Market Whales and Their Recent Bets on ANF Options

Market Whales and Their Recent Bets on ANF Options

Deep-pocketed investors have adopted a bullish approach towards Abercrombie & Fitch (NYSE:ANF), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ANF usually suggests something big is about to happen.

有深厚资金的投资者对阿伯克龙比&菲奇(纽交所:ANF)采取了看好的方式,这是市场参与者不能忽视的。我们在Benzinga对公开期权记录的追踪今天揭示了这次重大举动。这些投资者的身份尚不清楚,但是ANF发生如此重大的变化通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Abercrombie & Fitch. This level of activity is out of the ordinary.

我们从今天 Benzinga 的期权扫描仪中发现, Abercrombie & Fitch 有 8 笔非同寻常的期权活动。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 25% bearish. Among these notable options, 3 are puts, totaling $162,169, and 5 are calls, amounting to $168,650.

这些重量级投资者的总体情绪分化,50%看好和25%看淡。其中有3个看跌期权,总额为162169美元,另外5个是看涨期权,总额为168650美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $185.0 for Abercrombie & Fitch, spanning the last three months.

在评估交易量和未平仓量之后,显然主要市场运动者正在关注阿伯克龙比&菲奇150.0美元至185.0美元之间的价格区间,跨度为最近三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

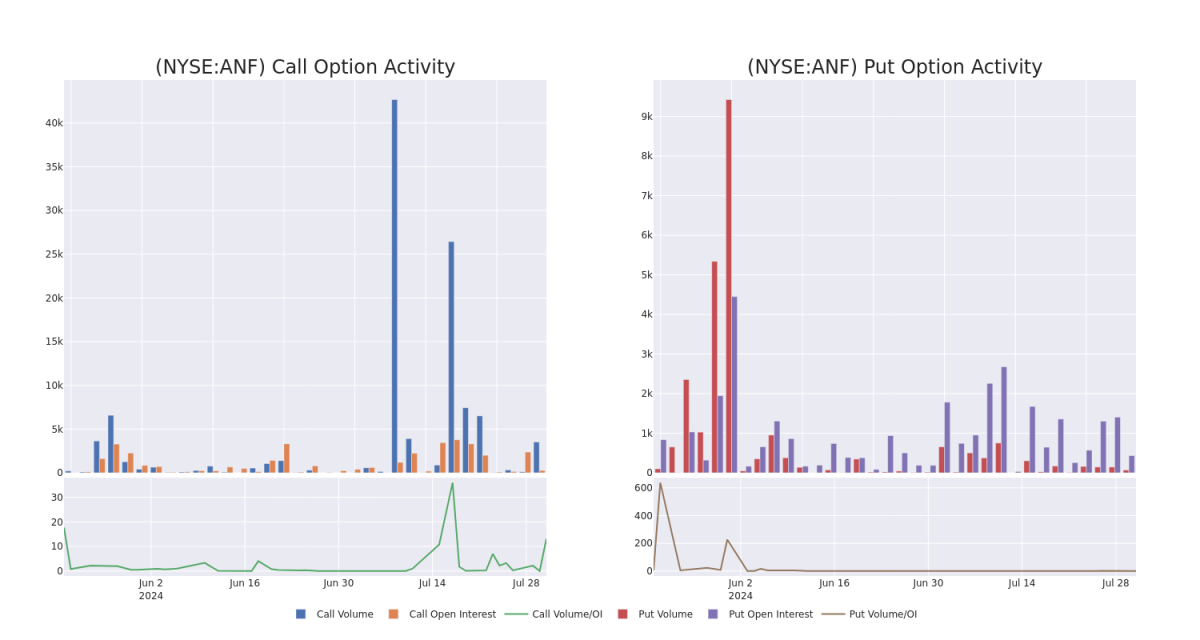

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Abercrombie & Fitch's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Abercrombie & Fitch's substantial trades, within a strike price spectrum from $150.0 to $185.0 over the preceding 30 days.

