Warren Buffett's Apple Sell-Off Echoes Chevron Move: What It Means For Investors

Warren Buffett's Apple Sell-Off Echoes Chevron Move: What It Means For Investors

Warren Buffett's recent decision to trim Berkshire Hathaway's (NYSE:BRK) (NYSE:BRK) stake in Apple Inc. (NASDAQ:AAPL) has caused quite a stir, with the tech giant's stock tumbling in premarket as well as day trading.

沃伦·巴菲特最近决定削减伯克希尔哈撒韦(纽交所:BRK)在苹果公司(纳斯达克:AAPL)的持股,造成轩然大波,科技巨头的股票在盘前和盘中交易中暴跌。

But before Apple investors hit the panic button, let's revisit a similar scenario from Buffett's past — the dramatic sell-off of Chevron Corp (NYSE:CVX) — to see what it might reveal about potential future moves.

但在苹果投资者按下恐慌按钮之前,让我们回顾一下巴菲特过去的一个类似场景——雪佛龙公司(纽交所:CVX)的大幅抛售——看看它可能揭示的潜在未来动向。

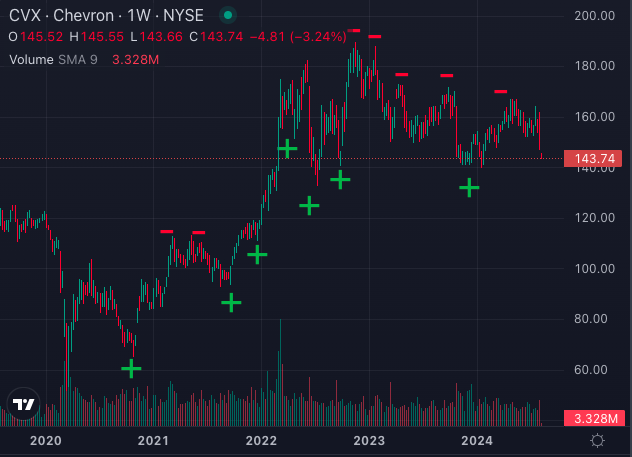

Warren Buffett's Chevron Share Sale: A Case Study In Market Timing

沃伦·巴菲特的雪佛龙股票出售:市场时间的案例研究

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

Buffett's substantial reduction in Apple shares is drawing comparisons to his earlier Chevron strategy. Here's a snapshot of what happened:

巴菲特减持苹果股票的巨额交易引起了人们对他早期雪佛龙策略的比较。以下是一个快照:

- Buffett first increased his Chevron stake dramatically in the fourth quarter of 2020, acquiring $1.6 billion worth of shares.

- His enthusiasm continued through the first quarter of 2022, when he expanded his position by a staggering $5.7 billion, marking a 316.2% increase. However, the subsequent years saw a sharp reversal.

- In the fourth quarter of 2022, Buffett started scaling back, selling $1.4 billion of Chevron shares.

- The sell-off gained momentum in 2023, with Berkshire reducing its Chevron stake by $5.5 billion — 18.8% of his holdings in the first quarter of 2023 and another $2.7 billion — 10.5% in the third quarter of 2023.

- 2020年第四季度,巴菲特大幅增持了雪佛龙,收购了16亿美元的股票。

- 他的热情一直持续到2022年第一季度,当时他增持了惊人的57亿美元,增长了316.2%。然而,随后几年出现了急剧逆转。

- 2022年第四季度,巴菲特开始缩减,出售了14亿美元的雪佛龙股票。

- 出售势头在2023年加速,伯克希尔哈撒韦在2023年第一季度减持了雪佛龙55亿美元,占其持股的18.8%,并在2023年第三季度再次削减了27亿美元,占其持股的10.5%。

Despite these significant sales, Chevron's stock faltered, dropping over 7% during this period, while the S&P 500 surged 18.5%.

尽管出售股票规模巨大,但雪佛龙公司的股价疲软,在此期间下跌了逾7%,而标准普尔500指数却上涨了18.5%。

Even since Buffett's final sale in the first quarter of 2024, which amounted to $1 billion, Chevron's stock has gained only 3.38%, lagging behind the S&P 500's 12% rise.

即便是自2024年第一季度巴菲特最后一次出售的10亿美元股票以来,雪佛龙公司的股价也只上涨了3.38%,落后于标准普尔500指数的12%涨幅。

Apple's Turn In The Spotlight: What's The Message?

苹果公司受到关注:这传递了什么样的信息?

The scale of Buffett's Chevron sales — totaling over $10 billion — provides a stark contrast to his Apple transaction.

巴菲特出售雪佛龙的规模——总计超过100亿美元——与他的苹果交易形成鲜明对比。

For context, Berkshire Hathaway's recent cut in Apple holdings, valued at approximately $51 billion, is significant but aligns with a pattern of strategic adjustments.

为了更好的理解,在伯克希尔哈撒韦近期削减510亿美元的苹果股份之前,我们来看看策略调整的模式。

For Apple investors, Buffett's Chevron history is a crucial reference. His aggressive divestment from Chevron, coupled with the stock's subsequent underperformance, serves as a reminder of the volatility that can affect even the most robust investments.

对于苹果投资者来说,巴菲特的雪佛龙经历是一个重要的参考。他从雪佛龙股票中大力剥离,加上股票随后的表现不佳,提醒我们即便是最健壮的投资也可能受到市场波动的影响。

While Apple remains a strong company, the Chevron experience highlights the importance of staying alert and prepared for potential market shifts.

虽然苹果公司依然是一家强大的公司,但雪佛龙的经历凸显了保持警惕和准备应对可能的市场转变的重要性。

For those holding Apple shares, it's a prompt to reassess your strategy and stay vigilant, ensuring your investments align with evolving market trends and conditions.

对于那些持有苹果股票的人来说,这是一个提示,他们要重新评估自己的策略,保持警惕,确保自己的投资与不断变化的市场趋势和条件相适应。

Photos: Shutterstock

照片:shutterstock

Buffett's substantial reduction in Apple shares is drawing comparisons to his earlier Chevron strategy. Here's a snapshot of what happened:

Buffett's substantial reduction in Apple shares is drawing comparisons to his earlier Chevron strategy. Here's a snapshot of what happened: