Rapid Yen Appreciation: Key Factors Boosting JPY

Rapid Yen Appreciation: Key Factors Boosting JPY

By RoboForex Analytical Department

由RoboForex分析部门提供

The Japanese yen continues its recovery rally. The USD/JPY pair falls to 143.38 on Monday.

日币持续上涨。周一美元/日元下跌至143.38。

This development is likely only the midpoint of the process as the market regains past losses and brings the JPY to equilibrium. USD/JPY is currently at its lowest level since 3 January.

这一发展很可能只是市场寻求平衡、恢复过去损失的中间阶段。美元/日元目前处于自1月3日以来的最低水平。

Several reasons are driving this movement. The first is the winding down of carry trade operations on the yen. The process started earlier when it became clear that the Bank of Japan was moving towards tightening monetary conditions.

有几个原因推动了这次行动。首先,人民币抵押交易正在收尾阶段。当日本银行开始收紧货币政策时,这个过程就已经开始了。

The second concern is that a US recession is playing an important role. Friday's employment data was weaker than expected, triggering fears that the Federal Reserve might delay its decision on interest rate cuts. The market is worried the Fed could be late in making a crucial decision.

第二个原因是美国经济衰退正在发挥重要作用。周五的就业数据低于预期,引发了联邦储备委员会可能推迟降息决定的担忧。市场担心联邦储备委员会可能迟迟未能作出关键决策。

The third key factor for the JPY is the increased attractiveness of the yen as a safe-haven asset amid escalating geopolitical tensions in the Middle East. The ongoing conflict in the region poses a hypothetical threat to global stability, and investors are factoring in this risk and favouring safe-haven assets.

JPY的第三个关键因素是随着中东地缘政治紧张局势升级,日元作为避险资产的吸引力增加。该地区持续的冲突对全球稳定构成假设性威胁,投资者正在考虑这种风险并偏爱避险资产。

Technical Analysis: USD/JPY

技术面分析:美元/日元

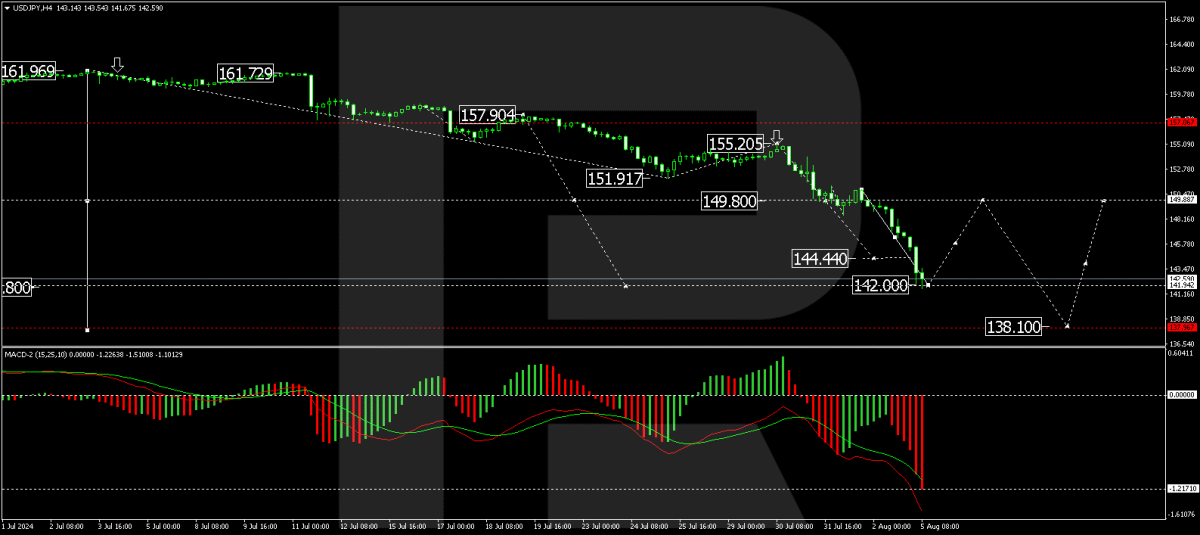

The USD/JPY pair formed a consolidation range of around 149.80 before breaking downwards on impactful news. The decline reached 142.00, setting a local low. We anticipate a new consolidation phase above this level. An upward break could see a corrective move towards 149.80. Conversely, a downward exit might extend losses towards 138.10. The MACD indicator supports this bearish outlook, showing continued downward momentum.

