或股票来筹集资本。许多公司最终会发行新股票来资助未来的成长。我们可以将公司的现金流与其市值进行比较,以了解公司需要发行多少新股来筹集一年的运营资金。

Since it has a market capitalisation of US$646m, Kura Sushi USA's US$21m in cash burn equates to about 3.2% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

由于Kura Sushi USA 的市值为64600万美元,其为期一年的2100万美元现金流烧损约占其市值的3.2%。鉴于这只占很小的比例,该公司可能轻松向投资者发行一些新股票,甚至可以通过贷款来资助另外一年的增长。

So, Should We Worry About Kura Sushi USA's Cash Burn?

那么,我们应该担心 Kura Sushi USA 的现金流状况吗?

It may already be apparent to you that we're relatively comfortable with the way Kura Sushi USA is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. On this analysis its cash burn reduction was its weakest feature, but we are not concerned about it. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking an in-depth view of risks, we've identified 2 warning signs for Kura Sushi USA that you should be aware of before investing.

可能你已经意识到了,我们相对于 Kura Sushi USA 的现金流状况感到相对轻松。特别是我们认为其现金运行时间是证明其在控制支出方面表现良好。在这个分析中,其现金流降低是其最弱的环节,但我们对此并不担心。考虑到这个报告中提到的各种指标后,我们对公司的现金支出方式感到相当舒适,因为它似乎在中期内坚定地实现其需求。在深入了解风险的情况下,我们确定了 Kura Sushi USA 的两个警告信号,你在投资之前应该知道。

Of course Kura Sushi USA may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

当然,Kura Sushi USA 可能不是最好的股票选择。因此,你可能希望查看这个盈利能力高的公司的免费集合,或者这个拥有高内部所有权的股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

Kura Sushi USA reduced its cash burn by 4.1% during the last year, which points to some degree of discipline. And considering that its operating revenue gained 30% during that period, that's great to see. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Kura Sushi USA reduced its cash burn by 4.1% during the last year, which points to some degree of discipline. And considering that its operating revenue gained 30% during that period, that's great to see. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.