Ningbo Ronbay New Energy Technology Co.,Ltd.'s (SHSE:688005) Shares Not Telling The Full Story

Ningbo Ronbay New Energy Technology Co.,Ltd.'s (SHSE:688005) Shares Not Telling The Full Story

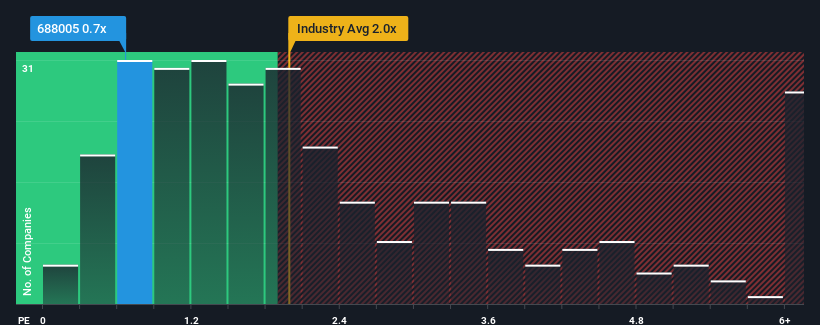

Ningbo Ronbay New Energy Technology Co.,Ltd.'s (SHSE:688005) price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Electrical industry in China, where around half of the companies have P/S ratios above 2x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Ningbo Ronbay New Energy TechnologyLtd Has Been Performing

While the industry has experienced revenue growth lately, Ningbo Ronbay New Energy TechnologyLtd's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo Ronbay New Energy TechnologyLtd.Is There Any Revenue Growth Forecasted For Ningbo Ronbay New Energy TechnologyLtd?

In order to justify its P/S ratio, Ningbo Ronbay New Energy TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 47% decrease to the company's top line. Even so, admirably revenue has lifted 171% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 32% as estimated by the nine analysts watching the company. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

With this information, we find it odd that Ningbo Ronbay New Energy TechnologyLtd is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Ningbo Ronbay New Energy TechnologyLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Ningbo Ronbay New Energy TechnologyLtd is showing 3 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Ningbo Ronbay New Energy TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com