Market Mover | Palantir Shares Surge 12% After Q2 Earnings Release

Market Mover | Palantir Shares Surge 12% After Q2 Earnings Release

August 6, 2024 - $PLTR.US$shares surged 12.58% to $27.12 in pre-market trading on Tuesday. The company announced its financial results for the second quarter, which ended on June 30, 2024, yesterday after the market closed.

2024年8月6日- $PLTR.US$周二美股盘前股价上涨12.58%,达到27.12美元。该公司昨天在市场收盘后公布了截至2024年6月30日的第二季度财报。

Q2 2024 Highlights

2024年第二季度要点

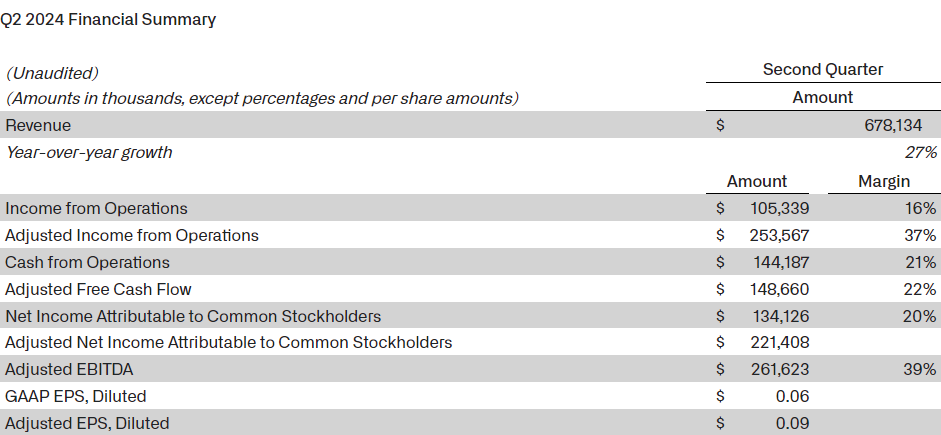

Revenue grew 27% year-over-year and 7% quarter-over-quarter to $678 million.

Closed 27 deals over $10 million.

Customer count grew 41% year-over-year and 7% quarter-over-quarter.

GAAP net income of $134 million, representing a 20% margin.

GAAP income from operations of $105 million, representing a 16% margin.

Adjusted EPS grew 80% year-over-year to $0.09.

营业收入同比增长27%,环比增长7%,达到67800万美元。

已经关闭了27笔超过1000万美元的交易。

客户数量同比增长41%,环比增长7%。

GAAP净利润为13400万美元,占20%的利润率。

GAAP收入为10500万美元,占16%的利润率。

调整后的每股收益同比增长80%,达到0.09美元。

Q3 Outlook

对于2024年财政年度的第三个财季(截至2024年6月),艾默生预计净销售额将增长11.0-12.5%,底层销售增长3.0-4.5%。

Revenue of between $697 - $701 million.

Adjusted income from operations of between $233 - $237 million.

预计营收为697至70100万美元。

预计调整后的收入为233至23700万美元。

For full year 2024:

2024年全年:

The company raised its revenue guidance to between $2.742 - $2.750 billion.

The company raised its US commercial revenue guidance to in excess of $672 million, representing a growth rate of at least 47%.

The company raised its adjusted income from operations guidance to between $966 - $974 million.

The company continue to expect adjusted free cash flow of between $800 million - $1 billion.

公司将营收指导范围提高至27.42亿至27.5亿美元之间。

公司将美国商业营收指导范围上调至超过67200万美元,增长率至少为47%。

公司将调整后的收入指导范围提高至966至97400万美元之间。

公司仍预计调整后的自由现金流为80000万至10亿美元之间。

Related Reading: Press Release

相关阅读:新闻发布

Customer count grew 41% year-over-year and 7% quarter-over-quarter.

Customer count grew 41% year-over-year and 7% quarter-over-quarter.