Behind the Scenes of Linde's Latest Options Trends

Behind the Scenes of Linde's Latest Options Trends

High-rolling investors have positioned themselves bullish on Linde (NASDAQ:LIN), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LIN often signals that someone has privileged information.

高额投资者已将自己定位为看好林德(纳斯达克股票代码:LIN),散户交易者注意这一点很重要。\ 这项活动今天通过Benzinga对公开期权数据的追踪引起了我们的注意。这些投资者的身份尚不确定,但是LIN的如此重大变动通常表明有人拥有特权信息。

Today, Benzinga's options scanner spotted 12 options trades for Linde. This is not a typical pattern.

今天,本辛加的期权扫描仪发现了林德的12笔期权交易。这不是典型的模式。

The sentiment among these major traders is split, with 33% bullish and 16% bearish. Among all the options we identified, there was one put, amounting to $1,024,800, and 11 calls, totaling $907,286.

这些主要交易者的情绪分歧,33%看涨,16%看跌。在我们确定的所有期权中,有一个看跌期权,金额为1,024,800美元,还有11个看涨期权,总额为907,286美元。

What's The Price Target?

目标价格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $460.0 for Linde over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将林德的价格定在400.0美元至460.0美元之间。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

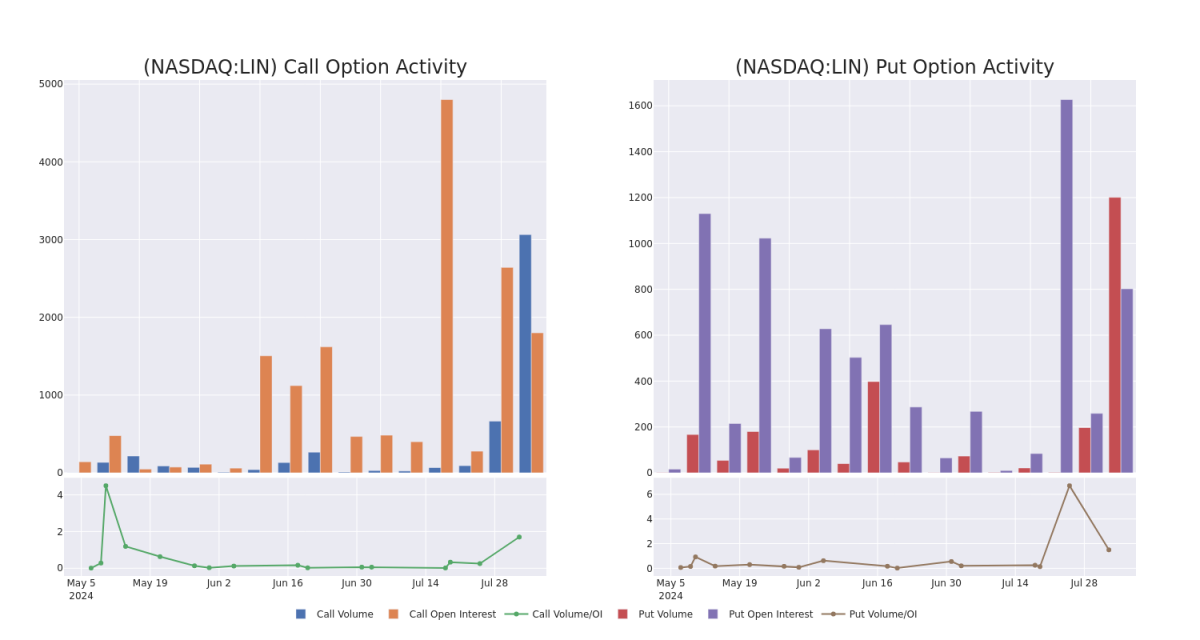

In today's trading context, the average open interest for options of Linde stands at 1301.0, with a total volume reaching 4,265.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Linde, situated within the strike price corridor from $400.0 to $460.0, throughout the last 30 days.

在今天的交易背景下,林德期权的平均未平仓合约为1301.0,总成交量达到4,265.00。随附的图表描绘了林德在过去30天中看涨期权和看跌期权交易量以及未平仓合约的变化,林德位于行使价走势从400.0美元到460.0美元之间。

Linde Option Volume And Open Interest Over Last 30 Days

过去30天林德期权交易量和未平仓合约

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LIN | PUT | TRADE | BULLISH | 01/17/25 | $9.8 | $8.5 | $8.54 | $400.00 | $1.0M | 802 | 1.2K |

| LIN | CALL | SWEEP | BULLISH | 01/17/25 | $22.3 | $21.3 | $21.8 | $460.00 | $207.4K | 1.8K | 196 |

| LIN | CALL | SWEEP | BULLISH | 01/17/25 | $21.9 | $21.2 | $21.55 | $460.00 | $189.6K | 1.8K | 406 |

| LIN | CALL | SWEEP | BULLISH | 01/17/25 | $22.3 | $21.4 | $21.85 | $460.00 | $107.8K | 1.8K | 247 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $25.6 | $23.7 | $24.07 | $460.00 | $74.6K | 1.8K | 45 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 林 | 放 | 贸易 | 看涨 | 01/17/25 | 9.8 美元 | 8.5 美元 | 8.54 美元 | 400.00 美元 | 100 万美元 | 802 | 1.2K |

| 林 | 打电话 | 扫 | 看涨 | 01/17/25 | 22.3 美元 | 21.3 美元 | 21.8 美元 | 460.00 美元 | 20.74 万美元 | 1.8K | 196 |

| 林 | 打电话 | 扫 | 看涨 | 01/17/25 | 21.9 美元 | 21.2 美元 | 21.55 美元 | 460.00 美元 | 189.6 万美元 | 1.8K | 406 |

| 林 | 打电话 | 扫 | 看涨 | 01/17/25 | 22.3 美元 | 21.4 美元 | 21.85 美元 | 460.00 美元 | 107.8 万美元 | 1.8K | 247 |

| 林 | 打电话 | 扫 | 粗鲁的 | 01/17/25 | 25.6 美元 | 23.7 美元 | 24.07 美元 | 460.00 美元 | 74.6 万美元 | 1.8K | 45 |

About Linde

关于林德

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm's main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue in 2023.

林德是世界上最大的工业气体供应商,业务遍及100多个国家。该公司的主要产品是大气气体(包括氧气、氮气和氩气)和工艺气体(包括氢气、二氧化碳和氦气),以及用于工业气体生产的设备。林德为各种终端市场提供服务,包括化工、制造业、医疗保健和炼钢。林德在 2023 年创造了大约 330 亿美元的收入。

In light of the recent options history for Linde, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于林德最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Current Position of Linde

林德的现状

- With a trading volume of 1,134,870, the price of LIN is down by -0.85%, reaching $449.49.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

- LIN的交易量为1,134,870美元,下跌了-0.85%,至449.49美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于即日起0天后发布。

What Analysts Are Saying About Linde

分析师对林德的看法

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $477.5.

在过去的30天中,共有2位专业分析师对该股发表了看法,将平均目标股价设定为477.5美元。

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Linde, targeting a price of $480.

- An analyst from UBS persists with their Neutral rating on Linde, maintaining a target price of $475.

- 花旗集团的一位分析师保持立场,继续对林德维持中性评级,目标价格为480美元。

- 瑞银的一位分析师坚持对林德的中性评级,维持475美元的目标价格。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Linde with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解林德的最新期权交易,以获取实时警报。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $460.0 for Linde over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $460.0 for Linde over the last 3 months.