VIX Spiked 180% on Monday, Marking Rare Move Since Financial Crisis. What It Means for Investors

VIX Spiked 180% on Monday, Marking Rare Move Since Financial Crisis. What It Means for Investors

As a series of global macro risks continue to disrupt the market and trigger a chain reaction, US stocks continued to adjust significantly under panic sentiment on Monday. The $.SPX.US$ fell by 3.0%, while the $.DJI.US$ fell by 2.6%, marking the largest single-day decline in about two years. The $.VIX.US$, also known as the "fear index" on Wall Street, soared by 180% before the market opened on Monday, recording the largest increase ever, but eventually retreated to less than 65% as market sentiment gradually calmed down.

With the VIX index reaching levels not seen since the most severe period of the financial crisis, some investors are trying to understand this phenomenon and identify any possible trading opportunities or insights into market trends.

随着VIX指数达到自金融危机最严重时期以来从未见过的水平,一些投资者正试图了解这种现象,并确定任何可能的交易机会或对市场趋势的见解。

What Is the Fear Index and Why Is It Surging Recently?

What Is the Fear Index and Why Is It Surging Recently?

什么是恐惧指数,为什么它最近飙升?

The $.VIX.US$ measures the market's expectation of volatility in the S&P 500 index for the next 30 days. Maintained by the Chicago Board Options Exchange (CBOE), the VIX is calculated based on the implied volatility of options on the $.SPX.US$, reflecting the level of fear and pressure in the market. Implied volatility typically rises during market turmoil or economic downturns. According to S&P Global, a VIX level above 30 is considered extremely high, indicating significant turbulence in the market.

The VIX index surpassed the crucial level of 65 on Monday, a situation that has only occurred twice in history: during the 2008 financial crisis (reaching 80.86) and in March 2020 during the outbreak of the COVID-19 pandemic (reaching 82.69). The surge in VIX this time has been influenced by a series of ongoing global macro events, including concerns about the weakening economic and employment data exacerbating fears of a recession in the US, unwinding of a large number of yen carry trades triggering sell-offs, disappointing earnings or guidance from high-valued tech stocks denting market sentiment, and escalating geopolitical tensions in the Middle East.

周一,VIX指数突破了关键水平65,这种情况在历史上只发生过两次:在2008年金融危机期间(达到80.86)和2020年3月 COVID-19 疫情爆发期间(达到82.69)。这次VIX的飙升受了一系列持续的全球宏观事件的影响,包括对经济和就业数据疲软加剧了人们对美国经济衰退担忧的担忧、引发抛售的大量日元套利交易的平仓、令人失望的高价值科技股的收益或指引削弱了市场情绪,以及中东地缘政治紧张局势升级。

Significant Clues in Monday's VIX Surge

Significant Clues in Monday's VIX Surge

周一 VIX 激增中的重要线索

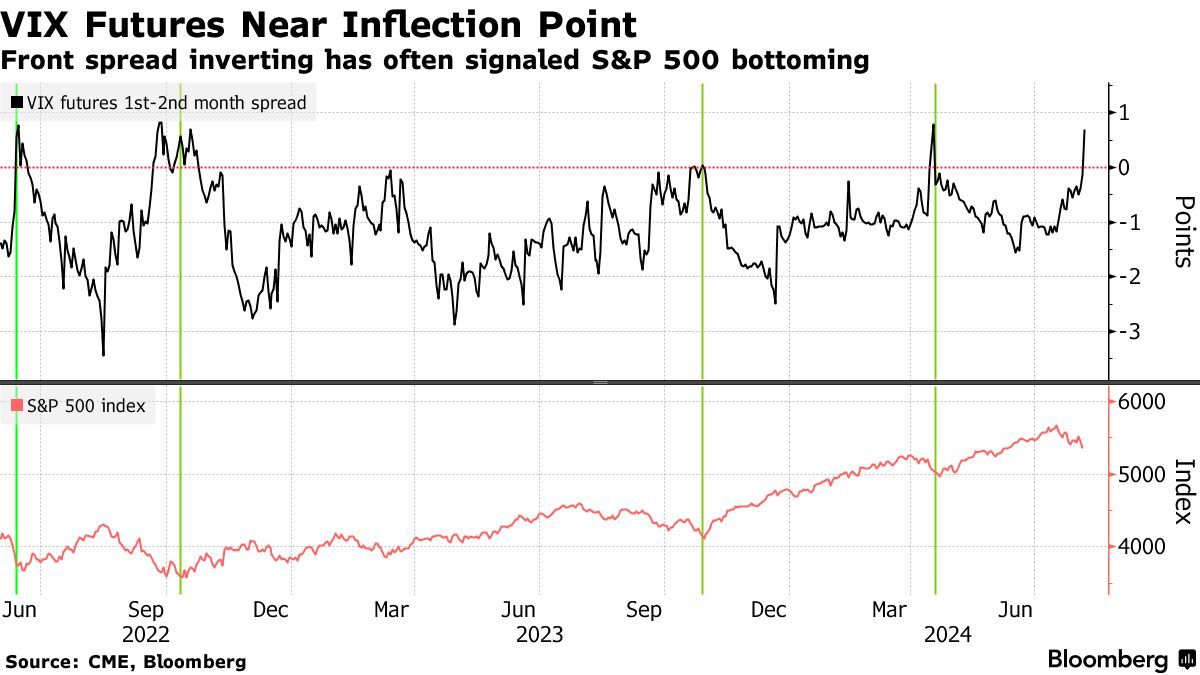

According to Jonathan Krinsky, the chief market technician at BTIG, the VIX index surged on Monday as panicked investors sought immediate protection. As a result, the spot price of VIX soared relative to the second-month VIX futures price, causing the spread between spot VIX and the next-month futures contract to briefly fall to nearly negative 30 points. This is even lower than the recent lowest level during the peak of the sell-off period caused by the COVID-19 pandemic. Typically, when the spread inverts by at least 10 basis points or more on a closing basis, it may indicate that the stock-market correction is reaching its bottom.

根据BTIG首席市场技术员乔纳森·克林斯基的说法,由于惊慌失措的投资者寻求立即保护,VIX指数周一飙升。结果,VIX的现货价格相对于第二个月的VIX期货价格飙升,导致现货VIX和下个月期货合约之间的价差短暂跌至近负30点。这甚至低于 COVID-19 疫情引发的抛售高峰期最近的最低水平。通常,当利差在收盘时反转至少10个基点或更多时,可能表明股市调整已触底。

Similar phenomena have also occurred in futures contracts of different maturities. According to Bloomberg data, a reversal was observed in the Chicago Board Options Exchange Volatility Index futures on Monday, with the front-month contract for August closing higher than the next-month contract for September. This also indicates that investors believe the near-term uncertainty is higher than the future uncertainty. Interestingly, the S&P 500 index was close to its lows during the past four occurrences of this phenomenon, including June and October 2022, October 2023, and April 2024.

在不同期限的期货合约中也出现了类似的现象。彭博社的数据显示,周一芝加哥期权交易所波动率指数期货出现逆转,8月份的前月合约收盘高于9月份的下个月合约。这也表明投资者认为短期的不确定性高于未来的不确定性。有趣的是,标准普尔500指数在过去四次出现这种现象时均接近低点,包括2022年6月和10月、2023年10月和2024年4月。

Exploring Trading Potential During Extreme Panic

Exploring Trading Potential During Extreme Panic

在极度恐慌期间探索交易潜力

1. A Sharp Spike in VIX Could Indicate a Bullish Contrarian Signal:

1。VIX的急剧飙升可能表明看涨的逆势信号:

Due to the strong negative correlation between VIX and stock market returns, a decline in the volatility index may stabilize the S&P 500 index. This is why some people believe that VIX can predict the turning point of SPX. In other words, although a surge in the VIX index usually occurs simultaneously with a sharp market decline, this process may be temporary, and the historical high of the VIX index usually precedes the stock market rebound. After extreme volatility spikes and then peaks and falls, it may indicate that the most painful period has passed and that stocks will once again be attractive.