评估成交量和未平仓量是期权交易的重要步骤。这些指标揭示了阿伯克龙比&菲奇特定行权价格的期权的流动性和投资者兴趣。即将发布的数据可视化了过去30天内连接到阿伯克龙比&菲奇实质性交易的看涨期权和看跌期权的成交量和未平仓量的波动范围,该波动范围为150.0美元至185.0美元。

Abercrombie & Fitch Option Activity Analysis: Last 30 Days

阿伯克龙比&菲奇期权活动分析:最近30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANF | PUT | TRADE | BEARISH | 08/16/24 | $25.5 | $24.5 | $25.5 | $170.00 | $61.2K | 344 | 1 |

| ANF | PUT | TRADE | BULLISH | 10/18/24 | $45.1 | $45.0 | $45.0 | $185.00 | $54.0K | 0 | 12 |

| ANF | PUT | SWEEP | NEUTRAL | 08/02/24 | $19.0 | $17.0 | $18.1 | $167.50 | $46.9K | 112 | 26 |

| ANF | CALL | SWEEP | BULLISH | 08/30/24 | $9.3 | $9.1 | $9.3 | $150.00 | $38.1K | 2.5K | 943 |

| ANF | CALL | TRADE | NEUTRAL | 08/30/24 | $9.3 | $8.9 | $9.11 | $150.00 | $36.4K | 2.5K | 751 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANF | 看跌 | 交易 | 看淡 | 08/16/24 | 25.5美元 | $24.5 | 25.5美元 | $170.00 | $61.2K | 344 | 1 |

| ANF | 看跌 | 交易 | 看好 | 10/18/24 | $45.1 | $45.0 | $45.0 | $185.00 | $54.0K | 0 | 12 |

| ANF | 看跌 | SWEEP | 中立 | 08/02/24 | $19.0 | $17.0 | $18.1 | $167.50 | $46.9K | 112 | 26 |

| ANF | 看涨 | SWEEP | 看好 | 08/30/2024 | $9.3 | $9.1 | $9.3 | $150.00 | $38.1K | 2.5千 | 943 |

| ANF | 看涨 | 交易 | 中立 | 08/30/2024 | $9.3 | $8.9 | $9.11 | $150.00 | 成交量: $36.4K | 2.5千 | 751 |

About Abercrombie & Fitch

关于 Abercrombie & Fitch

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

Abercrombie & Fitch Co 是一家专业零售商,出售男、女、儿童休闲服装、个人护理产品、配件。它通过其店铺和网站(包括 Abercrombie & Fitch、Abercrombie kids 和 Hollister 品牌)直接向消费者销售。大多数店铺位于美国,但该公司在加拿大、欧洲和亚洲拥有许多店铺。所有店铺都是租赁的。Abercrombie 通过其网站向100多个国家提供运输服务。该公司的商品来自数十家主要位于亚洲和中美洲的供应商。Abercrombie 在俄亥俄州拥有两个配送中心以支持其北美业务。它在欧洲和亚洲的销售使用第三方经销商。

Having examined the options trading patterns of Abercrombie & Fitch, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在检查了阿伯克龙比&菲奇的期权交易模式之后,我们现在将注意力直接转向公司。这个转变使我们可以深入了解其目前的市场地位和表现。

Present Market Standing of Abercrombie & Fitch

阿伯克龙比&菲奇的现在市场地位

- With a trading volume of 854,620, the price of ANF is down by -3.44%, reaching $142.41.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 20 days from now.

- ANF的交易量为854,620,价格下跌了-3.44%,达到了142.41美元。

- 当前RSI指标表明该股可能被超卖。

- 下一次的盈利报告将在20天后发布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abercrombie & Fitch options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在收益。敏锐的交易者通过不断学习、调整策略、监控多个因子以及密切关注市场动向来管理这些风险。通过Benzinga Pro获得实时警报,了解最新的Abercrombie & Fitch期权交易。