Decoding Palo Alto Networks's Options Activity: What's the Big Picture?

Decoding Palo Alto Networks's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bullish stance on Palo Alto Networks.

资金雄厚的鲸鱼对Palo Alto Networks持有明显看好态度。

Looking at options history for Palo Alto Networks (NASDAQ:PANW) we detected 18 trades.

查看Palo Alto Networks(NASDAQ:PANW)期权历史,我们发现了18笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 38% with bearish.

如果考虑每笔交易的具体情况,可以准确地说,50%的投资者持多头看好期权,38%的投资者持空头看淡期权。

From the overall spotted trades, 10 are puts, for a total amount of $555,395 and 8, calls, for a total amount of $405,699.

在总体交易中,投资者购买了10个看跌期权,总金额为$555,395,购买了8个看涨期权,总金额为$405,699。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $370.0 for Palo Alto Networks during the past quarter.

分析这些合同的成交量和未平仓利息,似乎大型机构在过去的一个季度里一直关注Palo Alto Networks的价格区间在$150.0到$370.0之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

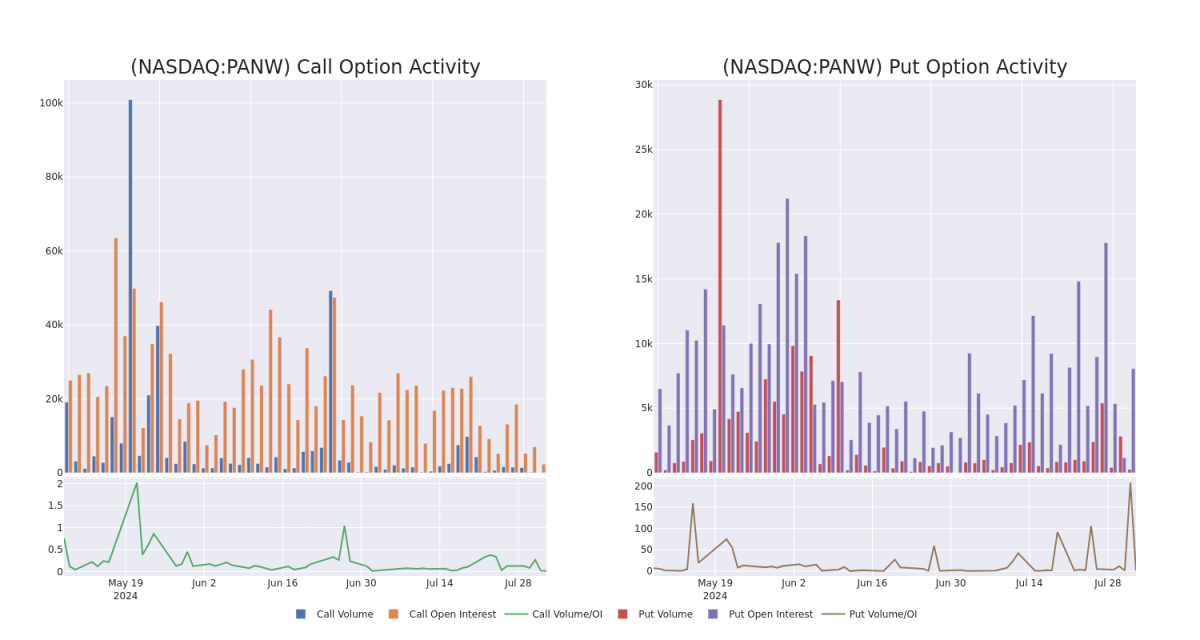

In terms of liquidity and interest, the mean open interest for Palo Alto Networks options trades today is 649.62 with a total volume of 273.00.

就流动性和利息而言,Palo Alto Networks期权交易今天的平均未平仓利息为649.62,成交量为273.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Palo Alto Networks's big money trades within a strike price range of $150.0 to $370.0 over the last 30 days.

在下图中,我们可以跟踪Palo Alto Networks的大宗交易在$150.0到$370.0的行权价格范围内,过去30天看跌和看涨期权的成交量和未平仓利息的发展。

Palo Alto Networks Call and Put Volume: 30-Day Overview

Palo Alto Networks的看涨和看跌成交量:30天概述

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | PUT | SWEEP | BULLISH | 08/02/24 | $28.8 | $25.55 | $25.55 | $330.00 | $171.1K | 298 | 38 |

| PANW | CALL | TRADE | BULLISH | 01/16/26 | $79.15 | $76.5 | $79.15 | $270.00 | $158.3K | 247 | 0 |

| PANW | PUT | TRADE | BULLISH | 08/02/24 | $24.7 | $22.3 | $22.3 | $330.00 | $73.5K | 298 | 4 |

| PANW | CALL | TRADE | BULLISH | 11/15/24 | $62.75 | $60.95 | $62.2 | $250.00 | $62.2K | 279 | 10 |

| PANW | PUT | TRADE | BEARISH | 01/16/26 | $46.0 | $41.65 | $46.0 | $300.00 | $55.2K | 579 | 12 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | 看跌 | SWEEP | 看好 | 08/02/24 | $28.8 | $25.55 | $25.55 | $330.00 | $171.1K | 298 | 38 |

| PANW | 看涨 | 交易 | 看好 | 01/16/26 | $79.15 | $76.5 | $79.15 | $270.00 | 158.3K美元 | 247 | 0 |

| PANW | 看跌 | 交易 | 看好 | 08/02/24 | $24.7 | $22.3 | $22.3 | $330.00 | $73.5K | 298 | 4 |

| PANW | 看涨 | 交易 | 看好 | 11/15/24 | $62.75 | $60.95 | $62.2 | $250.00 | $62.2K | 279 | 10 |

| PANW | 看跌 | 交易 | 看淡 | 01/16/26 | $46.0 | $41.65 | $46.0 | $ 300.00 | $55.2K | 579 | 12 |

About Palo Alto Networks

关于Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

Palo Alto Networks是一家以平台为基础的网络安全供应商,其产品涵盖网络安全、云安全和安全运营。这家总部位于加利福尼亚的公司在全球拥有85000多个客户,其中超过四分之三是全球1000强企业。

After a thorough review of the options trading surrounding Palo Alto Networks, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对Palo Alto Networks期权交易的全面审查,我们深入研究了该公司的市场现状和业绩。

Current Position of Palo Alto Networks

Palo Alto Networks的现状

- Trading volume stands at 516,498, with PANW's price down by -4.51%, positioned at $301.38.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 14 days.

- 交易量为516,498,PANW的价格下跌了-4.51%,位于$301.38。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计在14天内公布收益声明。

Professional Analyst Ratings for Palo Alto Networks

Palo Alto Networks的专业分析师评级

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $352.5.

在过去30天内,总共有2位专业分析师对这支股票发表了看法,并给出了平均目标价$352.5。

- An analyst from Keybanc persists with their Overweight rating on Palo Alto Networks, maintaining a target price of $380.

- An analyst from Redburn Atlantic has revised its rating downward to Neutral, adjusting the price target to $325.

- Keybanc的分析师坚持维持对Palo Alto Networks的超配评级,并保持目标价为$380。

- Redburn Atlantic的分析师已将其评级下调至中立,将价格目标调整为$325。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palo Alto Networks options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多种因子并密切关注市场行情来管理这些风险。通过Benzinga Pro的实时提醒保持对Palo Alto Networks期权交易的最新动态了解。

From the overall spotted trades, 10 are puts, for a total amount of $555,395 and 8, calls, for a total amount of $405,699.

From the overall spotted trades, 10 are puts, for a total amount of $555,395 and 8, calls, for a total amount of $405,699.