由于VIX与股市回报率之间存在很强的负相关性,波动率指数的下跌可能会稳定标准普尔500指数。这就是为什么有些人认为VIX可以预测SPX的转折点的原因。换句话说,尽管VIX指数的上涨通常与市场急剧下跌同时发生,但这个过程可能是暂时的,VIX指数的历史高点通常在股市反弹之前。在极端波动率飙升,然后达到峰值和下跌之后,这可能表明最痛苦的时期已经过去,股票将再次具有吸引力。

Historically, when the VIX index has experienced a significant increase (up 95% from the bottom within one year without a 20% correction), it has fallen an average of 19% in the following month and 34% on average in the next year. These correspond to the S&P 500 index rebounding 2% in the following month and 12% in the next year.

从历史上看,当VIX指数大幅上涨(在一年内从底部上涨95%,没有20%的修正)时,它在接下来的一个月平均下跌了19%,第二年平均下降了34%。这相当于标准普尔500指数在下个月反弹2%,明年反弹12%。

"You have to watch the VIX. When the VIX peaks and starts to roll over and fall down, the recovery can be just as quick," Fundstrat head of research Tom Lee said Monday.

“你必须看 VIX。当VIX达到峰值并开始翻转和下降时,复苏可能同样快。” Fundstrat研究主管汤姆·李周一表示。

Moreover, from a fundamental perspective, some of the concerns behind the panic may have been overblown.

此外,从基本面来看,恐慌背后的一些担忧可能被夸大了。

On the one hand, the latest US non-manufacturing ISM index for July released on Monday showed a reading of 51.4, better than the expected 51. The service sector has escaped from the worst contraction in four years recorded in June and returned to the expansion zone. Chris Williamson, chief business economist at S&P Global Market Intelligence, pointed out that as the service sector accounts for a relatively large proportion of the US economy, the PMI data for July indicates that the US economy continued to grow at the beginning of the third quarter, with a growth rate equivalent to an annualized GDP growth rate of 2.2%. This has somewhat calmed the extremely fragile market sentiment after a surge in unemployment rate data.

一方面,周一公布的美国7月最新非制造业iSM指数为51.4,好于预期的51。服务业在6月份摆脱了四年来最严重的萎缩,回到了扩张区。标普全球市场情报首席商业经济学家克里斯·威廉姆森指出,由于服务业占美国经济的比例相对较大,7月份的采购经理人指数数据表明,美国经济在第三季度初继续增长,增长率相当于2.2%的年化GDP增长率。在失业率数据激增之后,这在一定程度上平息了极其脆弱的市场情绪。

Given its basic prediction of a "soft landing", David Lefkowitz, head of US equities at UBS Global Wealth Management, believes that the risk-return outlook for the US stock market looks good, and counter-cyclical bullish signals are beginning to emerge.

鉴于其对 “软着陆” 的基本预测,瑞银全球财富管理美国股票主管戴维·莱夫科维茨认为,美国股市的风险回报前景看好,反周期看涨信号开始出现。

Jamie Cox, managing partner at Harris Financial Group, said that the sell-off looked like "hysteria" and that concerns about a US slowdown had been misguided.

哈里斯金融集团管理合伙人杰米·考克斯表示,抛售看起来像 “歇斯底里”,对美国经济放缓的担忧被误导了。

On the other hand, this round of volatility may have been amplified by concerns about economic recession and geopolitical issues, as well as liquidity issues, in a situation where the market was overcrowded and had previously made excessive profits. Therefore, if the market can withstand the spread of liquidity shocks in the short term, a rebound can be expected. Moreover, the Fed now has enough policy space to lower interest rates and boost the economy, and stabilize financial markets, as the Fed's policy rate is still at the highest level in more than 20 years, ranging from 5.25% to 5.5%, 138bps higher than the implied rate level by the Taylor rule.

