Market Mover | Intel Share Slump 21% After Q2 Results Disappoint; Suspends Dividend

Market Mover | Intel Share Slump 21% After Q2 Results Disappoint; Suspends Dividend

August 2, 2024 - $Intel (INTC.US)$shares slumped 21.93% to $22.68 in pre-market trading on Friday. The company has released its financial results for the second quarter of 2024, which significantly underperformed relative to market forecasts. In response to these results, the company has taken decisive action by suspending its dividend distribution and implementing a workforce reduction of 15%.

2024年8月2日 - $英特尔 (INTC.US)$周五美股盘前,股价大跌21.93%,跌至22.68美元。公司发布了2024年第二季度的财务报告,相对于市场预测表现显著不足。针对这些结果,公司采取果断行动,暂停股息分配并实施约15%的员工削减。

Q2 Financial Results

第二季度财务结果

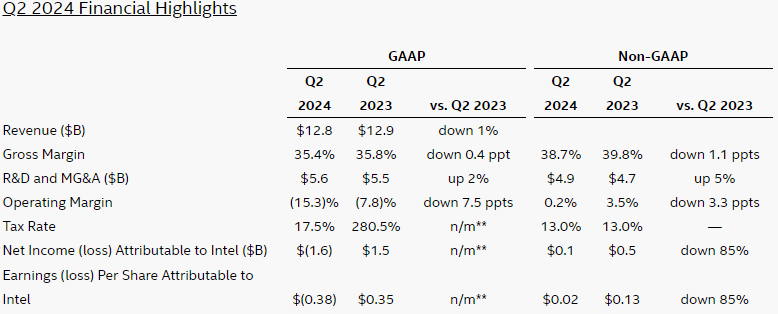

Revenue: Second-quarter revenue of $12.83 billion declined 1%YoY, while analysts were expecting $12.95 billion.

EPS: Non-GAAP adjusted earnings per share (EPS) for the second quarter were $0.02, down 85% YoY and $0.10 expected by analysts.

Gross margin: Adjusted gross margin for the second quarter was 38.7%, down 1.1 percentage points from the same period last year, compared with analyst expectations of 43.6% and 45.1% in the first quarter.

营业收入:第二季度营业收入为128.3亿美元,同比下降1%,而分析师预计为129.5亿美元。

每股收益:第二季度非通用会计准则调整后的每股收益为0.02美元,同比下降85%,分析师预计为0.10美元。

毛利率:第二季度调整后的毛利率为38.7%,比去年同期下降1.1个百分点,而分析师预计为43.6%,第一季度为45.1%。

Intel Products Highlights

英特尔产品亮点

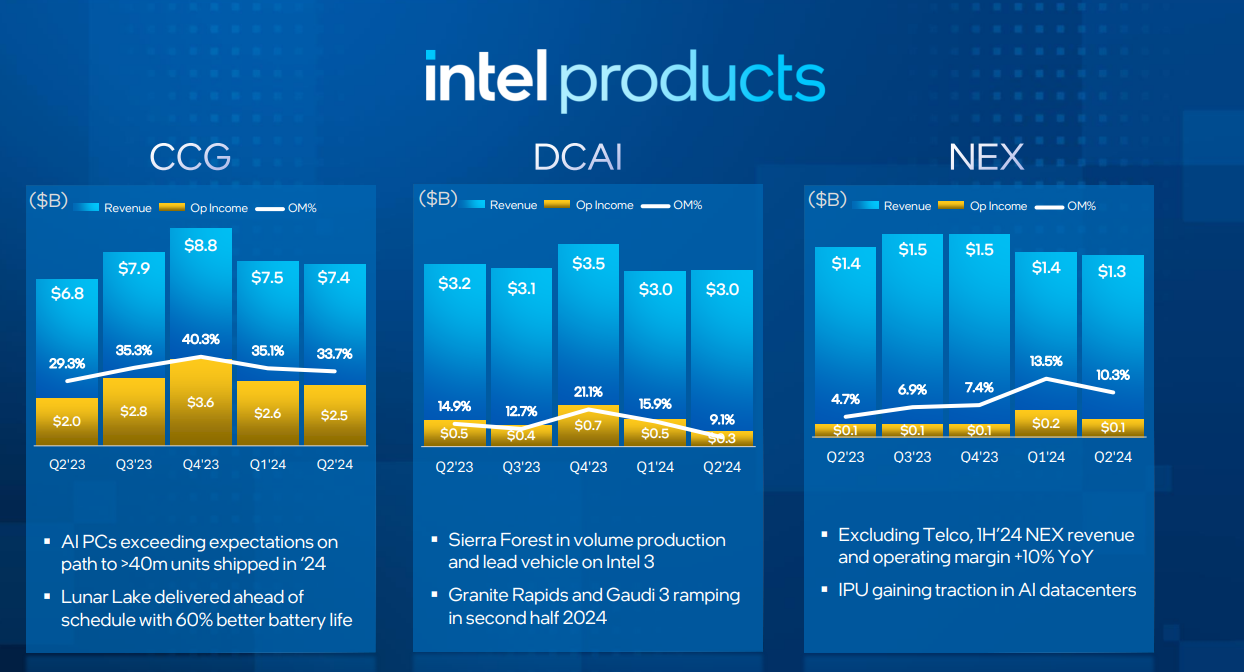

CCG: CCG revenue was $7.41 billion in the second quarter, up 9% YoY, while analysts expected $7.53 billion.