美元/日元对149.80左右的区间形成了一个巩固区间,然后在重要消息的影响下向下突破。下跌达到了142.00,设定了一个局部低位。我们预计会在这个水平以上看到一个新的巩固阶段。向上的突破可能会看到一个向149.80的修正举动。相反,向下的退出可能会将损失延伸至138.10。MACD指标支持这种看淡的前景,显示持续的下行动能。

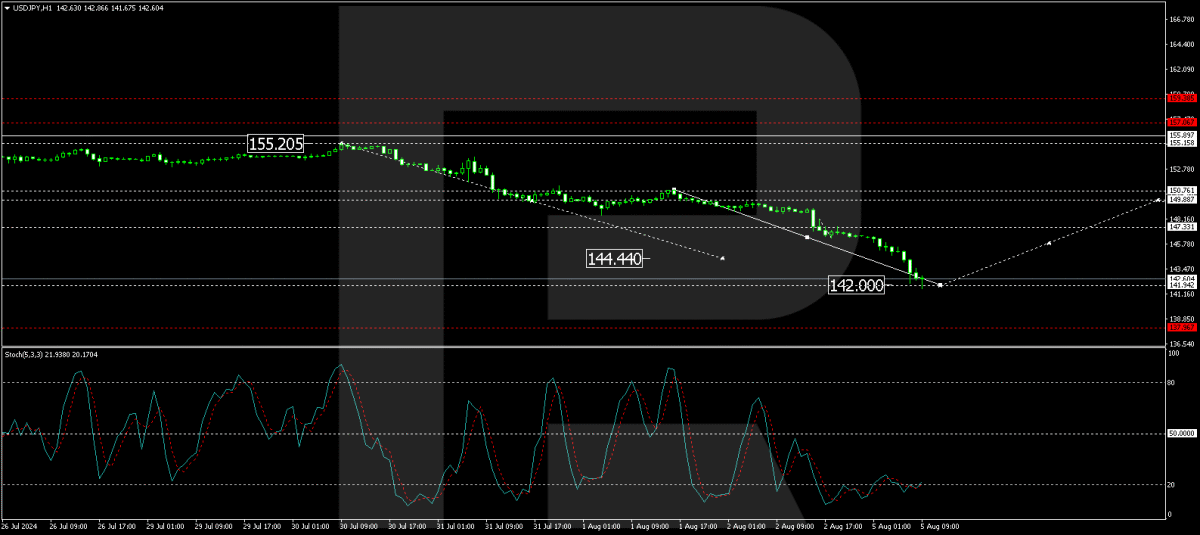

After reaching 142.00, a corrective phase to 147.33 may unfold, representing an intermediate target. Following this correction, a further decline to 144.66 could occur. This analysis aligns with the Stochastic oscillator, indicating a potential for an upward correction from oversold levels.

在达到142.00后,一个到147.33的修正阶段可能会展开,代表中间目标。在这个修正之后,进一步下跌至144.66可能会发生。这个分析与随机振荡器一致,表明有可能从超卖水平上升修正。

Disclaimer

免责声明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析仅代表作者个人观点,不得视为交易建议。RoboForex不承担基于本文所含交易建议和评论所产生的任何交易结果的责任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文来自非报酬的外部投稿人。它不代表Benzinga的报道,并且没有因为内容或准确性而被编辑。