另一方面,在市场人满为患且此前曾获得过高利润的情况下,对经济衰退、地缘政治问题以及流动性问题的担忧可能加剧了这一轮的波动。因此,如果市场能够在短期内承受流动性冲击的扩散,则可以预期会出现反弹。此外,美联储现在有足够的政策空间来降低利率和提振经济,稳定金融市场,因为美联储的政策利率仍处于20多年来的最高水平,从5.25%到5.5%不等,比泰勒规则的隐含利率水平高出138个基点。

Keith Lerner, co-chief investment officer at Truist Advisory Services, believes that the further downside risk of the S&P 500 index is only about 5%, that is, the index would fall to a low point of around 4,900 to 5,000 points:

Truist Advisory Services联席首席投资官基思·勒纳认为,标准普尔500指数的进一步下行风险仅为5%左右,也就是说,该指数将跌至4,900至5,000点左右的低点:

"The template tends to be there's a spike in the VIX, everyone has been caught offsides, and there's a battle between fear and greed."

“模板往往是VIX激增,每个人都被抓到越位,恐惧与贪婪之间存在斗争。”

2. Extreme VIX Values Unlikely to Last Long Due to Mean Reversion:

2。由于均值回归,极端的VIX值不太可能持续很长时间:

The VIX index exhibits mean reversion characteristics, tending to fluctuate around its average value. According to Dow Jones market data, as of 2023, the 10-year average value of the VIX index stands at 18.13. When the VIX exceeds its normal range between 10 and 30, the power of mean reversion offers opportunities for trading volatility.

VIX指数表现出均值回归特征,往往在平均值附近波动。根据道琼斯市场数据,截至2023年,VIX指数的10年平均值为18.13。当VIX超过10到30之间的正常范围时,均值回归的力量为交易波动提供了机会。

While investors cannot directly invest in the VIX, they can trade through tracking VIX futures contracts and exchange-traded funds (ETFs), as well as exchange-traded notes (ETNs) that hold these futures contracts.

虽然投资者不能直接投资VIX,但他们可以通过跟踪VIX期货合约和交易所交易基金(ETF)以及持有这些期货合约的交易所交易票据(ETN)进行交易。

If investors anticipate extreme increases in the VIX index leading to a market pullback, they can profit from shorting volatility through ETFs. Additionally, options are another major tool. Data from Cboe Global Markets showed that last Friday, options traders opened new bets in hopes of profiting from a decline in the VIX. Options trading volumes tied to the VIX reached a near-record 3.4 million, with the largest increase seen in put contracts.

如果投资者预计VIX指数的极端上涨会导致市场回调,那么他们可以通过ETF从做空波动中获利。此外,选项是另一个主要工具。芝加哥期权交易所环球市场的数据显示,上周五,期权交易者开启了新的赌注,希望从VIX的下跌中获利。与VIX挂钩的期权交易量达到接近创纪录的340万,其中看跌合约增幅最大。

Furthermore, due to the usual presence of a positive price spread (contango) in VIX futures trading, where futures prices are higher than spot prices, investors can consider mean reversion in price spreads if a market crash leads to a negative price spread (backwardation).

此外,由于VIX期货交易中通常存在正价差(contango),即期货价格高于现货价格,因此如果市场崩盘导致价格差为负(向后回调),投资者可以考虑价格差的均值回归。

However, if investors believe that the volatile situation will persist and expect an upward trend in the VIX that could harm their positions, they can hedge their portfolio's potential losses caused by stock price declines by purchasing VIX futures, options, or ETFs. These products increase in value as volatility rises.

但是,如果投资者认为动荡局势将持续下去,并预计VIX的上升趋势可能会损害他们的头寸,那么他们可以通过购买VIX期货、期权或ETF来对冲其投资组合因股价下跌而造成的潜在损失。随着波动性的增加,这些产品的价值也会增加。

Source: MarketWatch, Investopedia, Bloomberg

来源:MarketWatch、Investopedia、彭博社