Why Qualcomm Shares Are Falling Today: Next-Quarter Guidance Highlights Headwinds

Why Qualcomm Shares Are Falling Today: Next-Quarter Guidance Highlights Headwinds

Qualcomm Inc. (NASDAQ:QCOM) shares are trading lower Thursday, following the release of its fiscal third-quarter earnings.

高通公司(NASDAQ: QCOM)的股票周四下跌,其财务第三季度收益公布后出现了下滑。

Earnings Recap: Qualcomm reported third-quarter results with revenues of $9.4 billion, surpassing the consensus estimate of $9.22 billion. The company's earnings per share (EPS) also beat expectations, coming in at $2.33 versus the anticipated $2.25.

收益回顾:高通公司公布了第三季度业绩,收入为94亿美元,超过了市场预期的92.2亿美元,每股收益(EPS)为2.33美元,也超出了预期的2.25美元。

This performance was driven by strong growth in the Auto and IoT segments. However, the guidance for the next quarter highlighted potential headwinds, particularly the earlier-than-expected revoking of the company's license to sell to Huawei.

汽车和物联网领域强劲增长推动了高通公司的业绩表现。然而,下一季度的指引突出了潜在的阻力,尤其是公司销售许可证提前被吊销给华为的情况。

Analysts' Updates:

分析师更新:

- Piper Sandler: Analyst Harsh Kumar reiterated an Overweight rating, raising the price target from $185 to $205. Kumar noted the strength from Android and an upcoming ramp with a modem-only customer, despite flat guidance for the Auto segment sequentially.

- JPMorgan: Analyst Samik Chatterjee maintained an Overweight rating but lowered the price target from $235 to $230. Chatterjee highlighted the premium smartphone market and growth in the Autos and IoT businesses as key drivers.

- Cantor Fitzgerald: Analyst C.J. Muse reaffirmed a Neutral rating with a $215 price target, expressing disappointment with the initial guidance for the December quarter and highlighting the impact of Huawei's export restrictions.

- WestPark Capital: Analyst Kevin Garrigan reiterated a Hold rating, pointing out the strength in the premium-tier smartphone market and the Auto and IoT segments but noting the persistent Huawei headwind.

- Oppenheimer: Analyst Rick Schafer maintained a Perform rating, mentioning mixed results and uncertainties regarding Apple's future relationship with Qualcomm and the potential impact of AI.

- 派杰投资:分析师Harsh Kumar重申了股票超配的评级,并将价格目标从185美元上调至205美元。尽管汽车领域的业绩指南相对平稳,但Kumar指出了Android的强劲表现以及即将建立的独立调制解调器客户端的快速增长。

- 摩根大通:分析师Samik Chatterjee保持了超配评级,但将价格目标从235美元下调至230美元。Chatterjee强调高端智能手机市场和汽车、物联网业务的增长是重要的拉动力量。

- Cantor Fitzgerald:分析师C.J. Muse重申了中立评级,价格目标为215美元,对12月季度的初步指引感到失望,并强调了华为出口限制的影响。

- WestPark Capital:分析师Kevin Garrigan重申了持有评级,指出高端智能手机市场以及汽车和物联网板块的业绩表现强劲,但需要注意华为问题的持续影响。

- Oppenheimer:分析师Rick Schafer保持了绩效评级,提到了苹果公司未来与高通的关系的不确定性以及人工智能的潜在影响和结果的混杂。

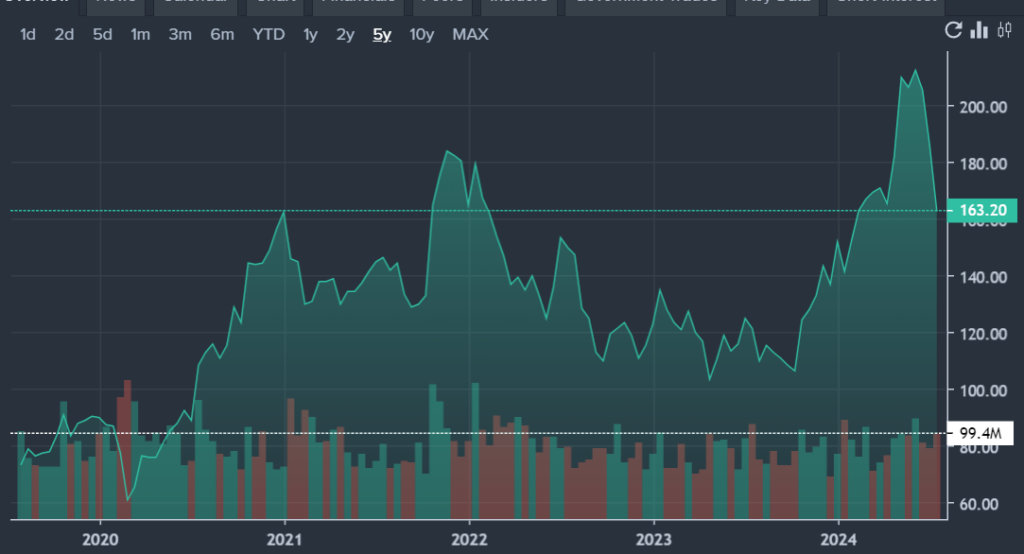

Price Action: Qualcomm's shares were down by 9.52% to $163.72, according to Benzinga Pro.

股价表现:根据Benzinga Pro,高通公司的股票下跌9.52%,至163.72美元。

Now Read:

现在阅读:

- 4 Stocks Trading Near 52-Week High That Can Climb Further

- 4只交易接近52周高点的股票,可以进一步攀升。

Image Credits – Shutterstock.

图片来源- shutterstock。