DCAI: DCAI revenue was $3.05 billion, down 3% YoY, while analysts expected $3.07 billion.

NEX: NEX revenue was $1.3 billion in the second quarter, down 1% YoY and down 8% in the first quarter.

客户计算机组(CCG):第二季度CCG营收为74.1亿美元,同比增长9%,而分析师预计为75.3亿美元。

数据中心加速器及网络部门(DCAI):第二季度DCAI营收为30.5亿美元,同比下降3%,而分析师预计为30.7亿美元。

新兴业务组(NEX):第二季度NEX营收为13亿美元,同比下降1%,第一季度下降8%。

Q3 2024 Dividend

2024年第三季度股息

The company announced that its board of directors has declared a quarterly dividend of $0.125 per share on the company’s common stock, which will be payable Sept. 1, 2024, to shareholders of record as of Aug. 7, 2024.

公司宣布,其董事会已经宣布公司普通股的每股股息为0.125美元,将于2024年9月1日支付给截至2024年8月7日的股东。

As noted earlier, Intel is suspending the dividend starting in the fourth quarter.

正如前面所述,英特尔将从第四季度开始暂停派发股息。

Cost-Reduction Plan

成本降低计划

As Intel nears the completion of rebuilding a sustainable engine of process technology leadership, it announced a series of initiatives to create a sustainable financial engine that accelerates profitable growth, enables further operational efficiency and agility, and creates capacity for ongoing strategic investment in technology and manufacturing leadership. These initiatives follow the establishment of separate financial reporting for Intel Products and Intel Foundry, which provides a "clean sheet" view of the business and has uncovered significant opportunities to drive meaningful operational and cost efficiencies. The actions include structural and operating realignment across the company, headcount reductions, and operating expense and capital expenditure reductions of more than $10 billion in 2025 compared to previous estimates. As a result of these actions, Intel aims to achieve clear line of sight toward a sustainable business model with the ongoing financial resources and liquidity needed to support the company’s long-term strategy.

随着英特尔重建可持续的工艺技术领导引擎即将完成,公司宣布了一系列措施,创造一个可持续的财务引擎,加速盈利增长,实现更高的运营效率和敏捷性,并为科技和制造业的领导地位的持续战略投资创造容量。这些措施紧随在英特尔产品和英特尔晶圆厂进行独立财务报告之后,这提供了对该业务的“从零开始”的视角,并发现了驱动有意义的运营和成本效率的重大机会。这些行动包括公司内部的结构和运营调整、裁员、运营支出和资本支出在2025年将比以前的预估节约超过100亿美元。由于这些行动,英特尔旨在实现对可持续业务模式的明确展望,同时拥有持续的财务资源和流动性,以支持公司的长期战略。

Business Outlook

业务展望

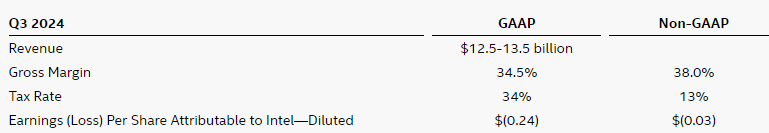

Revenue: Third-quarter revenue is expected to be $12.5 billion to $13.5 billion, while analysts expect $14.38 billion.

EPS: Third-quarter adjusted EPS loss is expected to be $0.03, while analysts expect EPS earnings of $0.30.

Gross margin: Third-quarter gross margin is expected to be 38%, while analysts expect 45.5%.

营业收入:第三季度预计营业收入为125亿至135亿美元,而分析师预计为143.8亿美元。

每股收益:第三季度调整后的每股收益预计为亏损0.03美元,而分析师预计每股收益为0.30美元。

毛利率:预计第三季度毛利率为38%,而分析师预计为45.5%。

“Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies while accelerating our IDM 2.0 transformation,” said Pat Gelsinger, Intel CEO. “These actions, combined with the launch of Intel 18A next year to regain process technology leadership, will strengthen our position in the market, improve our profitability and create shareholder value.”

“我们第二季度的财务业绩令人失望,即使我们实现了重要的产品和工艺技术里程碑。下半年的趋势比我们先前预期的更具挑战性,我们正在利用我们的新经营模式采取果断行动,将提高运营和资本效率,同时加快我们的IDm 2.0转型。这些行动加上明年推出的英特尔18A以重获工艺技术领导地位,将强化我们在市场上的地位,提高我们的盈利能力并创造股东价值。”英特尔首席执行官Pat Gelsinger表示。

Related Reading: Press Release

相关阅读:新闻发布